- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR) Is Down 6.9% After Securing US$8.2 Million Air Force Nuclear Power Contract Extension - What's Changed

Reviewed by Sasha Jovanovic

- Intuitive Machines announced in late October that it secured an US$8.2 million contract extension from the U.S. Air Force Research Laboratory to accelerate development of compact nuclear power systems for spacecraft and lunar infrastructure.

- This award fast-tracks preparation of Stirling-based nuclear power technology for flight demonstration on the International Space Station, supporting longer-duration missions in harsh lunar and deep space environments where solar energy falls short.

- We’ll examine how this new contract extension supports Intuitive Machines’ move into advanced space power technology and affects its long-term investment case.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Intuitive Machines Investment Narrative Recap

To be a shareholder of Intuitive Machines, you have to believe in a future where commercial and government investment in lunar and deep space missions will translate into substantial long-term revenue through advanced infrastructure services. The latest US$8.2 million nuclear power contract is a milestone for technology adoption, but it does not directly address the company’s immediate financial risks, particularly its dependence on large government awards and ongoing unprofitability, that remain the most important short-term factors for the stock.

Among recent announcements, the US$9.8 million Orbital Transfer Vehicle (OTV) contract in July stands out for portfolio diversification. This award relates closely to Intuitive Machines’ emphasis on in-space mobility, a demand area amplified by advances like the Stirling nuclear power system, and may contribute to reducing reliance on single-mission revenue events over time.

But in contrast to the opportunity of lunar energy breakthroughs, investors should also be aware of the inherent risk if key government contracts are delayed or reprioritized...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines is projected to reach $502.2 million in revenue and $41.2 million in earnings by 2028. This outlook depends on a 30.5% annual revenue growth rate and a $283 million increase in earnings from the current level of -$241.8 million.

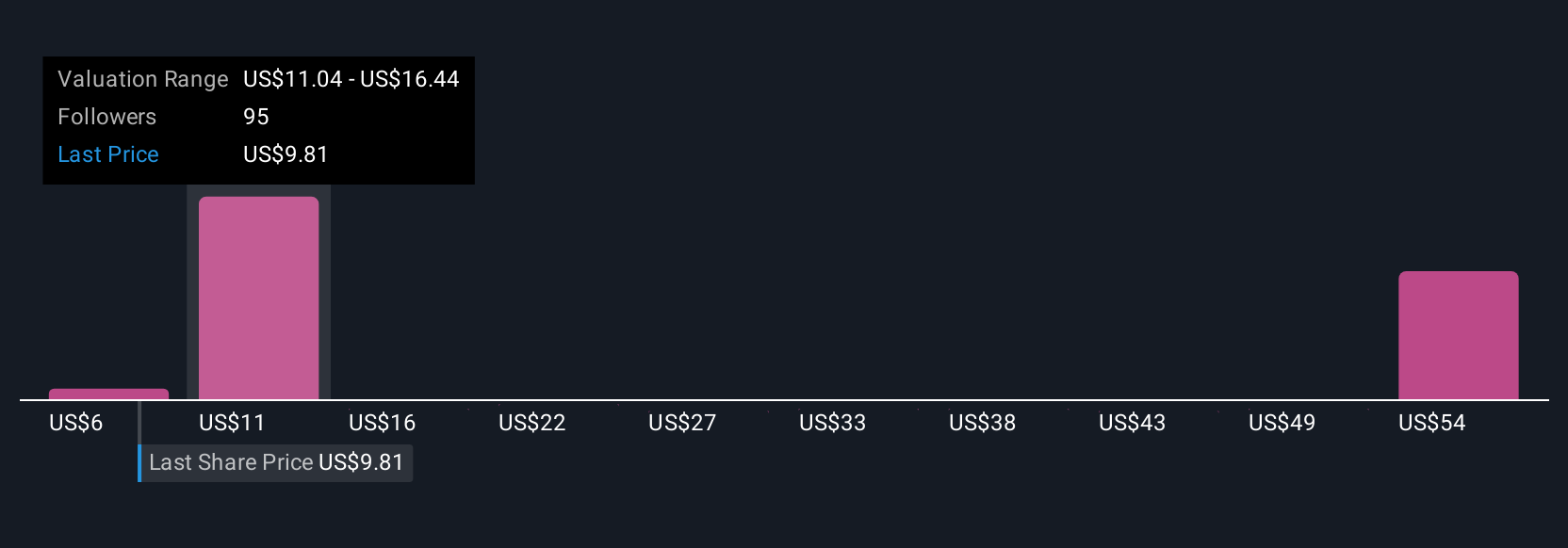

Uncover how Intuitive Machines' forecasts yield a $15.43 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Twenty-seven fair value estimates from the Simply Wall St Community range from US$5.69 to US$58.79, reflecting sharply different forecasts for Intuitive Machines’ prospects. While views are split, the company’s reliance on lumpy government contract awards remains a crucial factor shaping outcomes for everyone tracking this stock’s future.

Explore 27 other fair value estimates on Intuitive Machines - why the stock might be worth less than half the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives