- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR): Assessing Valuation After Cost Management Drives Narrower Losses and Operational Progress

Reviewed by Simply Wall St

Intuitive Machines (LUNR) reported its third quarter earnings, highlighting a sizable improvement in net loss even as revenue dipped slightly from last year. This signals real progress in cost management for the company.

See our latest analysis for Intuitive Machines.

Following these results, Intuitive Machines’ shares have shown some renewed energy, with a 4.4% gain in the past day and a 3.1% lift over the week, helped by optimism around better cost management. However, the stock’s year-to-date share price return of -53.4% and a one-year total shareholder return of -38.7% underscore the challenges it has faced, though momentum could be shifting if operational progress continues.

If Intuitive Machines’ turnaround story has you on the lookout for other innovative names, this is the perfect moment to broaden your search and discover See the full list for free.

With Intuitive Machines demonstrating significant improvement in its bottom line, investors are now left to wonder whether current pessimism is overdone and the stock is undervalued, or if any potential rebound is already reflected in the price.

Most Popular Narrative: 41.5% Undervalued

According to the most widely followed narrative, Intuitive Machines’ fair value sits well above its last close, suggesting significant upside should future expectations play out. The analysis draws on rapid top-line growth projections and improving margins as the core pillars behind this bullish outlook.

Ongoing expansion into high-margin, adjacent markets, including lunar surface mobility, in-space networking, reentry vehicles for biopharma and semiconductor transport, and potentially lunar nuclear power, creates new scalable, diversified earnings streams with multi-year and multi-billion-dollar revenue potential. This helps offset the lumpiness inherent in "success-based" mission awards.

Curious how bold revenue forecasts and an expected profit transformation set the stage for this optimistic price target? The vital drivers include a rapid acceleration in earnings plus a future valuation multiple rarely seen in space tech. Want to know exactly what assumptions underpin this big upside? The full narrative reveals the high-stakes estimates that fuel the story.

Result: Fair Value of $15.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks around delayed government contracts and continued negative cash flow could easily undermine the case for Intuitive Machines’ expected turnaround.

Find out about the key risks to this Intuitive Machines narrative.

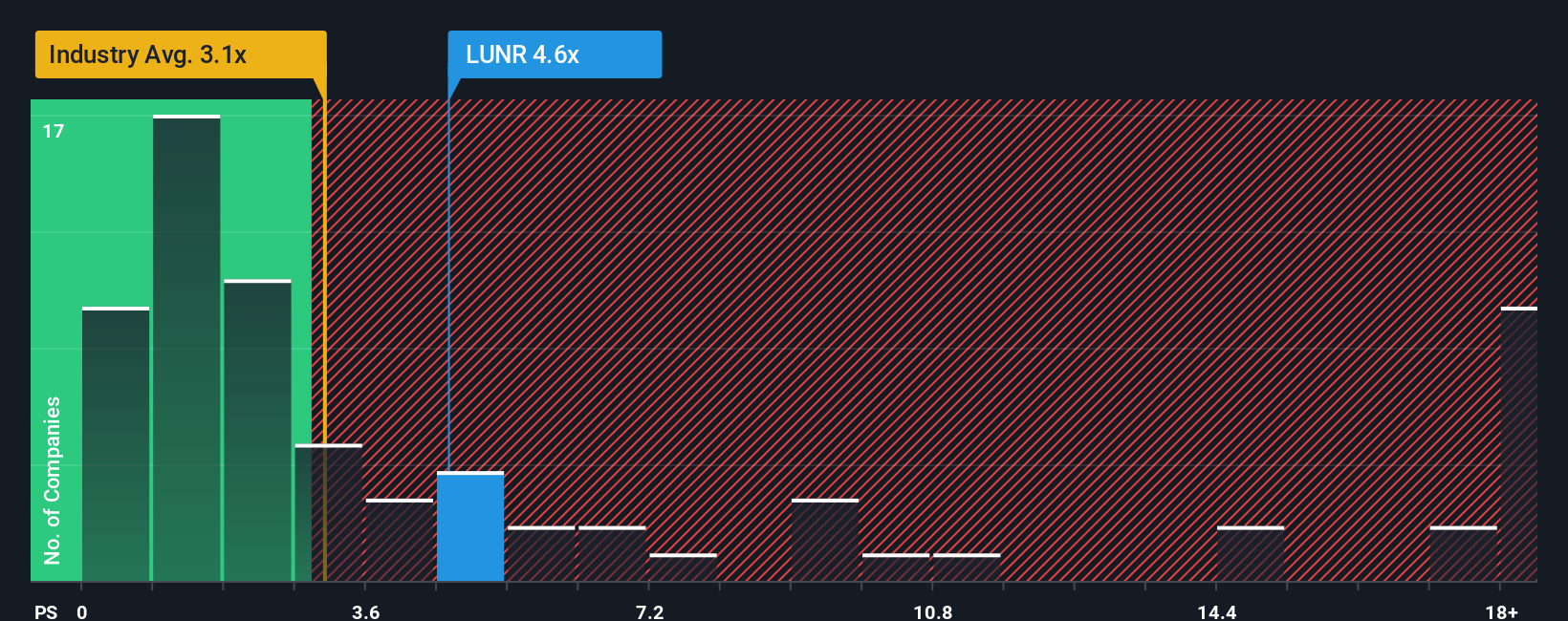

Another View: Caution From Market Comparisons

While analysts see major upside based on future potential, the market’s current pricing tells a more reserved story. Intuitive Machines trades at a price-to-sales ratio of 4.9 times, which is well above the industry average of 3 times and the peer average of 1.7 times. The market’s “fair ratio” for this stock is 2.2 times. This suggests investors are paying a premium that could add valuation risk if growth expectations disappoint. Is confidence in a turnaround running ahead of reality, or is this optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If you have a different perspective or want to dive into the numbers personally, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your Intuitive Machines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Hundreds of compelling companies are waiting to be uncovered. Take a step toward smarter investing by checking out these hand-picked opportunities on Simply Wall Street:

- Tap into stable growth and the potential for consistent yield by checking out these 14 dividend stocks with yields > 3% with market-beating dividend records and healthy financials.

- Uncover tomorrow’s groundbreaking innovators now with these 26 AI penny stocks, presenting remarkable artificial intelligence companies at the cutting edge of technology.

- Find value that others might be overlooking when you browse these 920 undervalued stocks based on cash flows and target stocks with compelling fundamentals priced well below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success