- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Does the Recent NASA Contract Signal a Valuation Opportunity for Intuitive Machines in 2025?

Reviewed by Bailey Pemberton

- Curious if Intuitive Machines is a hidden gem or an overhyped rocket? You’re in the right spot to get clarity on whether the stock’s price makes sense right now.

- After a dramatic 34.4% climb over the past year, Intuitive Machines has recently cooled off, dropping 15.8% in the last week and 9.1% for the month. This eye-catching swing could mean opportunity or risk.

- Recent headlines about Intuitive Machines’ NASA contract wins and milestones in lunar delivery tech have captured investor attention, driving both optimism and volatility. Momentum from these announcements is fueling big conversations about the company’s real-world potential in the commercial space sector.

- But when it comes to value, Intuitive Machines earns a 2 out of 6 on our valuation checks, suggesting there’s more to this story than first meets the eye. Before you jump to any conclusions, let’s break down the different ways to put a price tag on the company. Stick with us for an even better way to approach valuation by the end of this article.

Intuitive Machines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Machines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to the present day at an appropriate rate. This approach helps investors gauge whether a stock's current price reflects its true long-term potential based on expected financial performance.

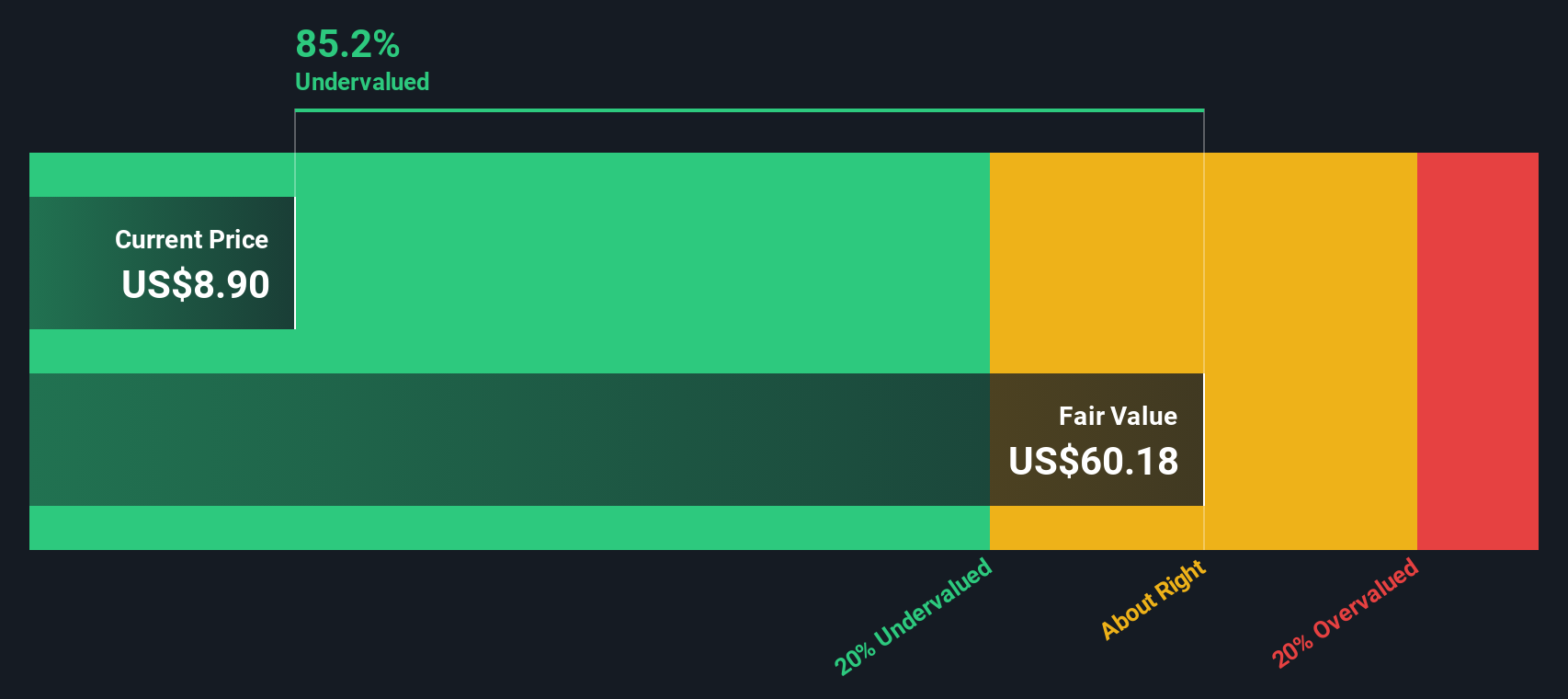

For Intuitive Machines, the DCF uses a 2 Stage Free Cash Flow to Equity model. The company currently reports a negative free cash flow of -$51.2 Million, reflecting both heavy investment and early-stage risk. Analysts project that free cash flow will turn positive over time, with an estimate of $127 Million by 2029. Projections out to 2035, extrapolated beyond the standard five-year analyst forecast, suggest continued steady growth in free cash flow, potentially reaching over $822 Million in the next decade.

According to this DCF analysis, the calculated intrinsic value for Intuitive Machines stands at $64.22 per share. Based on recent trading, this figure implies the stock is about 83.8 percent undervalued compared to its current share price.

This substantial valuation gap suggests the market may be overlooking Intuitive Machines’ future potential, according to these optimistic cash flow scenarios.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Machines is undervalued by 83.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Intuitive Machines Price vs Sales

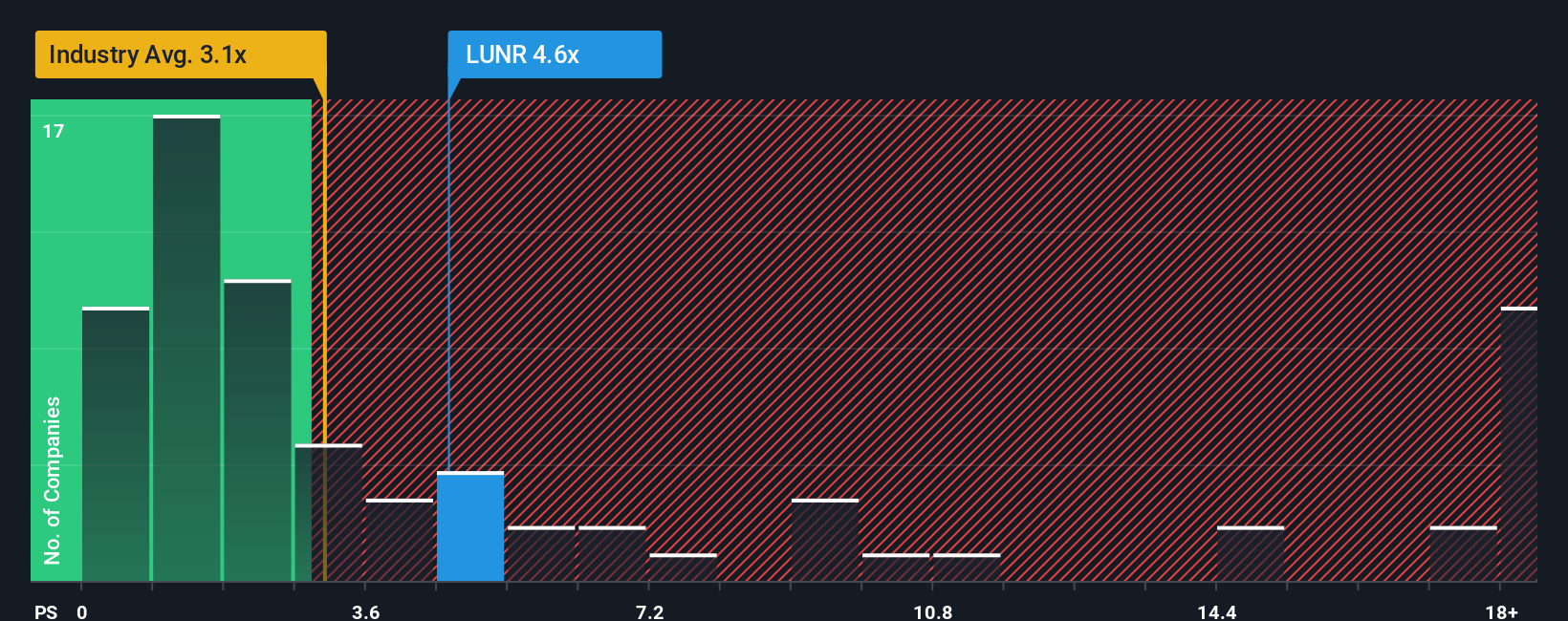

The Price-to-Sales (P/S) ratio is a popular valuation metric, especially for younger or rapidly growing companies that may not yet be profitable. Since Intuitive Machines is still in its early growth stages and has yet to generate consistent profits, P/S offers investors a way to assess value based on revenue potential rather than net earnings.

Intuitive Machines currently trades at a P/S ratio of 5.42x. To put this in perspective, the Aerospace & Defense industry averages around 3.07x, while the company’s closest peers average about 2.47x. On the surface, this suggests Intuitive Machines is more richly valued by the market compared to typical industry players and competitors.

However, relying solely on straight industry or peer comparisons can be misleading, as those numbers do not factor in Intuitive Machines’ unique growth outlook, risk profile, or its market position. This is where the Simply Wall St Fair Ratio comes in. This proprietary metric calculates a fair P/S ratio tailored to the company’s specific attributes, including growth prospects, risk, profit margins, industry context, and market cap.

The Fair Ratio for Intuitive Machines is 1.44x, which is significantly lower than the current P/S of 5.42x. This gap suggests the stock is trading well above what would be considered fair based on its own fundamentals and risk profile.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Machines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative takes your perspective on Intuitive Machines, the story you believe about its future, and connects it directly to your financial forecast and a fair value estimate. This powerful approach lets you turn your beliefs about the company’s growth, revenue, and margins into a cohesive investment thesis that lives beyond a single number.

On Simply Wall St’s Community page, millions of investors are already using Narratives to make investment decisions more transparent and dynamic. Narratives empower you to compare the fair value from your personal scenario with today’s share price, helping you decide if it is time to buy or sell. When news breaks or earnings are released, Narratives update automatically so your value estimate always reflects the latest facts.

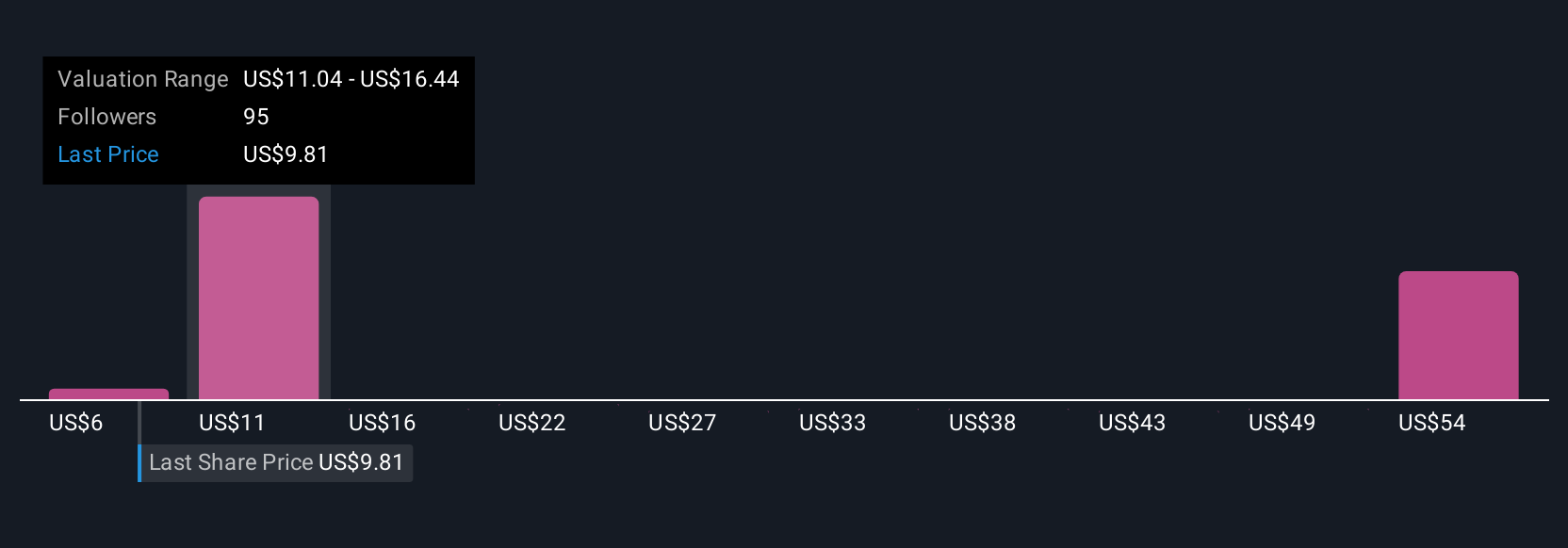

For Intuitive Machines, some investors focus on the company’s expanding NASA contracts, seeing rapidly rising profits and setting fair values as high as $18.50. Others are more cautious about execution risks and opt for much lower figures, even as low as $8.50. This demonstrates that your Narrative is unique to your outlook, and you can easily test how your story stands up against market reality.

Do you think there's more to the story for Intuitive Machines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives