- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (KTOS): Exploring Valuation After Strong Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Kratos Defense & Security Solutions.

After an extraordinary run, Kratos Defense & Security Solutions has delivered a remarkable 243% year-to-date share price return and an even more impressive 296% total shareholder return over the past year. Recent momentum has picked up, highlighted by a 52% gain in the past three months, as investors react to the company’s consistent growth and increasing relevance in the defense arena.

If this momentum in aerospace and defense stocks has your attention, it might be time to discover See the full list for free.

But with shares now trading just below analyst targets after such stellar gains, the key question is whether Kratos is still undervalued or if the market has already priced in all the company’s future growth prospects.

Most Popular Narrative: 2.7% Undervalued

With Kratos's fair value narrative landing just above the last close, the stock sits in a narrow band where every projection counts. The current market optimism hinges on whether ambitious future growth and margin forecasts really warrant this premium.

Kratos' early investments in serial production of tactical drones (for example, Valkyrie) and rapid scaling in missile propulsion and microelectronics put it ahead of competitors as demand for unmanned and autonomous solutions escalates globally. With sole-source and first-to-market positions, Kratos is poised for significant incremental revenue and higher-margin growth as large contracts come online, particularly as international orders (with premium margins) ramp up.

The math behind this price target is not what you’d expect from an average defense stock. Discover how projected innovation-led margin expansion and bold contract wins unlock a valuation formula that could surprise you. Want to know what sets Kratos’s story apart from its sector rivals? Click through to uncover the full blueprint behind this valuation.

Result: Fair Value of $93.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high investment requirements and any delays in major contract awards could quickly challenge the optimistic scenario that is currently shaping Kratos’s outlook.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

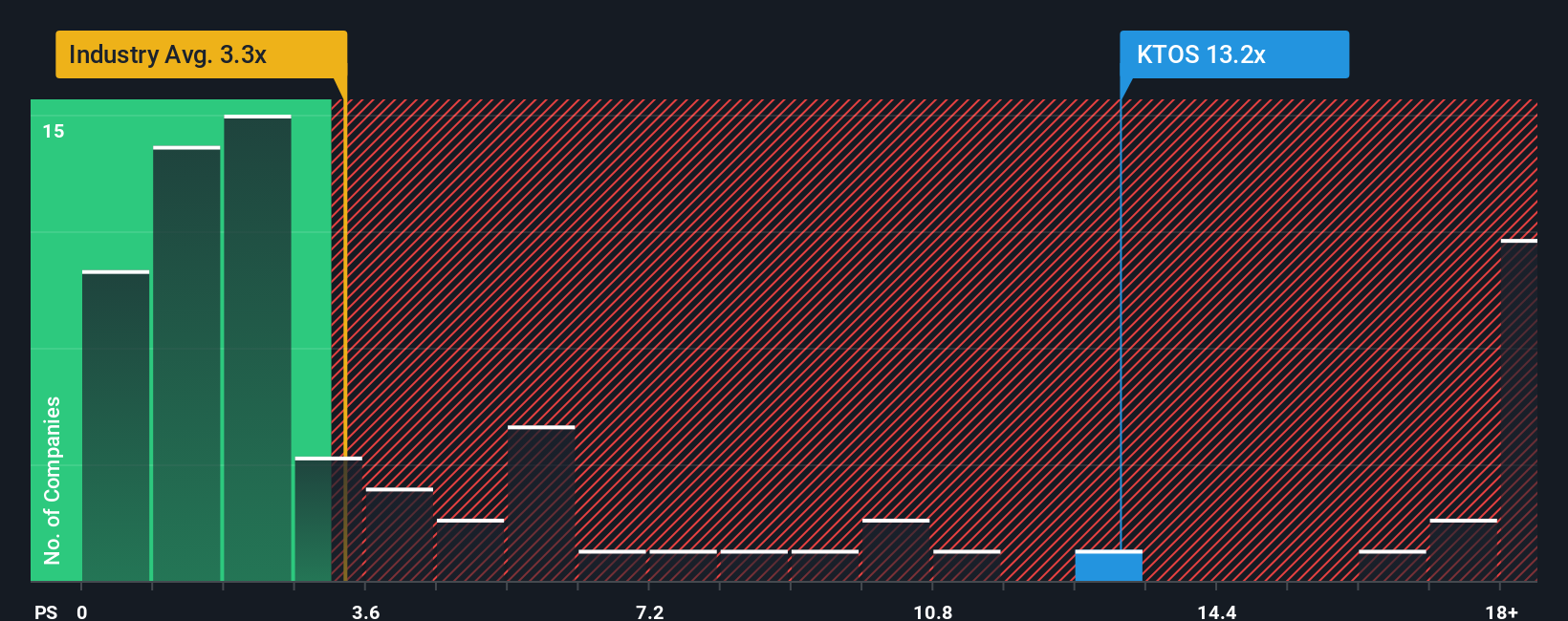

Another View: Multiples Paint a Tougher Picture

While the earlier analysis shows Kratos as undervalued, looking at the price-to-sales ratio raises a red flag. At 12.6x, the company is trading well above industry peers (3.1x) and the fair ratio (2.7x). This gap suggests investors may be overpaying for future growth, at least by this metric. Does the premium make sense, or is there a valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kratos Defense & Security Solutions.

Looking for More Smart Investment Ideas?

Unlock a world of opportunity by searching strategies you might have missed. The right stock could be just a click away with the right screener.

- Spot hidden opportunities in tech by starting with these 26 AI penny stocks, making waves in artificial intelligence and powering tomorrow’s breakthroughs.

- Secure steady returns as you browse these 23 dividend stocks with yields > 3%, tailored for those seeking reliable income and attractive yields from strong, established businesses.

- Power up your strategy by targeting these 28 quantum computing stocks, leading the charge in transformative quantum computing advancements for the next generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion