- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense (KTOS): Assessing Valuation Following Bold Expansion and New Facility Investments

Reviewed by Simply Wall St

Kratos Defense & Security Solutions (KTOS) has recently doubled down on its expansion strategy by relocating its Microwave Electronics Division to a state-of-the-art facility and opening a new propulsion manufacturing plant. These moves are focused on boosting production to stay ahead of rising defense sector demand.

See our latest analysis for Kratos Defense & Security Solutions.

Kratos’ recent expansion moves, which include new high-tech facilities and a sizable manufacturing investment, have stoked investor optimism and sent its share price up 187% year-to-date. Momentum has been strong, with a 1-year total shareholder return of 181%. This points to a market eager for growth, even as some insider selling and cost pressures remain in the mix.

If defense sector tailwinds have you looking for other promising companies, see who else is building momentum in aerospace and security with our curated See the full list for free..

But after such a rapid climb, is Kratos still trading below its potential, or have investors already factored in all the expected growth? Is there a real buying opportunity here, or is the market already anticipating the next move?

Most Popular Narrative: 24.1% Undervalued

With Kratos closing at $75.77, the most tracked narrative pegs its fair value much higher, suggesting a substantial gap between analyst expectations and the latest price. This contrast sets the stage for a deeper look at what could be fueling such bullish projections.

Kratos' early investments in serial production of tactical drones (e.g., Valkyrie) and rapid scaling in missile propulsion and microelectronics put it ahead of competitors as demand for unmanned and autonomous solutions escalates globally. With sole-source and first-to-market positions, Kratos is poised for significant incremental revenue and higher-margin growth as large contracts come online, particularly as international orders (with premium margins) ramp up.

Want to know which key assumptions drive this projected upside? Hint: revenue momentum is just the beginning. There are bold profit targets and margin jumps behind this headline figure. The full narrative reveals the levers that could justify such a premium. Find out what’s really driving this optimistic valuation.

Result: Fair Value of $99.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain disruptions or unexpected delays in major contract awards could easily challenge the bullish outlook and put pressure on future growth.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

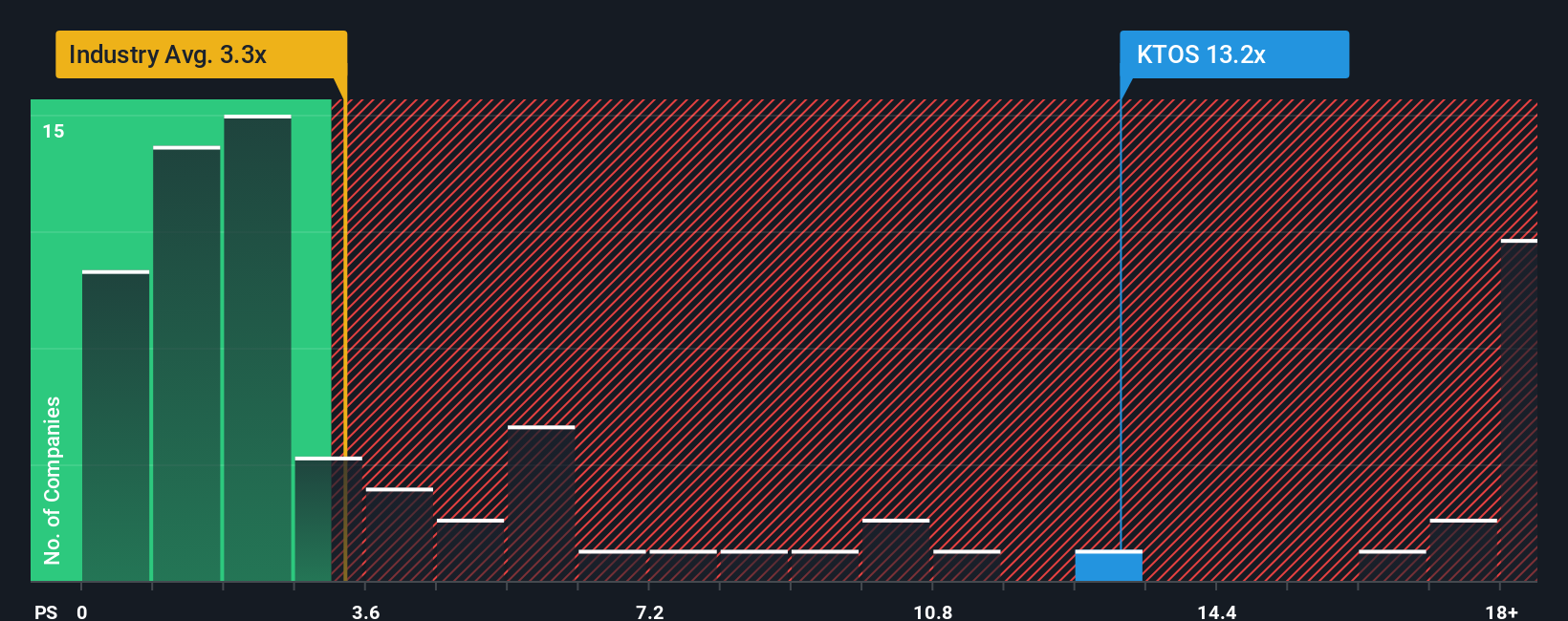

Another View: Expensive by Revenue Multiples

While fair value estimates point to upside, traditional valuation ratios present a much higher bar. Kratos is trading at a price-to-sales ratio of 10x, significantly above both the industry average of 3x and the fair ratio of 2.7x. This difference suggests investors are paying a substantial premium for future potential. Whether this optimism will persist remains to be seen.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can craft your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kratos Defense & Security Solutions.

Looking for more investment ideas?

Don’t limit your strategy to a single opportunity. Explore new markets and trends with tools that help keep you ahead of the crowd.

- Boost your potential returns by targeting these 15 dividend stocks with yields > 3%, which can offer steady income and resilience during market swings.

- Access early-stage potential with these 25 AI penny stocks, designed to transform major industries and expand possibilities.

- Find undervalued opportunities by focusing on these 925 undervalued stocks based on cash flows, where strong fundamentals could indicate potential before the next market move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success