- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Here's Why Kratos Defense & Security Solutions (NASDAQ:KTOS) Can Manage Its Debt Responsibly

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Kratos Defense & Security Solutions

What Is Kratos Defense & Security Solutions's Net Debt?

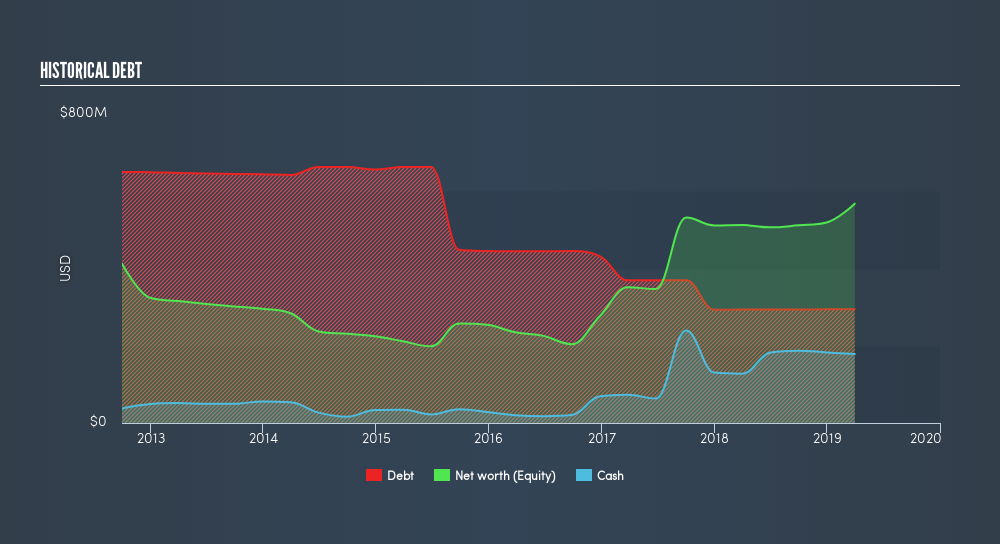

The chart below, which you can click on for greater detail, shows that Kratos Defense & Security Solutions had US$294.4m in debt in March 2019; about the same as the year before. However, because it has a cash reserve of US$178.4m, its net debt is less, at about US$116.0m.

How Healthy Is Kratos Defense & Security Solutions's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kratos Defense & Security Solutions had liabilities of US$195.3m due within 12 months and liabilities of US$405.7m due beyond that. Offsetting these obligations, it had cash of US$178.4m as well as receivables valued at US$239.3m due within 12 months. So it has liabilities totalling US$183.3m more than its cash and near-term receivables, combined.

Given Kratos Defense & Security Solutions has a market capitalization of US$2.53b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Since Kratos Defense & Security Solutions does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Kratos Defense & Security Solutions has a quite reasonable net debt to EBITDA multiple of 2.11, its interest cover seems weak, at 1.72. This does suggest the company is paying fairly high interest rates. In any case, it's safe to say the company has meaningful debt. Pleasingly, Kratos Defense & Security Solutions is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 101% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Kratos Defense & Security Solutions's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, Kratos Defense & Security Solutions saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We weren't impressed with Kratos Defense & Security Solutions's interest cover, and its conversion of EBIT to free cash flow made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble growing its EBIT. When we consider all the factors mentioned above, we do feel a bit cautious about Kratos Defense & Security Solutions's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Kratos Defense & Security Solutions insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives