Stock Analysis

- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Can You Imagine How Jubilant Kratos Defense & Security Solutions' (NASDAQ:KTOS) Shareholders Feel About Its 146% Share Price Gain?

It hasn't been the best quarter for Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) shareholders, since the share price has fallen 29% in that time. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 146% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Check out our latest analysis for Kratos Defense & Security Solutions

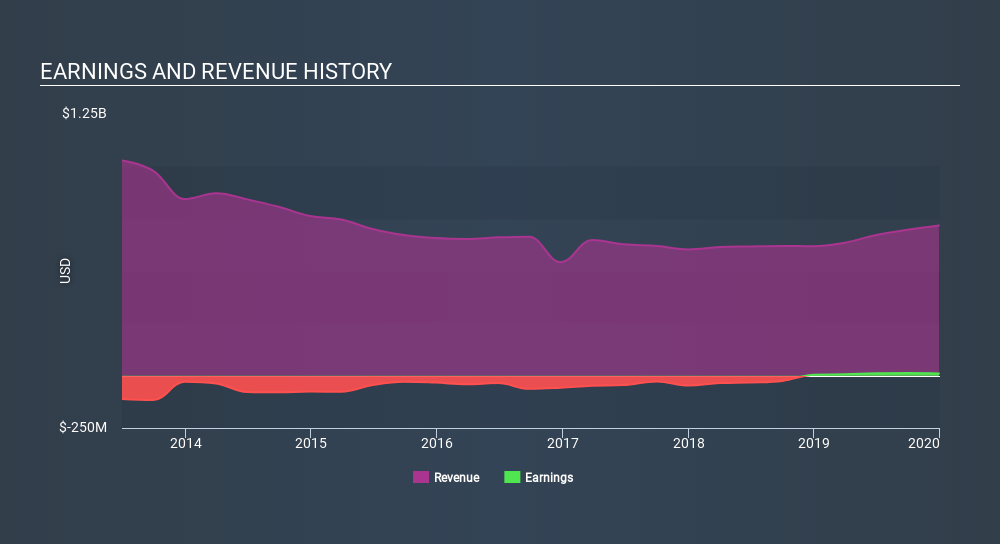

Given that Kratos Defense & Security Solutions only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Kratos Defense & Security Solutions saw its revenue shrink by 1.6% per year. On the other hand, the share price done the opposite, gaining 20%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that Kratos Defense & Security Solutions shareholders are down 4.7% for the year. Unfortunately, that's worse than the broader market decline of 3.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Kratos Defense & Security Solutions you should be aware of, and 1 of them is significant.

Kratos Defense & Security Solutions is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

Kratos Defense & Security Solutions, Inc.

Flawless balance sheet with reasonable growth potential.