- United States

- /

- Machinery

- /

- NasdaqGS:KRNT

Shareholders in Kornit Digital (NASDAQ:KRNT) have lost 74%, as stock drops 9.1% this past week

As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of Kornit Digital Ltd. (NASDAQ:KRNT); the share price is down a whopping 74% in the last three years. That would certainly shake our confidence in the decision to own the stock. Furthermore, it's down 22% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Kornit Digital isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Kornit Digital

Given that Kornit Digital didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Kornit Digital's revenue dropped 19% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 20% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

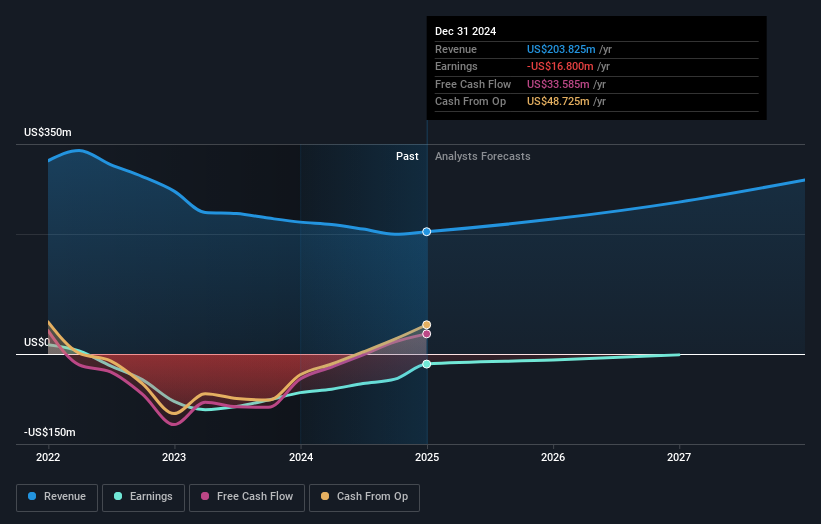

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Kornit Digital in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Kornit Digital shareholders have received a total shareholder return of 35% over one year. That certainly beats the loss of about 7% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Kornit Digital you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kornit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KRNT

Kornit Digital

Develops, designs, and markets digital printing solutions for the fashion, apparel, and home decor segments of printed textile industry in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives