- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ISSC

Should You Be Adding Innovative Solutions and Support (NASDAQ:ISSC) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Innovative Solutions and Support (NASDAQ:ISSC). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Innovative Solutions and Support

How Fast Is Innovative Solutions and Support Growing Its Earnings Per Share?

In the last three years Innovative Solutions and Support's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Innovative Solutions and Support's EPS soared from US$0.18 to US$0.28, in just one year. That's a impressive gain of 56%.

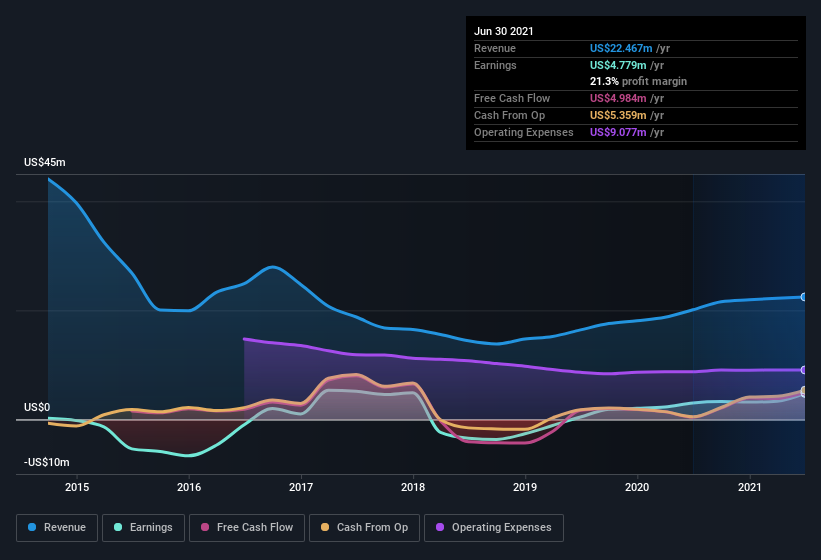

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Innovative Solutions and Support is growing revenues, and EBIT margins improved by 2.6 percentage points to 14%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Innovative Solutions and Support is no giant, with a market capitalization of US$133m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Innovative Solutions and Support Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Innovative Solutions and Support insiders have a significant amount of capital invested in the stock. To be specific, they have US$42m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 32% of the company; visible skin in the game.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Innovative Solutions and Support with market caps under US$200m is about US$546k.

The Innovative Solutions and Support CEO received US$408k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Innovative Solutions and Support Deserve A Spot On Your Watchlist?

For growth investors like me, Innovative Solutions and Support's raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the takeaway for me is that Innovative Solutions and Support is worth keeping an eye on. Even so, be aware that Innovative Solutions and Support is showing 2 warning signs in our investment analysis , you should know about...

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Innovative Solutions and Support, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ISSC

Innovative Aerosystems

Engages in the engineering, manufacturing, and supply of advanced avionic solutions.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion