- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ISSC

A Fresh Look at Innovative Aerosystems (ISSC) Valuation Following New Board Appointment

Reviewed by Simply Wall St

Innovative Aerosystems (ISSC) has added Richard Silfen to its board as an independent director. This appointment increases the board’s size and brings fresh M&A and capital markets experience at a strategic moment for the company.

See our latest analysis for Innovative Aerosystems.

Shares of Innovative Aerosystems have had a rollercoaster year, with short-term volatility recently intensifying. Just last month, the share price fell 27.7%, though over the past 12 months shareholders have still enjoyed a 13.4% total return. The latest board appointment may signal confidence in the company’s long-term direction, even as the market recalibrates its near-term outlook.

If moments of strategic change catch your interest, this could be a great opportunity to discover See the full list for free.

With the stock trading well below analyst targets and showing a sizeable intrinsic discount, investors are left to wonder if this is a chance to buy into future growth or if the optimism is already reflected in the price.

Price-to-Earnings of 13x: Is it justified?

Innovative Aerosystems is trading at a price-to-earnings (P/E) ratio of 13x, while its last closing price was $8.62. This figure places ISSC at a substantially lower valuation than its industry peers and the broader market.

The price-to-earnings ratio expresses how much investors are willing to pay for each dollar of the company’s earnings. For companies like ISSC in the Aerospace & Defense sector, a lower P/E can either signal a bargain or highlight market skepticism about future prospects.

With ISSC valued at 13x earnings, compared to the Aerospace & Defense industry average of 38.7x and a peer average of 23.2x, the market seems to be significantly underpricing Innovative Aerosystems' current profitability relative to other companies in the space. This suggests a notable discount that could narrow if the company’s growth and execution continue to outpace expectations and the sector’s performance trends.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13x (UNDERVALUED)

However, continued share price declines and recent underperformance over multiple periods may indicate lingering doubts about Innovative Aerosystems' ability to sustain growth momentum.

Find out about the key risks to this Innovative Aerosystems narrative.

Another View: Discounted Cash Flow Perspective

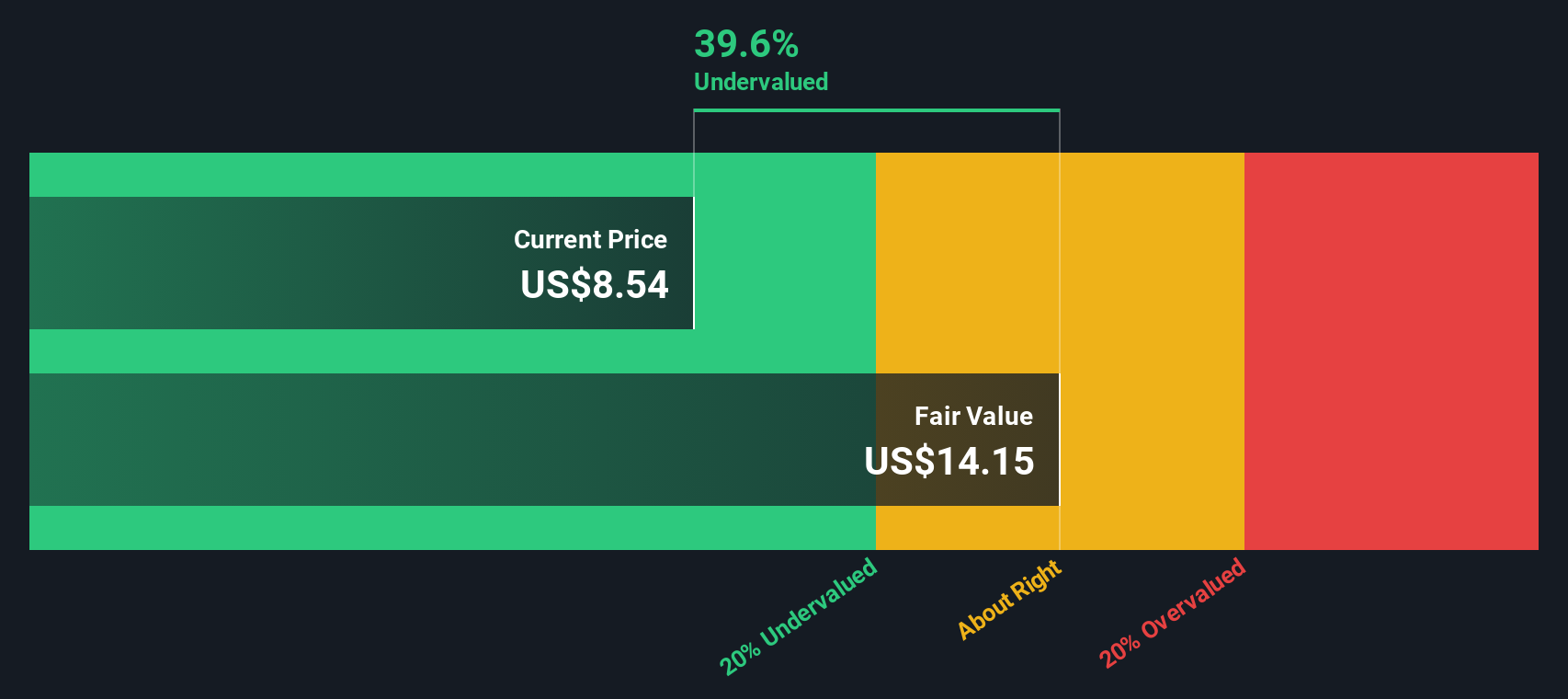

Looking at our DCF model, Innovative Aerosystems appears significantly undervalued. Its current share price of $8.62 is well below our estimated fair value of $14.12. This suggests the market might be missing the company's potential, or it could be pricing in risks that investors should not ignore.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innovative Aerosystems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innovative Aerosystems Narrative

If you see the story a little differently, or want to dig deeper into the data yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Innovative Aerosystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just focus on one opportunity when you could be missing out on great trends. Uncover more smart picks and set yourself up for investing success:

- Boost your potential returns by checking out these 869 undervalued stocks based on cash flows that offer compelling value well below their true worth.

- Secure reliable income streams by tapping into these 15 dividend stocks with yields > 3% yielding over 3% to reinforce your portfolio’s stability.

- Ride the future of computing innovation by pursuing these 27 quantum computing stocks and position yourself ahead as this breakthrough sector accelerates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISSC

Innovative Aerosystems

Engages in the engineering, manufacturing, and supply of advanced avionic solutions.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives