- United States

- /

- Trade Distributors

- /

- NasdaqCM:IPW

There's No Escaping iPower Inc.'s (NASDAQ:IPW) Muted Revenues Despite A 26% Share Price Rise

iPower Inc. (NASDAQ:IPW) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

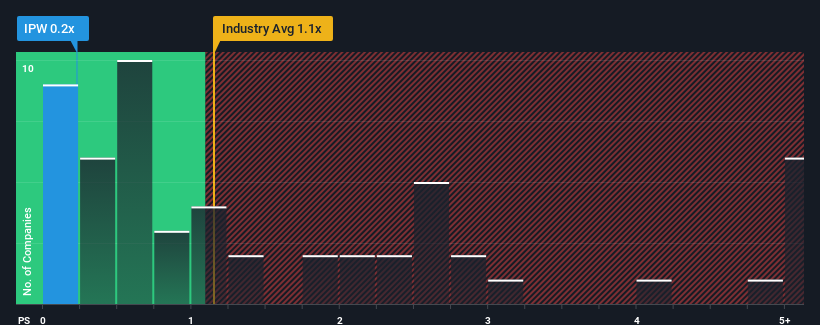

In spite of the firm bounce in price, when close to half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider iPower as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

We've discovered 3 warning signs about iPower. View them for free.Check out our latest analysis for iPower

What Does iPower's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at iPower over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on iPower will help you shine a light on its historical performance.How Is iPower's Revenue Growth Trending?

In order to justify its P/S ratio, iPower would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 30% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 98% shows it's noticeably less attractive.

With this information, we can see why iPower is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From iPower's P/S?

Despite iPower's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of iPower confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for iPower (1 is concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if iPower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IPW

iPower

Operates as an online retailer and supplier of consumer home, pet, garden, outdoor, and consumer electronics products for commercial and home cultivators growing specialty crops, and home goods customers in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives