- United States

- /

- Industrials

- /

- NasdaqGS:IEP

Assessing Icahn Enterprises (IEP) Valuation: Is the Current Market Price Reflecting True Value?

Reviewed by Simply Wall St

Icahn Enterprises (IEP) shares have seen some movement lately as investors assess recent performance numbers and the company's longer-term track record. The stock is trading around $8.75, prompting fresh looks at its valuation.

See our latest analysis for Icahn Enterprises.

Icahn Enterprises has had a bumpy ride over the past year, with the stock’s current $8.75 share price marking a modest recovery from recent lows but still reflecting a 1-year total shareholder return of -14% and deeper declines over longer periods. Momentum remains subdued. Investors appear to be weighing ongoing challenges and reassessing the company’s outlook and valuation as the broader market looks for clearer signs of sustainable growth potential.

If you’re rethinking your watchlist, now is the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With ongoing volatility and lackluster returns, investors are left to ask whether Icahn Enterprises is now trading at a bargain, or if the current share price has already factored in its future prospects. Could there be untapped value, or is the market one step ahead?

Price-to-Sales Ratio of 0.6x: Is it justified?

Icahn Enterprises currently trades at a price-to-sales ratio of 0.6x, placing its valuation below global industrial peers and signaling potential relative value compared to the broader sector. With the share price at $8.75, this low multiple suggests that the market may be discounting the company’s future prospects more than its industry counterparts.

The price-to-sales ratio measures a company's market value relative to its total revenues, providing a sense of how much investors are willing to pay per dollar of revenue. For diversified industrial companies, this multiple often serves as a quick litmus test of perceived growth and profitability potential, especially when earnings are volatile or negative.

In Icahn Enterprises’ case, the 0.6x price-to-sales figure is not only lower than the industry average (0.8x) but also matches its estimated fair price-to-sales ratio. This suggests that the current market valuation could reasonably reflect the company’s business fundamentals. Compared to peer companies averaging 1.1x, Icahn appears attractively priced relative to revenues alone, though this reflects both ongoing profitability challenges and subdued growth prospects.

Explore the SWS fair ratio for Icahn Enterprises

Result: Preferred multiple of price-to-sales 0.6x (ABOUT RIGHT)

However, ongoing revenue declines and persistent net losses could weaken any hopes for a turnaround in valuation momentum.

Find out about the key risks to this Icahn Enterprises narrative.

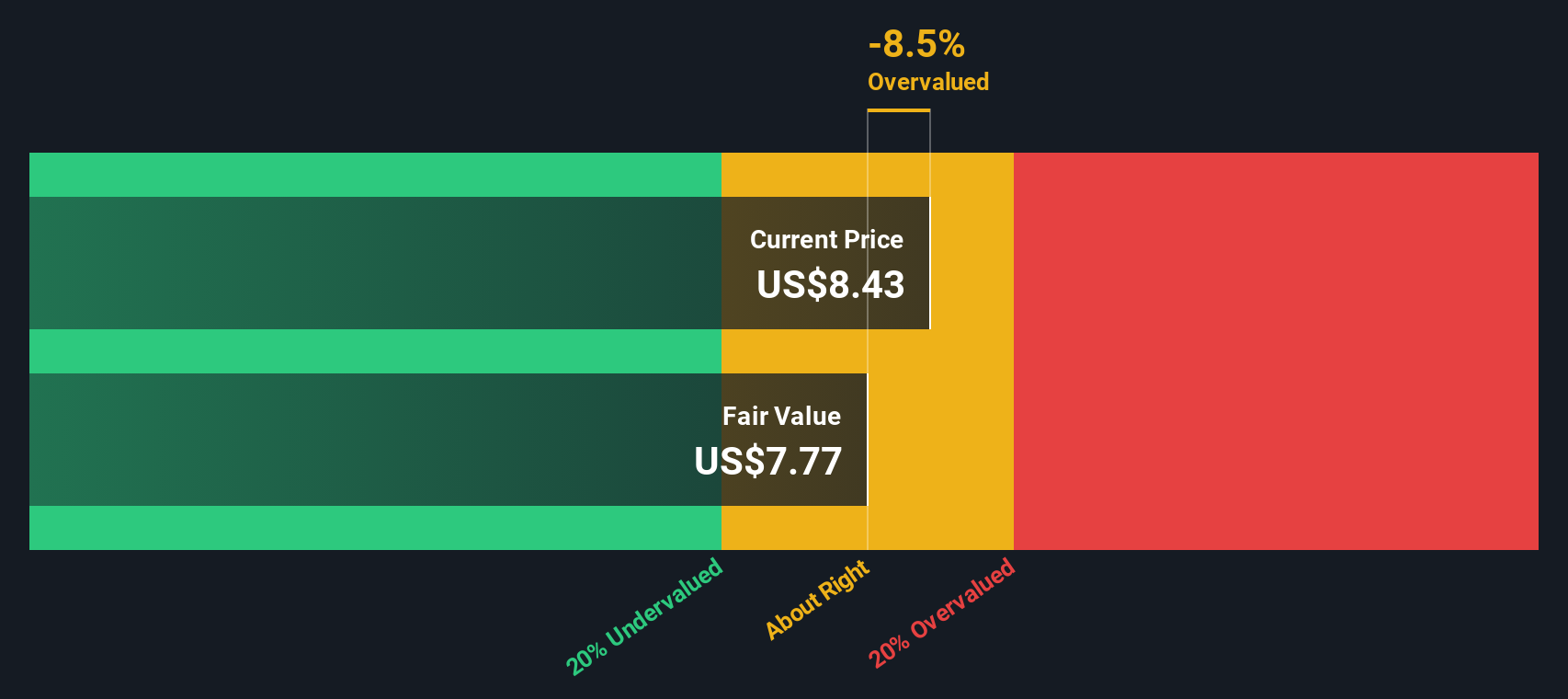

Another View: SWS DCF Model Says Shares May Be Overvalued

While the price-to-sales ratio presents Icahn Enterprises as potentially good value compared to peers, our DCF model offers a sharply different perspective. The SWS DCF model estimates fair value at just $0.16 per share, which is far below the current market price. Could the market outlook be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Icahn Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Icahn Enterprises Narrative

If our analysis doesn't quite match your outlook or you want to dig deeper into the numbers, you can build your perspective in just a few minutes with Do it your way.

A great starting point for your Icahn Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next breakthrough stock could be a click away. Power your portfolio forward with these handpicked opportunities that savvy investors are already checking out.

- Boost your income and stability by checking out these 16 dividend stocks with yields > 3% offering attractive yields exceeding 3%.

- Catalyze your growth strategy with these 31 healthcare AI stocks which are redefining innovation in the medical and biotech space.

- Tap into tomorrow’s leaders among these 3593 penny stocks with strong financials based on strong fundamentals and positioned for the next leg up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IEP

Icahn Enterprises

Through its subsidiaries engages in the investment, energy, automotive, food packaging, real estate, home fashion and pharma in the United States and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives