- United States

- /

- Industrials

- /

- NasdaqGS:HON

Is Now the Right Moment for Honeywell After Recent Smart Building Partnership News?

Reviewed by Bailey Pemberton

Wondering whether it’s the right time to make a move on Honeywell International? You’re not alone. Investors everywhere are eyeing this industrial giant as its share price resumes an upward trend, gaining 2.5% in just the past week and nudging up 3.0% over the last month. Yet, zooming out, Honeywell stock is still down 4.9% for the year, leaving some on the sidelines to weigh whether this is a signal of opportunity or concern.

Behind these moves, recent headlines have shed new light on Honeywell’s prospects. The company’s recent announcement in smart building technology partnerships and a focus on sustainability initiatives have caught investors’ attention, hinting at growth potential in segments well aligned with global trends. Though not seismic news, these developments feed into the evolving narrative around Honeywell’s long-term transformation and potential risk-reward profile.

If you’re looking for a quick verdict on value, Honeywell currently earns a valuation score of 2 out of 6, suggesting it appears undervalued in two out of the six checks we use. But what does that really mean? Next, we’ll dig into each valuation approach and how the numbers stack up. And if you’re truly focused on understanding the real “fair value,” stick around, as there is a smarter, more holistic method you won’t want to miss at the end of this article.

Honeywell International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Honeywell International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. For Honeywell International, this means evaluating the expected cash the business could generate in the years ahead and determining what that is worth in today's dollars.

Currently, Honeywell reports Free Cash Flow (FCF) of about $6.29 Billion. Analyst estimates project annual FCF growth through 2029, with Simply Wall St extrapolating numbers beyond that timeline. Specifically, forecasts suggest FCF could rise to $7.29 Billion by 2029. After five years, additional cash flow projections are extended out to 2035, with the most distant estimate placing FCF at approximately $8.55 Billion (all in USD).

Based on the DCF method using the 2 Stage Free Cash Flow to Equity model, Honeywell’s intrinsic value is estimated at $212.22 per share. When compared to the current share price, this suggests the stock is about 1.0% overvalued, which is a very small margin.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Honeywell International's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

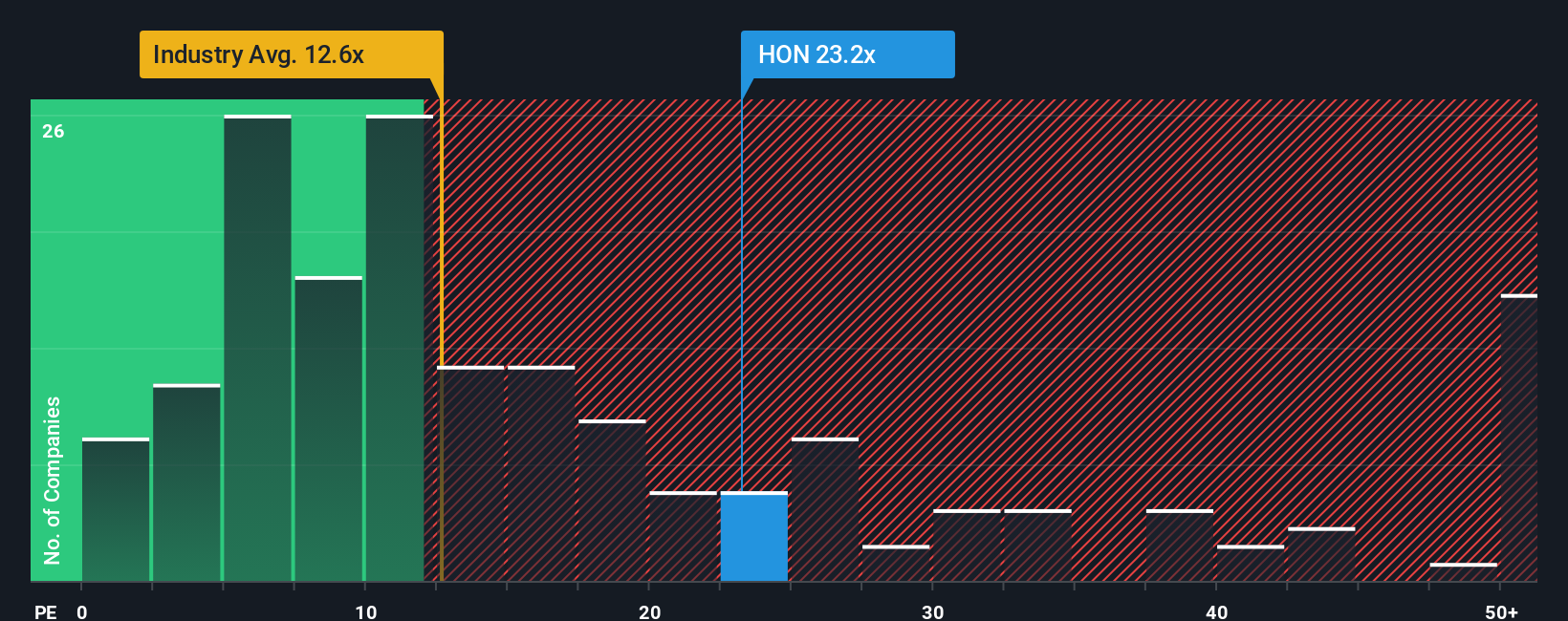

Approach 2: Honeywell International Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a favored metric for valuing profitable companies because it focuses on the relationship between a company’s earnings and its current stock price. For investors, the PE ratio offers a straightforward view of how much the market is willing to pay for each dollar of Honeywell International’s earnings.

Different factors influence what is considered a “normal” or “fair” PE ratio. Companies with higher growth prospects or lower risk often command higher PE ratios, while those with slower growth or more uncertainty tend to trade at lower multiples. It is important, therefore, to judge the PE ratio in the context of these underlying dynamics rather than in isolation.

Honeywell International is currently trading at a PE ratio of 22.2x. This is significantly above the Industrials industry average of 12.8x, but below the peer group average of 28.6x. Simply Wall St’s “Fair Ratio,” which takes into account key factors like Honeywell’s earnings growth prospects, profit margins, risk profile, industry dynamics, and market capitalization, arrives at a tailored benchmark of 27.8x for Honeywell.

The Fair Ratio is a more insightful measure than simply comparing with the industry or peers, as it consolidates company-specific strengths and risks into a single, actionable benchmark. Thus, it gives a more accurate sense of how the stock should be valued relative to its unique context.

With Honeywell’s current PE of 22.2x and a Fair Ratio of 27.8x, the shares are trading slightly below their fair value based on earnings. This suggests that the market may be placing a discount on Honeywell relative to its longer-term growth and profitability profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Honeywell International Narrative

Earlier we mentioned that there is a smarter, more holistic way to understand valuation, and this is where Narratives come in. A Narrative is a simple, intuitive way for investors to capture their own story or perspective about a company. It is not just about focusing on numbers, but about connecting their outlook for Honeywell International’s future revenue, earnings, and margins to a concrete, personalized fair value.

Narratives work by anchoring your investment viewpoint to a financial forecast, which then drives a fair value estimate. This approach makes your investment decisions much more transparent and explainable. On Simply Wall St’s Community page, millions of investors are already sharing their Narratives, making this tool both powerful and accessible for everyone, whether you’re a beginner or an experienced investor.

Rather than relying only on static ratios or consensus targets, Narratives let you compare your fair value directly with Honeywell International’s current price. This allows you to know exactly when you think it is time to buy or sell based on what you believe will unfold. Since Narratives update automatically as news breaks or fresh company results are released, your viewpoint always reflects the most relevant information.

For example, some investors anticipate Honeywell could be worth as much as $290 if restructuring unlocks future growth, while others perceive challenges and set their target as low as $203. Your Narrative puts you in control of that story.

For Honeywell International, we make it straightforward for you with previews of two leading Honeywell International Narratives:

- 🐂 Honeywell International Bull Case

Fair Value: $248.54

Current price is approximately 13.7% below this fair value.

Expected revenue growth: 4.18%

- Separation into three focused companies is expected to unlock value and drive long-term growth, benefiting both revenue and margins.

- Strategic acquisitions and a push into high-growth sectors such as LNG and data centers are anticipated to enhance operational stability and profitability.

- Key risks include economic and geopolitical uncertainties as well as execution challenges during the separation, which could pressure short-term results.

- 🐻 Honeywell International Bear Case

Fair Value: $203.00

Current price is approximately 5.6% above this fair value.

Expected revenue growth: 3.67%

- Tariff pressures and shifting trade patterns are likely to compress margins and hinder revenue growth.

- Separation into three companies brings significant execution risk and near-term earnings challenges due to high one-time costs.

- While strategic actions aim to enhance earnings and stakeholder value, the optimistic market expectations may not be fully justified if global demand falters.

Do you think there's more to the story for Honeywell International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives