- United States

- /

- Industrials

- /

- NasdaqGS:HON

Honeywell (HON): Profit Margin Decline Challenges Bullish Narratives on Growth and Valuation

Reviewed by Simply Wall St

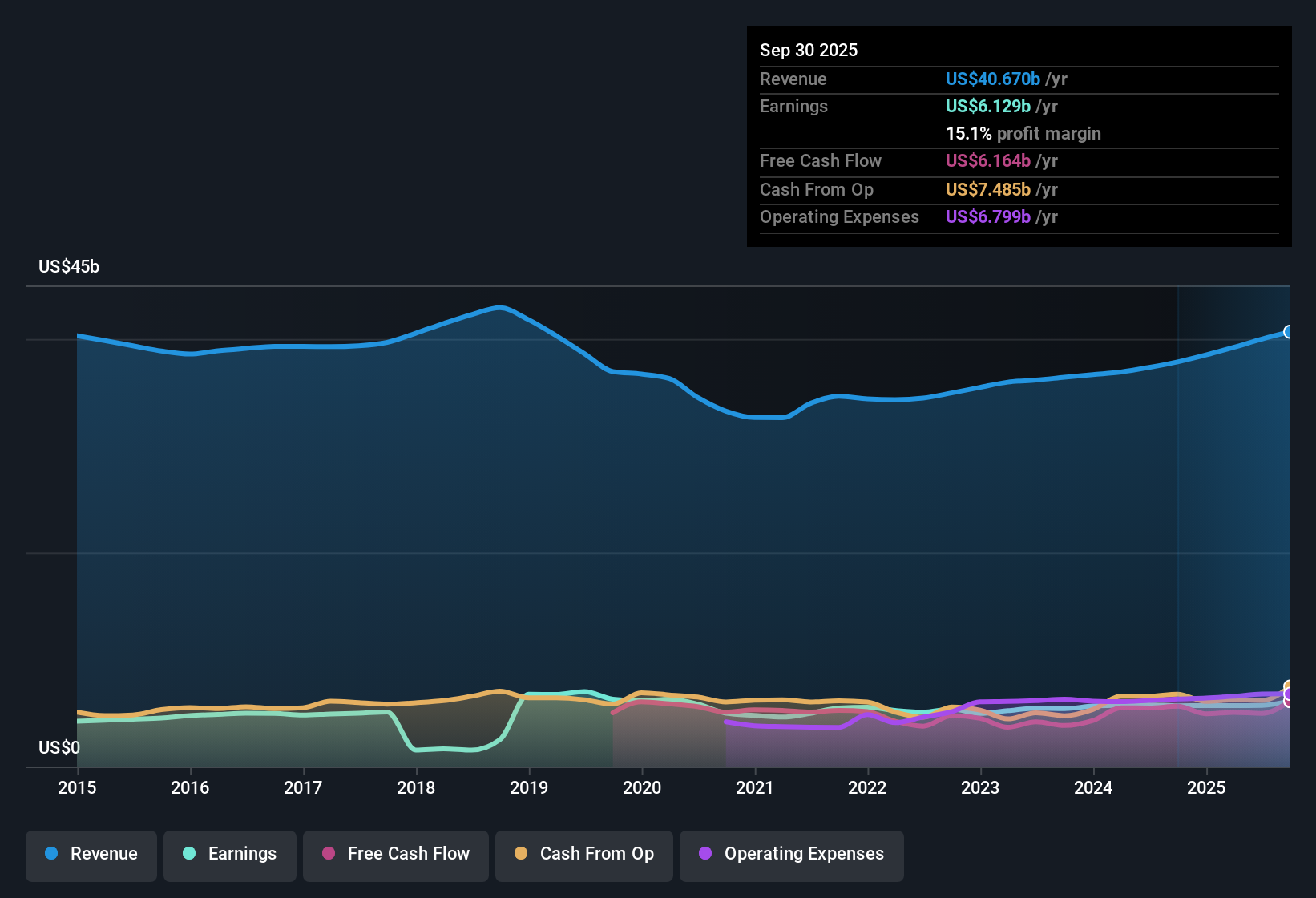

Honeywell International (HON) closed out the quarter with a net profit margin of 14.3%, slipping from last year’s 15.5% as annual earnings contracted despite a five-year annual earnings growth rate of 3.7%. Looking ahead, analysts expect earnings to grow at a 7.4% rate per year, well behind the US market’s 15.5% average, and revenue growth to track at 4.4% annually. With margins still healthy and a reputation for quality earnings, the results highlight a steady but unspectacular performance relative to broader market expectations.

See our full analysis for Honeywell International.Next, we’ll put these earnings numbers head-to-head with the current market narrative to see whether the community’s expectations match the reality, or if there are surprises in the underlying story.

See what the community is saying about Honeywell International

Separation Costs Stretch Margin Recovery

- Honeywell faces over $1.5 billion in one-time costs from its plan to separate into three public companies. These expenses may weigh down margin expansion efforts despite a recent net profit margin of 14.3%.

- Bears argue these restructuring expenses and execution risks could pressure near-term earnings, even if profit margins are projected to climb to 16.9% in three years.

- Expected separation costs, together with $500 million in possible tariff exposure, may counteract positive impacts from future margin improvement. This highlights their concern about short-term profitability.

- Bears also point out that revenue growth forecasts of only 3.7% per year trail both the US market and consensus expectations, adding to skepticism over Honeywell’s plans to unlock value through its breakup.

Dividend Strength Stands Out in Sector

- While Honeywell’s price-to-earnings ratio of 24.5x is well below the peer average of 28.7x, its combination of high-quality earnings and an attractive dividend helps differentiate it from industry rivals.

- The consensus narrative notes that ongoing share repurchases and segment growth in areas such as LNG and data centers are set to support stable dividends and enhance long-term value.

- Analysts expect the number of shares outstanding to decline by 2.36% annually over the next three years. This can further boost earnings per share and keep dividend growth on a steady trajectory.

- Expansion into high-growth verticals and continued productivity improvements are positioned to reinforce Honeywell’s appeal for dividend-focused investors, offering resilience even as margin recovery takes time.

Valuation Trades at a Premium to Industrials

- Despite offering better value than direct peers, Honeywell’s 24.5x earnings multiple is still nearly double the global industrials sector average of 12.7x. Its $220.67 share price remains above DCF fair value of $202.34.

- According to the analysts’ consensus view, the share price is trailing the official price target of $249.40, but the gap between current price and sector multiples reflects a premium that demands delivery on margin guidance and strategic execution.

- While the stock looks attractive versus peers, the premium against broader industrials and the modest growth trajectory raise the bar for future performance.

- Any shortfall in executing the separation plan or realizing expected revenue gains could narrow that premium quickly, making valuation a central debate point for both bulls and bears.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Honeywell International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot a different story in the numbers? Shape your unique perspective and contribute your own take in just a few minutes. Do it your way

A great starting point for your Honeywell International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Honeywell’s sluggish earnings growth, heavy restructuring costs, and premium valuation highlight its struggle to keep pace with broader market expectations.

To sidestep those challenges, use stable growth stocks screener (2088 results) to target companies that consistently deliver on both earnings and revenue, regardless of the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives