- United States

- /

- Trade Distributors

- /

- NasdaqGS:HEES

There's No Escaping H&E Equipment Services, Inc.'s (NASDAQ:HEES) Muted Earnings

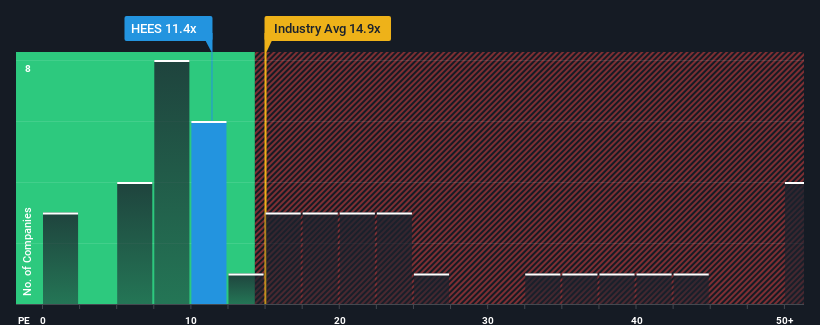

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider H&E Equipment Services, Inc. (NASDAQ:HEES) as an attractive investment with its 11.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, H&E Equipment Services has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for H&E Equipment Services

What Are Growth Metrics Telling Us About The Low P/E?

H&E Equipment Services' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 63%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 1.0% over the next year. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

With this information, we are not surprised that H&E Equipment Services is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From H&E Equipment Services' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of H&E Equipment Services' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with H&E Equipment Services (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if H&E Equipment Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HEES

H&E Equipment Services

Operates as an integrated equipment services company in the United States and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives