- United States

- /

- Construction

- /

- NasdaqGS:GLDD

Should Great Lakes Dredge & Dock (NASDAQ:GLDD) Be Disappointed With Their 76% Profit?

Some Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) shareholders are probably rather concerned to see the share price fall 32% over the last three months. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. In the last three years the share price is up, 76%: better than the market.

See our latest analysis for Great Lakes Dredge & Dock

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

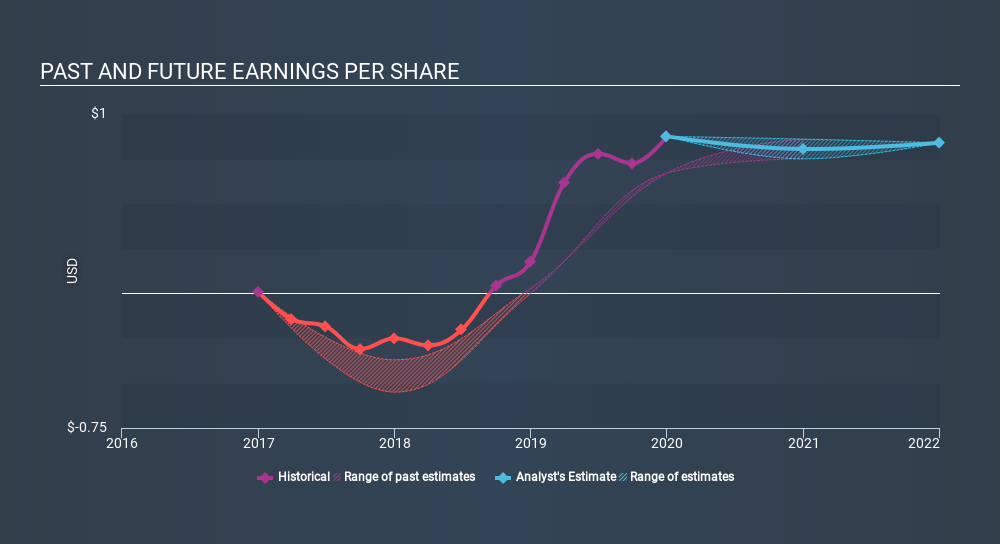

Great Lakes Dredge & Dock was able to grow its EPS at 361% per year over three years, sending the share price higher. The average annual share price increase of 21% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat. We'd venture the lowish P/E ratio of 8.92 also reflects the negative sentiment around the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Great Lakes Dredge & Dock has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Great Lakes Dredge & Dock shareholders are down 19% for the year. Unfortunately, that's worse than the broader market decline of 8.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 4.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Great Lakes Dredge & Dock (1 makes us a bit uncomfortable) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:GLDD

Great Lakes Dredge & Dock

Provides dredging services in the United States.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives