- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Firefly Aerospace (FLY): Examining Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Firefly Aerospace (FLY) has seen its stock price move in recent trading, sparking discussion among investors about what might be driving the action. Performance over the past month has been volatile and is raising questions about valuation.

See our latest analysis for Firefly Aerospace.

Firefly Aerospace’s recent 15.12% 1-day share price decline certainly grabbed attention, but that drop follows a broader trend with a 26.10% 30-day share price decrease and a sharp 67.72% decline year-to-date. While volatility can signal shifting investor sentiment, it also suggests that some see potential for a turnaround, especially with ongoing developments in the aerospace sector.

If current market swings have you scouting for new opportunities, it could be the perfect moment to discover See the full list for free.

With shares trading well below analyst price targets and the company posting strong revenue growth, the question for investors is clear: does Firefly Aerospace represent an undervalued opportunity, or is the market already factoring in its future prospects?

Price-to-Sales of 27.9x: Is it justified?

Firefly Aerospace trades at a price-to-sales ratio of 27.9x, which is significantly higher than both its peers and the broader US Aerospace & Defense industry. This remains true even with its recent last close price of $19.48. This indicates that investors are paying a substantial premium for every dollar of Firefly's revenue.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of company sales. This metric is especially relevant for companies in high-growth or unprofitable phases, such as Firefly Aerospace. A high P/S multiple can reflect confidence in future growth, but it also introduces risk if those expectations are not met.

Compared to the industry average of 2.9x and a peer average of just 2.2x, Firefly Aerospace's P/S ratio appears particularly elevated. If the company's growth projections do not materialize, market sentiment could quickly shift toward industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 27.9x (OVERVALUED)

However, steep losses and negative net income growth raise concerns that Firefly Aerospace could face ongoing challenges if positive momentum does not return soon.

Find out about the key risks to this Firefly Aerospace narrative.

Another View: Discounted Cash Flow Approach

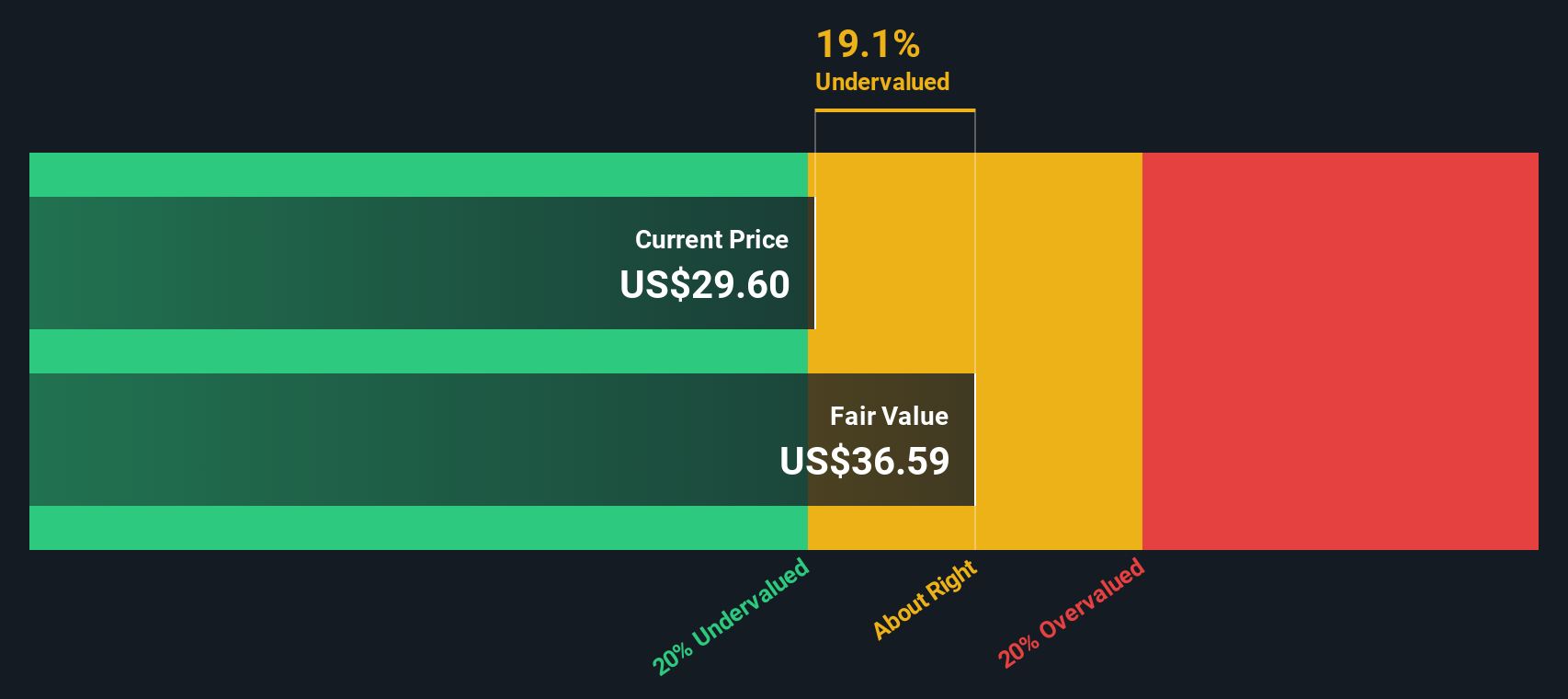

Switching to our DCF model for a fresh perspective, we find that Firefly Aerospace's shares are trading at a 44.9% discount to our estimate of fair value ($35.33). This suggests that, based on long-term cash flow potential, the stock could be undervalued, even though market multiples remain elevated. Could the crowd be overlooking future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Firefly Aerospace for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Firefly Aerospace Narrative

If you’re not convinced by these results, or want to see the numbers for yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Firefly Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart investment idea?

Don’t let standout opportunities slip past you. Find companies with momentum, growth potential, or resilient income sources that match your style and goals.

- Tap into the power of emerging technology by checking out these 27 AI penny stocks, which are poised for rapid advancements and significant returns in artificial intelligence.

- Maximize your passive income strategy and see which picks offer reliable yields by browsing these 18 dividend stocks with yields > 3%, featuring above-average payouts.

- Position yourself at the forefront of innovation and track real breakthroughs in computing with these 26 quantum computing stocks, highlighting opportunities that promise real-world impact and future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives