- United States

- /

- Electrical

- /

- NasdaqCM:FLUX

Flux Power Holdings, Inc. (NASDAQ:FLUX) Soars 36% But It's A Story Of Risk Vs Reward

Despite an already strong run, Flux Power Holdings, Inc. (NASDAQ:FLUX) shares have been powering on, with a gain of 36% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

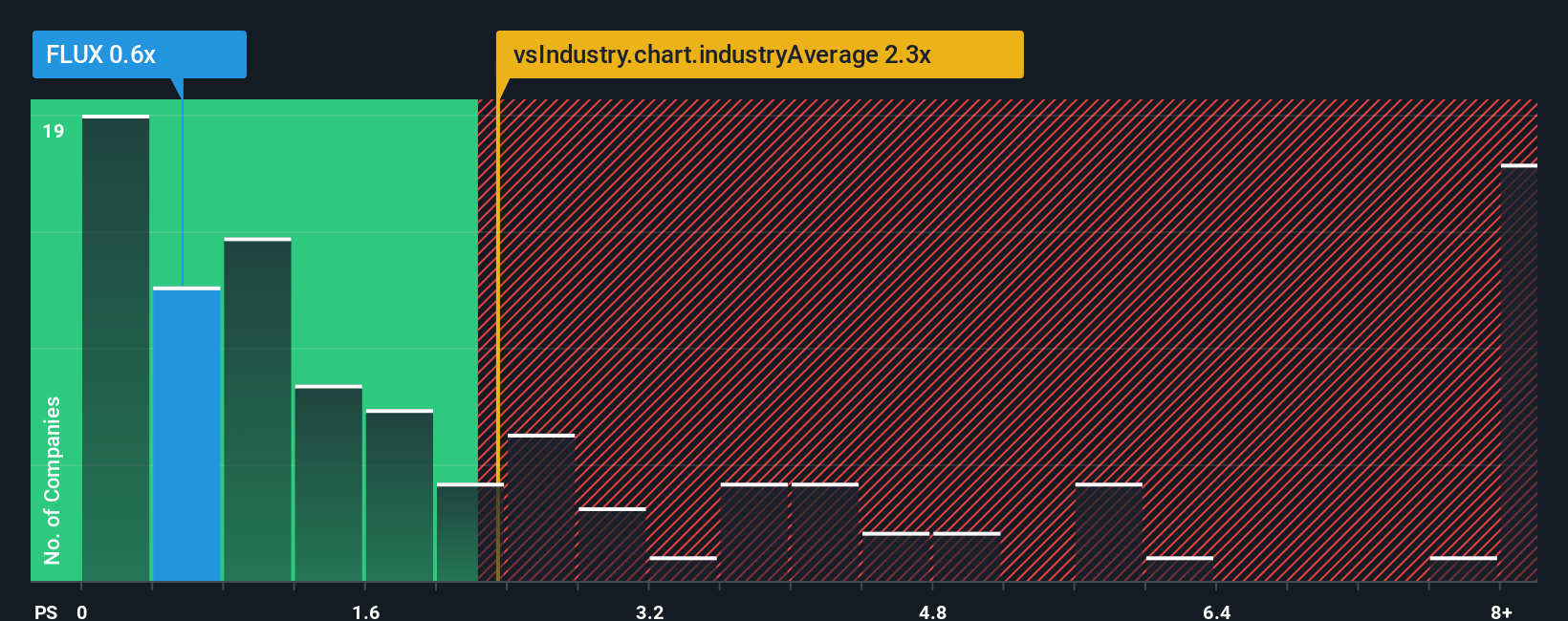

Although its price has surged higher, Flux Power Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Flux Power Holdings

How Flux Power Holdings Has Been Performing

Flux Power Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Flux Power Holdings.How Is Flux Power Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Flux Power Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 78% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 21% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Flux Power Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Flux Power Holdings' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Flux Power Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You need to take note of risks, for example - Flux Power Holdings has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FLUX

Flux Power Holdings

Through its subsidiary, designs, develops, manufactures, and sells lithium-ion energy storage solutions in North America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives