- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Can Fluence (FLNC) Leverage New Arizona Project to Bolster Its Profitability Story?

Reviewed by Sasha Jovanovic

- Earlier this month, Torch Clean Energy announced a partnership with Fluence Energy to develop a 160 MW solar-plus-storage facility in Arizona, integrating Fluence's advanced Gridstack Pro 5000 energy storage solution to enhance grid balancing and qualify for federal tax credits.

- This collaboration aims to address rising regional energy demands and reflects increasing optimism for renewables and battery storage in the face of growing data center infrastructure needs.

- We’ll explore how this major project partnership could influence Fluence Energy’s investment narrative amid ongoing questions about execution and profitability.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fluence Energy Investment Narrative Recap

To invest in Fluence Energy, you have to believe large-scale grid storage and renewable integration will see sustained demand from surging electrification, data centers, and policy support, even while fierce tariff headwinds and supply chain risks compress near-term growth. The recent Torch Clean Energy partnership is positive for long-term backlog and highlights Fluence’s relevance in grid modernization, but this alone does not meaningfully shift the pressing question of whether the company can accelerate backlog conversion and translate it into improving short-term profitability.

Among recent company updates, Fluence’s September milestone shipment of battery storage systems made entirely with U.S. components stands out. This move toward domestic supply could be increasingly relevant as the company seeks to address tariff risks, support margin recovery, and enable projects like Winchester to fully benefit from federal incentives.

However, in contrast to this operational progress, investors should be aware that ...

Read the full narrative on Fluence Energy (it's free!)

Fluence Energy is projected to reach $4.2 billion in revenue and $97.9 million in earnings by 2028. This outlook assumes a 19.5% yearly revenue growth rate and a $116.3 million increase in earnings from the current level of -$18.4 million.

Uncover how Fluence Energy's forecasts yield a $10.21 fair value, a 50% downside to its current price.

Exploring Other Perspectives

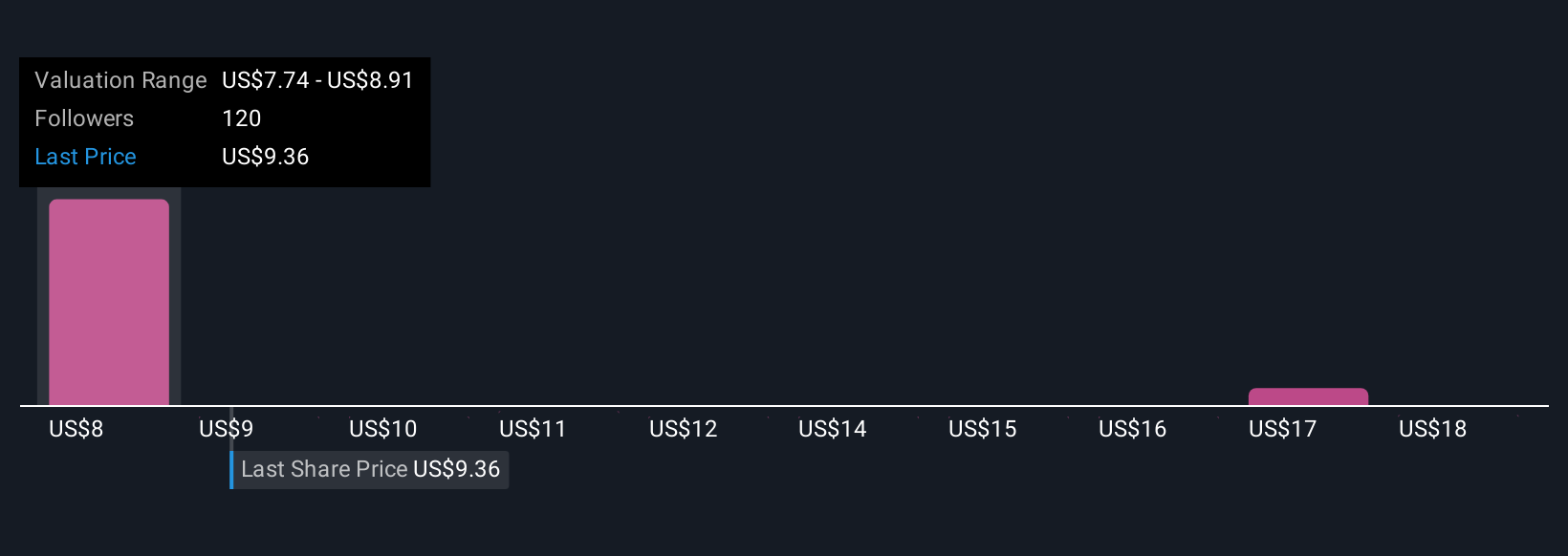

Seven community-member fair value estimates for Fluence Energy range widely from US$10.21 to US$25.75 per share on Simply Wall St. While supply chain shifts strengthen the investment case, U.S.-China trade policy uncertainty remains a crucial factor shaping optimism among market participants.

Explore 7 other fair value estimates on Fluence Energy - why the stock might be worth as much as 26% more than the current price!

Build Your Own Fluence Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fluence Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluence Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives