- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

A Look at Fluence Energy (FLNC) Valuation After Production Updates and Upcoming Earnings Shift Investor Sentiment

Reviewed by Simply Wall St

Fluence Energy (FLNC) rallied 12% as investors shifted their portfolios ahead of the company’s upcoming fiscal year earnings, following updates about production ramp-up challenges and year-end targets for its newly launched US factories.

See our latest analysis for Fluence Energy.

While Fluence Energy has delivered a remarkable 52% share price return in the past month and an even stronger 148% gain over three months, its total shareholder return over the last year is still down slightly. Momentum has accelerated sharply lately as investors react to the company’s production ramp-up plans and the potential for improving fundamentals, which signals that sentiment could be shifting from caution to optimism.

If Fluence’s turnaround has you curious about other fast-rising opportunities, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares surging and anticipation ahead of earnings running high, are Fluence Energy’s gains justified by its fundamentals, or has the recent rally already factored in the company’s future growth prospects? Could this be a genuine buying opportunity, or is the market already pricing in the turnaround?

Most Popular Narrative: 105.7% Overvalued

Fluence Energy’s most-followed narrative indicates the current market price of $21 significantly exceeds the consensus fair value estimate of $10.21. This marks a wide disconnect between analyst fundamental projections and prevailing investor optimism. This gap warrants a closer look at the assumptions driving that valuation difference.

Rapid global electrification and surging power demand, driven by data centers, transportation, and industrial sectors, are expected to sharply increase the need for grid resilience and flexibility, leading to substantial projected growth for large-scale battery storage. This expansion will drive material revenue growth for Fluence over the next several years.

Want to understand what’s fueling this lofty valuation? The narrative is built on bold multi-year profit forecasts and a projected margin turnaround. But which surprising growth drivers are at the heart of that fair value? Find out what underpins the forecasted turnaround. One figure could change how you see the stock’s trajectory.

Result: Fair Value of $10.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainty and supply chain challenges could quickly derail optimism, especially if project execution or cost controls fall short of expectations.

Find out about the key risks to this Fluence Energy narrative.

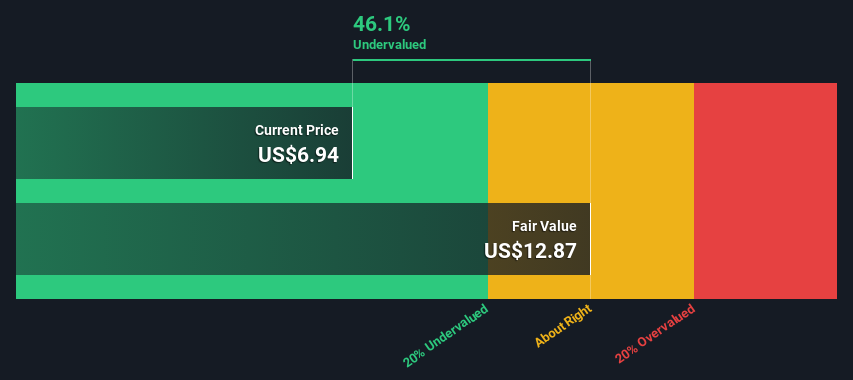

Another View: What About the SWS DCF Model?

While the current price-to-sales ratio paints Fluence Energy as attractively valued versus its industry and peers, our SWS DCF model offers a different perspective. This approach estimates a fair value of $16.30, which is well below the current share price, suggesting that future cash flows may not fully justify the market's optimism. Might this signal caution, or does it reflect underappreciated growth potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fluence Energy Narrative

If you would rather chart your own path or see the numbers through a personal lens, you can build a narrative from scratch in just a few minutes. Your perspective could reveal something new. Do it your way

A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself every advantage by searching beyond a single stock. Smart investors use fresh ideas. Here’s your chance to get ahead with tailored opportunities fitting your interests:

- Unlock high-yield opportunities by checking out these 20 dividend stocks with yields > 3%, with solid financial performance and yields above 3%.

- Tap into the next AI-powered breakthroughs by evaluating these 27 AI penny stocks, delivering innovation in automation and digital intelligence.

- Catch exciting undervalued potential and see which companies may be flying under the radar in these 836 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives