- United States

- /

- Trade Distributors

- /

- NasdaqCM:FGI

FGI Industries Ltd. (NASDAQ:FGI) Shares Fly 153% But Investors Aren't Buying For Growth

The FGI Industries Ltd. (NASDAQ:FGI) share price has done very well over the last month, posting an excellent gain of 153%. The last month tops off a massive increase of 141% in the last year.

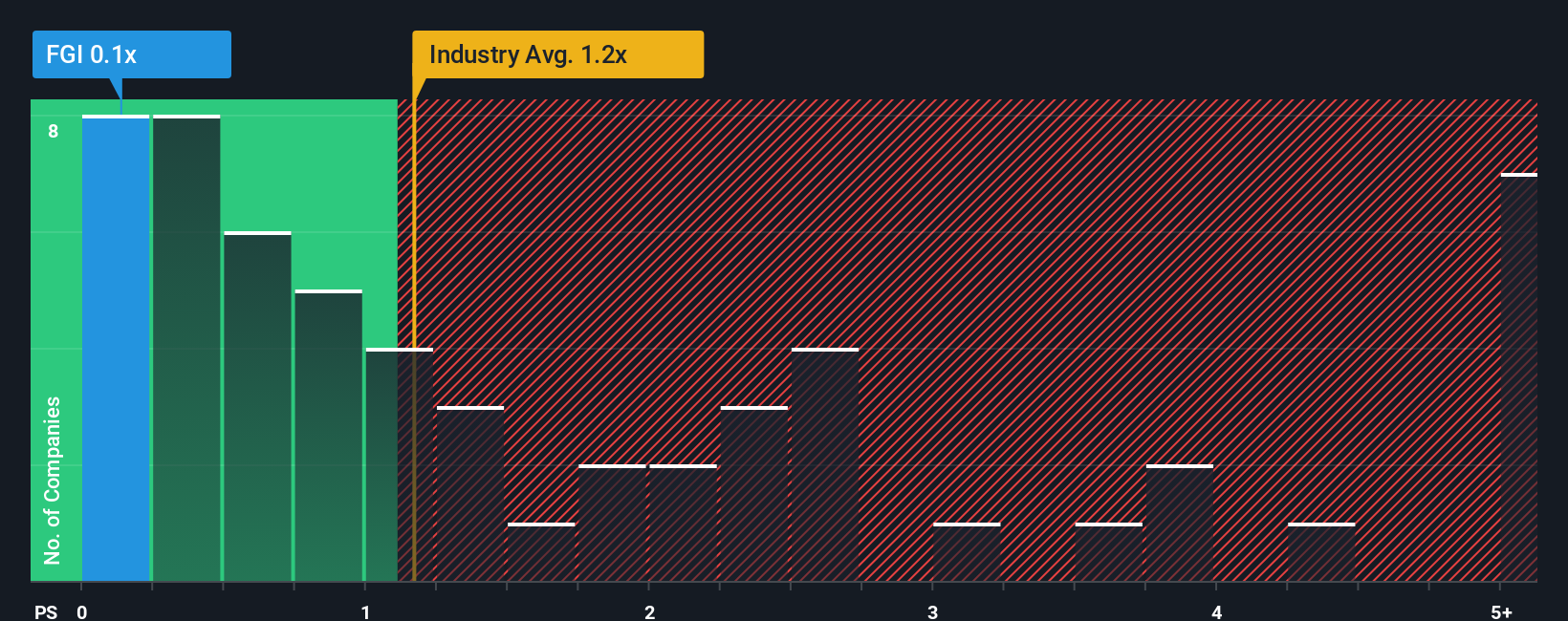

Although its price has surged higher, given about half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider FGI Industries as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for FGI Industries

What Does FGI Industries' P/S Mean For Shareholders?

FGI Industries could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think FGI Industries' future stacks up against the industry? In that case, our free report is a great place to start.How Is FGI Industries' Revenue Growth Trending?

In order to justify its P/S ratio, FGI Industries would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 30% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.4% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 21% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that FGI Industries' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite FGI Industries' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of FGI Industries' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for FGI Industries (3 shouldn't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FGI

FGI Industries

FGI Industries ltd. supplies bath and kitchen products retail, wholesale, commercial and specialty channel customers in the United States, Canada, Europe, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives