- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Franklin Electric (FELE) Margin Drop and $59M One-Off Challenge Bullish Growth Narrative

Reviewed by Simply Wall St

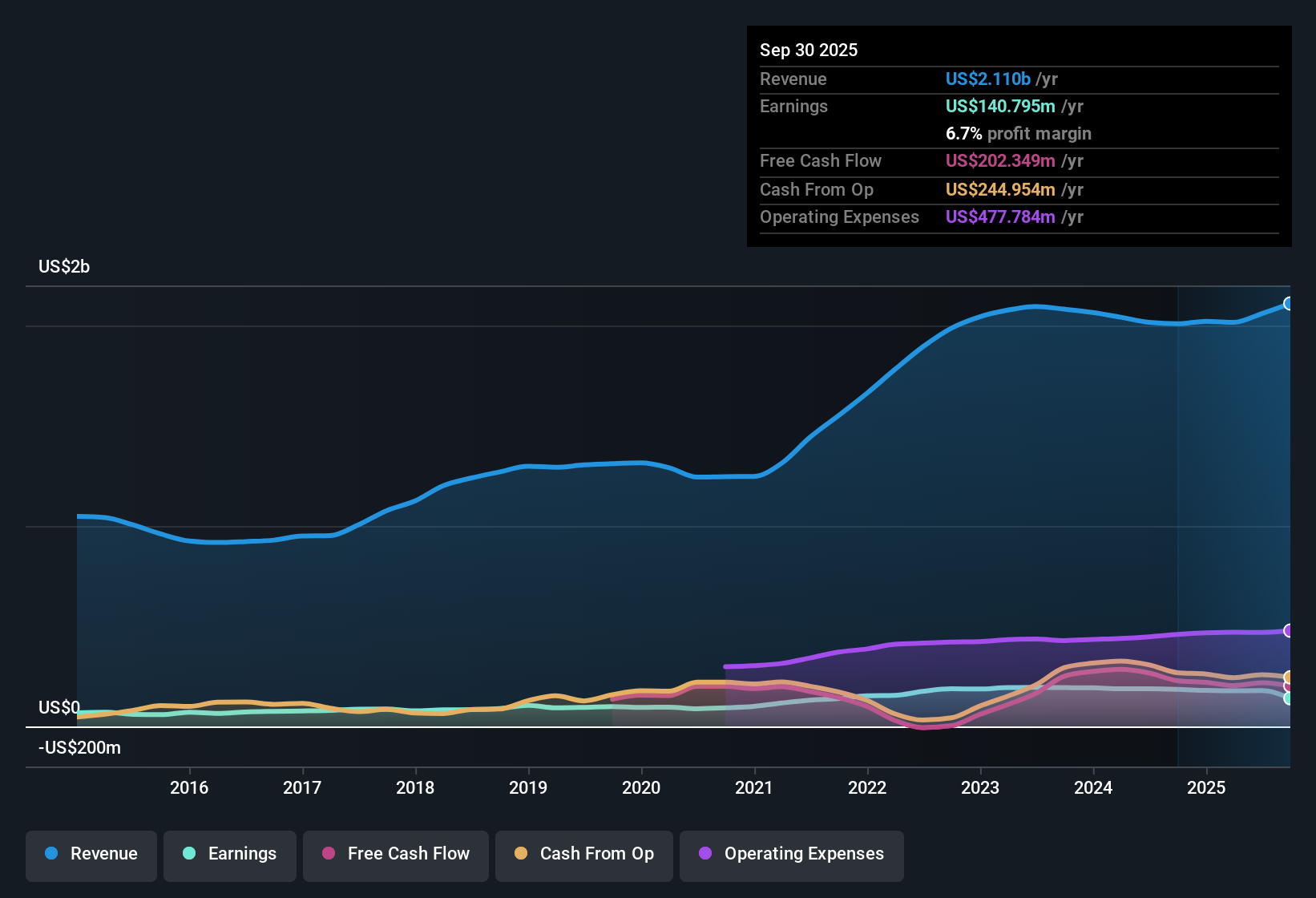

Franklin Electric (FELE) posted revenue growth forecasts of 5% per year, lagging behind the broader US market’s 10.1% pace. Net profit margins slipped to 6.7% from 9.2% in the previous year, with the most recent twelve months impacted by a one-off $59 million loss. Yet, EPS is expected to surge, as earnings are set to rise 28.9% annually, pushing well past significant growth thresholds and outpacing the wider US market’s 15.6% rate.

See our full analysis for Franklin Electric.The next step is to see how these headline results measure up against the dominant market narratives and widely held views.

See what the community is saying about Franklin Electric

Margins Show Signs of Recovery

- Analysts expect profit margins to rise from today’s 8.7% to 10.7% within three years, pointing to a rebound after seeing net margins fall to 6.7% in the most recent twelve months due to a one-off $59 million loss.

- According to the analysts' consensus view, ongoing cost optimization and the integration of recent acquisitions are seen as paving the way for higher-margin products and scalable operational efficiency.

- Strategic acquisitions, including Barnes and PumpEng, are already delivering faster cross-selling and regional manufacturing expansion, which consensus believes will help offset the margin pressure from earlier cost volatility.

- Consensus narrative highlights that disciplined capital deployment, together with smart water technology investments, make sustained net margin gains more achievable as long as order trends remain consistent and the integration of new operations is successful.

To see if these margin trends could drive long-term outperformance as analysts expect, catch the full consensus take here: 📊 Read the full Franklin Electric Consensus Narrative..

Peer Valuation Paints a Mixed Picture

- Franklin Electric’s price-to-earnings (P/E) ratio of 30.1x is cheaper than the peer average of 42x, but more expensive than the US Machinery industry’s average of 24.7x. The current share price of $95.26 is below both the analyst price target ($109.25) and the DCF fair value ($113.87).

- Consensus narrative makes clear that while some analysts see the discounted share price as a value opportunity, others highlight the premium to industry averages as a caution for new buyers.

- Bears argue that unless Franklin delivers on projected earnings growth, the premium to sector multiples could cap upside, despite trading below both target and DCF fair value.

- On the flipside, consensus points to discounted cash flow and relative peer value to justify holding, especially if margin expansion trends materialize as forecasted.

Cyclical Exposure and One-Offs Add Risk

- The past year’s net margin drop, from 9.2% to 6.7%, was driven by a significant $59 million non-recurring charge. This highlights how volatile sectors like dewatering and mining can swing reported profits.

- Consensus narrative warns that reliance on cyclical markets and the impact of integration costs from new acquisitions pose ongoing earnings quality risk.

- Critics highlight that segment-level pressures and cost shocks can keep expenses high, limiting how much of the optimistic earnings growth will reach the bottom line if industry cycles turn negative.

- Meanwhile, consensus maintains that successful execution on integration and cost actions could offset much of this volatility, but it will remain a key watch point for risk-focused investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Franklin Electric on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the numbers? You can start building your own narrative and insights in just a few minutes. Do it your way.

A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Franklin Electric’s earnings quality and margins remain exposed to industry cycles, acquisition integration costs, and the risk of missing growth forecasts.

If you want less volatility and steadier results, search for companies with a history of consistent expansion and reliable performance using stable growth stocks screener (2117 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives