- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Franklin Electric (FELE): Exploring Valuation Signals After Recent Stability in Share Price

Reviewed by Simply Wall St

See our latest analysis for Franklin Electric.

Franklin Electric’s share price has remained fairly steady around $95 in recent weeks. This follows a year in which the company delivered a total shareholder return of -0.2%. However, its three- and five-year total shareholder returns of 24% and 62.6% indicate that longer-term momentum remains intact.

If you’re weighing new opportunities, this could be the perfect moment to uncover fast growing stocks with high insider ownership.

With steady returns and the current share price below analyst targets, is Franklin Electric an overlooked value, or has the market already factored in its growth prospects, leaving little room for upside?

Most Popular Narrative: 11.8% Undervalued

Franklin Electric’s most widely followed fair value estimate sits at $108, a notable premium compared to the latest closing price just above $95. With the gap catching investors’ attention, the underlying growth assumptions deserve a closer look.

Strategic recent acquisitions, such as Barnes and PumpEng, are being integrated ahead of plan. This is leading to faster-than-expected cross-selling opportunities and regional manufacturing expansion, which enables operational efficiencies and diversifies revenue streams. These developments create upside for both revenue and margins.

Curious which bold forecasts are powering this target? The narrative’s future assumptions hinge on accelerating profit margins and revenue growth, with key metrics rivaling some of the fastest-growing names in the industry. Want to know the numbers and main financial levers that drive this fair value? Get the full story in the complete narrative.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on cyclical sectors along with ongoing margin pressures from recent acquisitions could challenge the company’s ability to deliver on these bullish forecasts.

Find out about the key risks to this Franklin Electric narrative.

Another View: Multiples Tell a Different Story

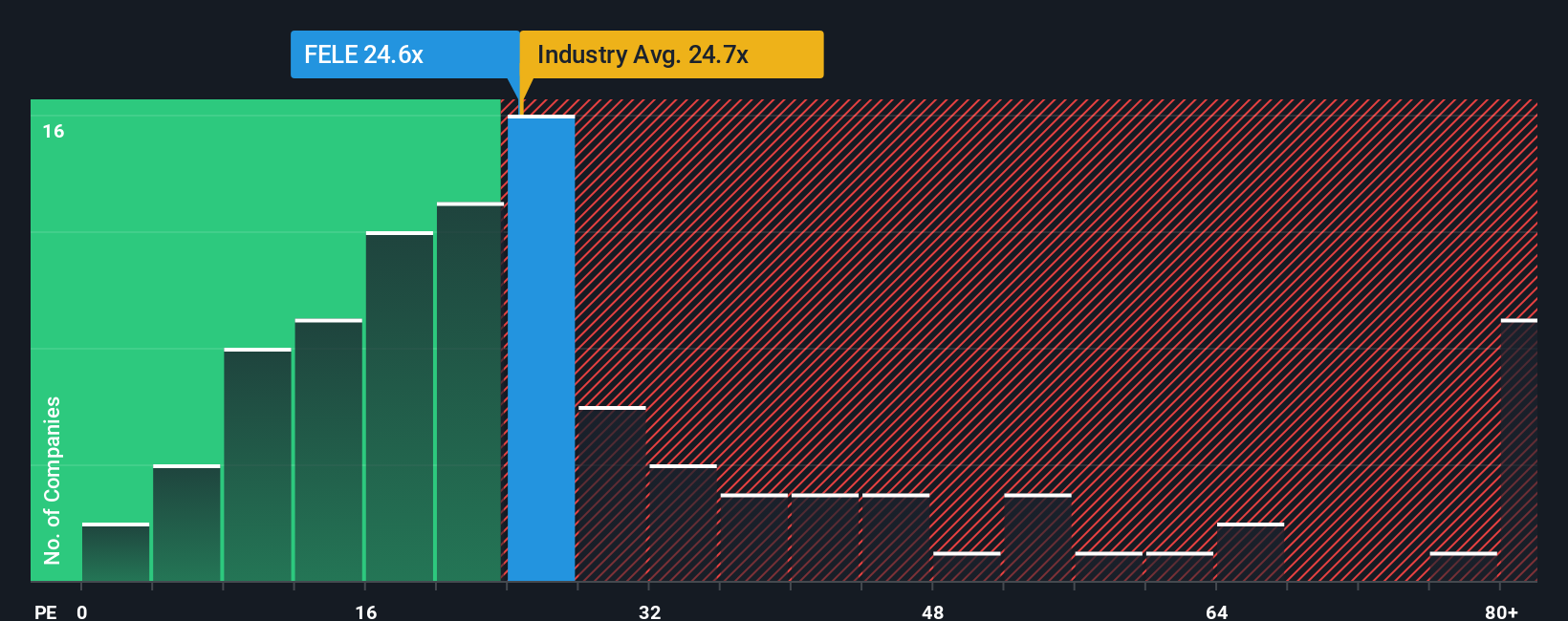

Looking at Franklin Electric from a pricing angle, its current price-to-earnings ratio is 30.1x, which is higher than the US Machinery industry average of 24.5x and above the fair ratio of 29.7x. This implies investors are paying a premium for expected growth, which increases the risk if future results fall short. Could the market be overestimating Franklin Electric’s upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Electric Narrative

If you want to reach your own conclusion or dig deeper into the numbers yourself, you can construct a personalized narrative in just minutes. Do it your way

A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means never settling for just one opportunity. Stay ahead of the curve and open the door to emerging trends and potential breakout stocks right now. These opportunities move quickly, so act fast.

- Uncover income potential as you tap into these 21 dividend stocks with yields > 3% delivering yields above 3% for a more rewarding portfolio.

- Ride the future of healthcare by targeting breakthroughs through these 34 healthcare AI stocks focused on transformative medical technologies powered by artificial intelligence.

- Expand your reach into overlooked companies by seizing the upside with these 3586 penny stocks with strong financials showing strong balance sheets and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives