- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Franklin Electric (FELE): Exploring Valuation as Revenue and Earnings Rise Despite Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Franklin Electric.

Franklin Electric’s share price has drifted lower over the last year, reflecting a 1-year total shareholder return of -11.2 percent despite notable revenue and earnings growth. Multi-year gains indicate that long-term investors have still done well. Recent momentum seems muted, suggesting the market is waiting for a fresh catalyst or a shift in sentiment.

If you’re interested in spotting the next mover, it might be a great time to broaden your search and uncover fast growing stocks with high insider ownership

With shares sitting below analyst price targets and recent growth in core financials, investors are left to wonder if Franklin Electric is being undervalued in the current market, or if future upside is already built into the price.

Most Popular Narrative: 13.3% Undervalued

The most popular narrative points to a fair value of $108 for Franklin Electric, suggesting notable upside from the last close at $93.67. The narrative draws on strong growth assumptions and strategic transformations, creating a bullish outlook for the years ahead.

Expansion into sustainable, energy-efficient water technologies and strategic acquisitions are enhancing product offerings, operational efficiency, and market presence for long-term growth. Cost optimization, digitalization, and disciplined capital deployment are boosting margins and supporting durable, above-market earnings performance.

Want to know the story behind this optimistic view? The narrative’s valuation banks on ambitious margin expansion and game-changing cost actions. What projections power these bullish numbers? Curious how these financial moves could propel returns? Click to see what might set Franklin Electric apart from the crowd.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on cyclical markets and integration challenges from recent acquisitions could quickly undermine margin gains and threaten Franklin Electric’s near-term growth story.

Find out about the key risks to this Franklin Electric narrative.

Another View: Multiple-Based Valuation

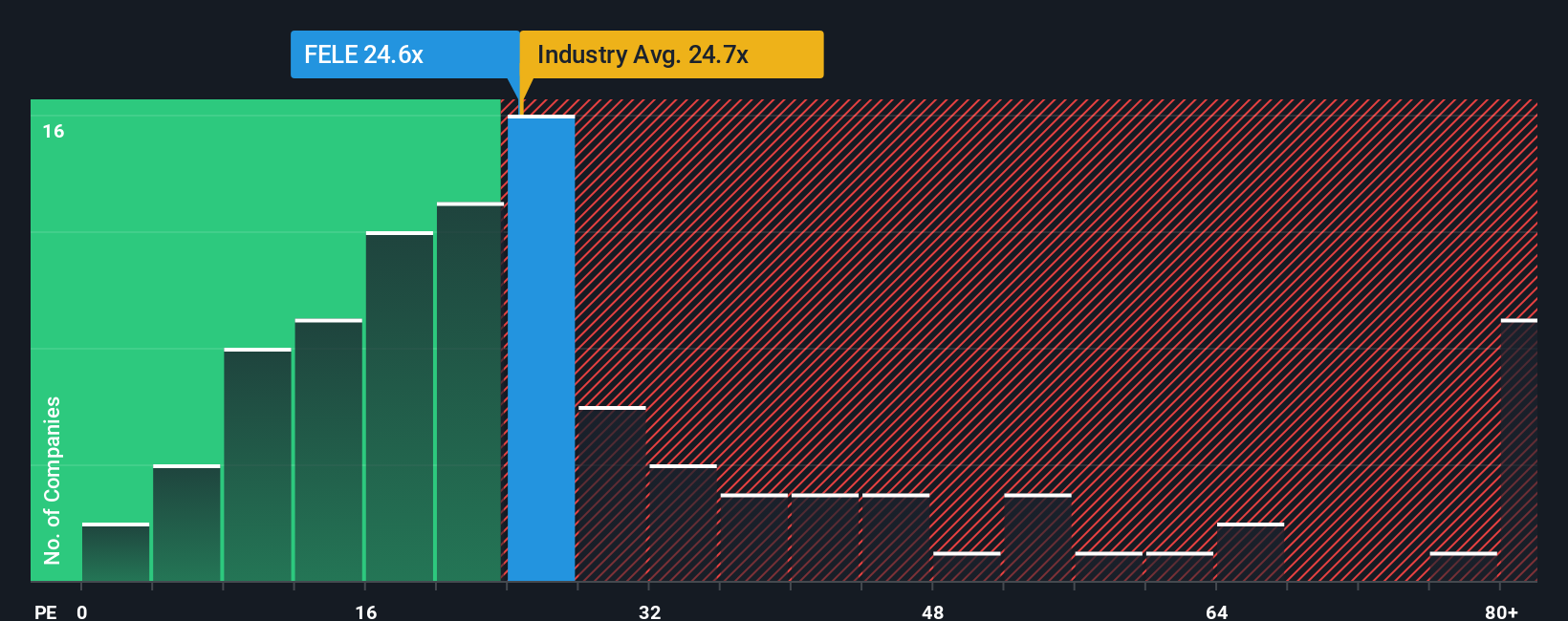

Looking at valuation through the lens of price-to-earnings, Franklin Electric trades at 29.6 times earnings, which is higher than the US Machinery industry average of 24.6 and above the fair ratio of 27.3. This signals some premium pricing, which could raise questions about the margin of safety for new investors. Are these higher expectations justified, or does it point to valuation risk on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Electric Narrative

If you see things differently or want to test your own thesis, you can dive in and build a custom narrative of your own in just a few minutes. Do it your way

A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Open the door to new opportunities with investment ideas that could transform your portfolio. Skip the guesswork and see what other forward-thinking investors are acting on right now.

- Capture untapped potential by scanning for these 876 undervalued stocks based on cash flows poised for a market re-rating as fundamentals catch up with their prices.

- Grow your passive income with these 15 dividend stocks with yields > 3% delivering reliable cash flow with yields that surpass the market average.

- Ride the innovation wave and spot tomorrow’s leaders with these 27 quantum computing stocks at the forefront of computing’s next big leap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives