- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

A Look at Fastenal’s (FAST) Valuation Following Revenue Growth and Leadership Changes

Reviewed by Simply Wall St

Fastenal (FAST) has caught investor attention after its latest earnings showed an 11.7% jump in revenue over last year, even though earnings per share landed just under expectations. The company also welcomed a new Chief Financial Officer, Max Tunnicliff, earlier this month.

See our latest analysis for Fastenal.

Riding a wave of robust revenue growth alongside some leadership changes, Fastenal’s share price currently stands at $40.30. While the recent 90-day price return has dipped nearly 20%, momentum over the past year has built steadily, and its three-year total shareholder return of almost 69% illustrates a longer story of strong compounding performance.

If Fastenal’s mix of steady growth and evolving leadership has you thinking broader, now is the perfect time to check out fast growing stocks with high insider ownership

With revenue growth outpacing earnings and a share price trailing analyst targets by a narrow margin, the question now is whether Fastenal represents an overlooked value, or if the market has already accounted for its future potential for growth.

Most Popular Narrative: 7.5% Undervalued

Fastenal’s last close of $40.30 sits below the most widely followed fair value estimate of $43.58, signaling room for potential upside based on the latest consensus. This premium narrative relies on structural changes and growth initiatives that could transform the company’s trajectory, with significant assumptions about future sales, margins, and technology strategies.

The company is expanding its Fastenal Managed Inventory (FMI) technology which currently represents over 43% of revenue, aiming to enhance revenue growth by increasing efficiency in customer supply chains. Fastenal aims to increase its digital footprint to represent 66-68% of sales, up from 61%, potentially boosting revenue by optimizing purchasing and operational efficiency.

Want to understand the deal behind this higher valuation? The narrative leans heavily on digital transformation, ambitious profit margin expansion, and an increase in operational efficiency. Curious which projections analysts are relying on to justify the premium? The details may surprise you.

Result: Fair Value of $43.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions affecting supply chains and persistent margin pressures remain key risks that could challenge Fastenal’s bullish valuation narrative.

Find out about the key risks to this Fastenal narrative.

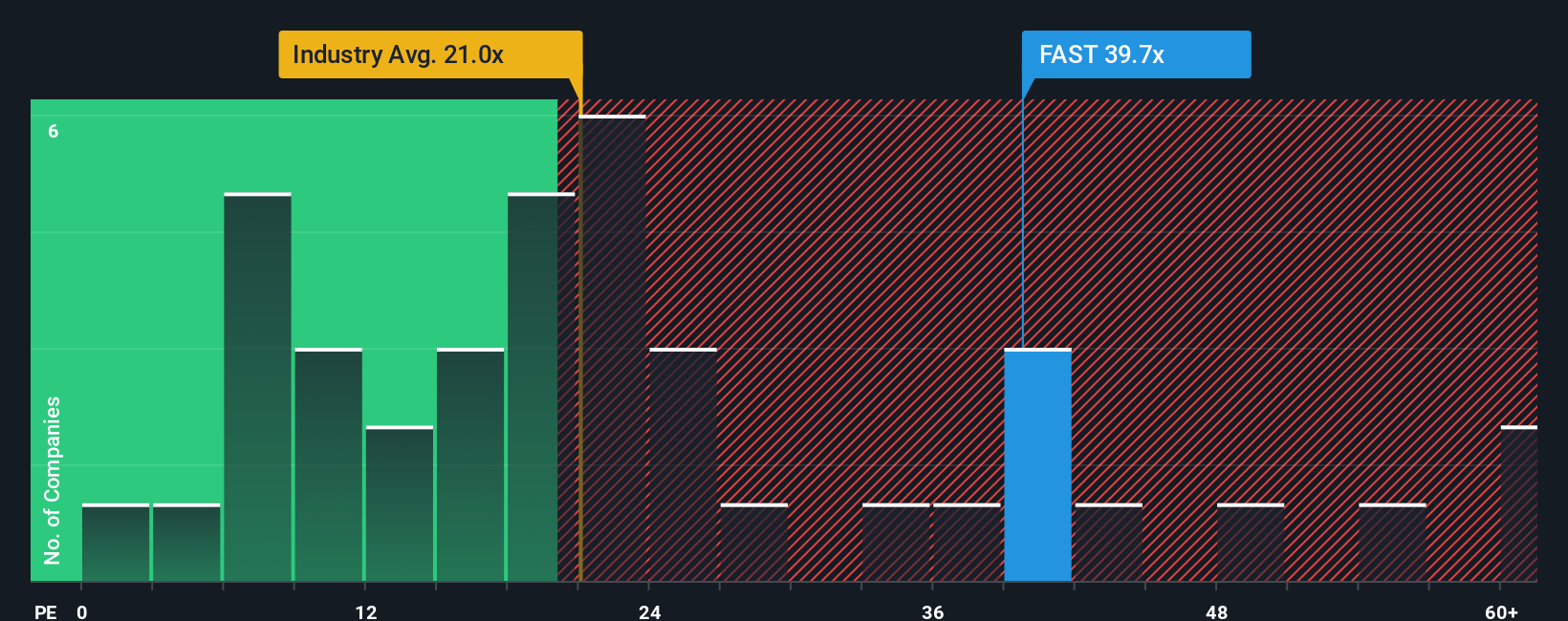

Another View: Multiples Suggest a Premium Price

While some see upside based on fair value models, Fastenal’s current price-to-earnings ratio is 37.7x. This is significantly higher than both the industry average of 19.3x and its fair ratio of 26.1x. This premium suggests the market expects stronger growth, but it also increases the risk if those expectations are not met. Could there be more downside risk than first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastenal Narrative

If you want to dig into the numbers on your own terms and share your perspective, the tools are available. Build your own narrative from scratch in just minutes. Do it your way

A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your potential to just one stock? Take control with powerful tools from Simply Wall Street and be the first to spot tomorrow’s winning trends.

- Boost your income strategy by tapping into these 15 dividend stocks with yields > 3% which offers attractive yields and reliable growth potential.

- Uncover the frontrunners in artificial intelligence as you browse these 25 AI penny stocks that are poised to redefine industries and accelerate future profits.

- Seize undervalued opportunities before the crowd does using these 927 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success