- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

Enovix (NasdaqGS:ENVX) Sees 33% Share Price Rise In Last Quarter

Reviewed by Simply Wall St

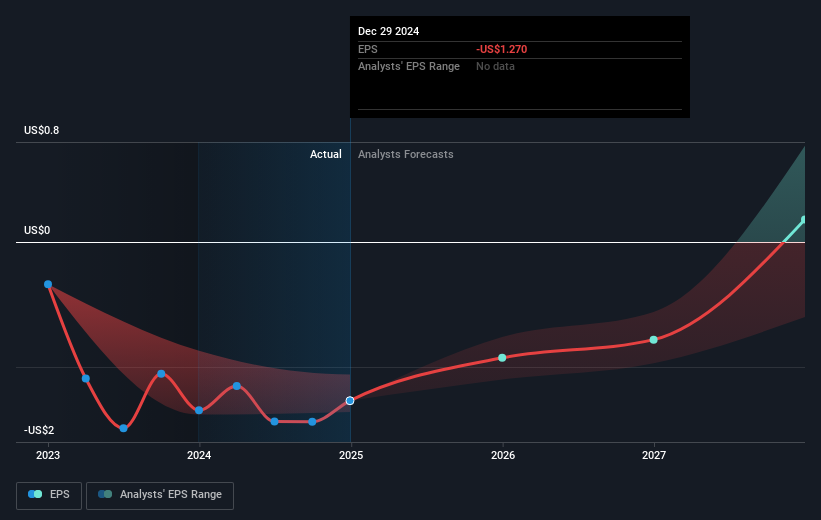

Enovix (NasdaqGS:ENVX) saw its share price rise by 33% in the last quarter, a time marked by several pivotal activities. The company's earnings announcement revealed a reduction in net loss, which may have positively influenced investor sentiment. Enovix also issued optimistic guidance for Q2 2025, projecting revenue growth compared to the previous quarter. Additionally, the appointment of a new CFO, Ryan Benton, could signal financial leadership stability, further boosting confidence. This performance aligned with a broader market rally, as the S&P 500 and Nasdaq reached new highs amid positive economic developments, contributing to Enovix's strong quarterly gain.

The recent developments at Enovix, such as the positive earnings announcement and promising guidance for Q2 2025, have the potential to significantly impact the company's narrative by positioning it as a growth-focused entity. This could enhance investor confidence, particularly with the strategic leadership of newly appointed CFO Ryan Benton. Over a longer-term period of three years, Enovix's total return, including share price and dividends, was 13.42%. This broader timeframe indicates moderate growth, pointing to the potential for future gains if market conditions remain favorable.

In the past year, Enovix underperformed the US Electrical industry, which saw a 34% return. However, the company's recent quarter showcases a reversal with a 33% increase in share price, suggesting a potential shift in momentum. The revenue projection associated with expansion into the defense and AR/VR markets could boost forecasts, though substantial manufacturing investments are necessary to sustain this trajectory. Any possible delays in smartphone production could complicate these optimistic projections, impacting earnings growth potential.

With Enovix's current share price at US$5.83, there’s a substantial gap to the analyst price target of US$26.91. This suggests market optimism about Enovix’s ability to meet its growth objectives. Future revenue and profitability assumptions, while ambitious, hinge on successful product rollouts and capitalizing on emerging market opportunities. Monitoring these developments will be critical for stakeholders aiming to understand Enovix's potential trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Enovix

Designs, develops, and manufactures lithium-ion battery cells in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives