- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

Enovix (NasdaqGS:ENVX) Expands Leadership in India with New R&D Head Appointment

Reviewed by Simply Wall St

Enovix (NasdaqGS:ENVX), recently experienced significant changes within its executive team, appointing Srikanth Kethu as Head of Enovix India on July 14, 2025, to bolster R&D and operational expansion in the region. Over the last quarter, the company saw a substantial increase in its share price by 134.11%, possibly influenced by multiple factors including the launch of the AI-1™ platform, financial updates indicating an improved net loss, and a $60 million share repurchase program. Despite broader market uncertainties with trade policies and stagnant index movements, Enovix's developments appear to have positively influenced investor sentiment.

Be aware that Enovix is showing 1 possible red flag in our investment analysis.

Enovix's recent executive appointment and strategic developments, such as the launch of the AI-1™ platform and a $60 million share repurchase program, could positively influence both its operational capabilities and investor sentiment. These initiatives aim to bolster R&D and expand operational capacity, potentially leading to increased revenue and earnings growth, especially with the upcoming high-volume production in Malaysia and next-gen battery innovations aligned with smartphone and AR/VR launches. However, they also come with risks, including the strain from high-capital manufacturing investments and dependence on smartphone market success.

Over the past three years, Enovix's total return, including share price and dividends, was 35.16%. This performance provides a broader context for the company's recent 134.11% quarterly share price surge despite a volatile background. Compared to the U.S. Electrical industry, Enovix underperformed last year, which saw a 31.3% return. Meanwhile, the broader U.S. market returned 11.4% over the same period, highlighting Enovix's variance from broader industry trends.

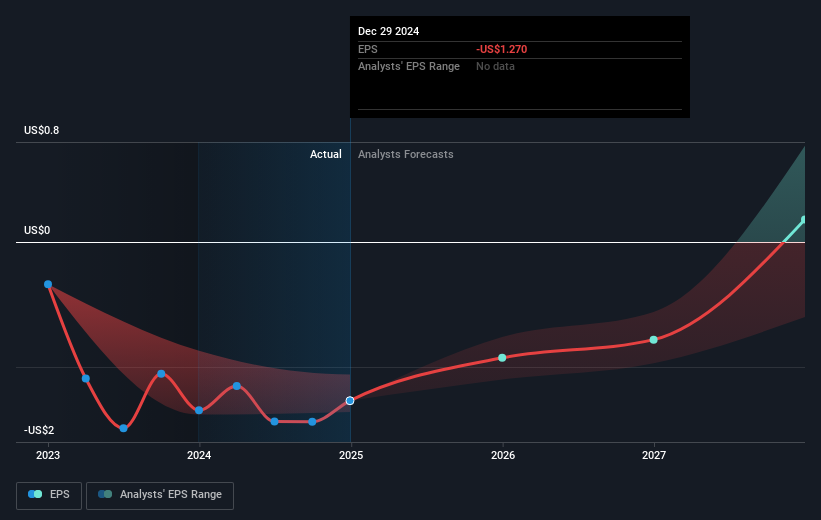

In light of the enhanced revenue prospects from defense and smart eyewear markets, analysts are projecting significant annual revenue growth of 171.2% for Enovix over the next three years. Despite this optimism, the company isn't expected to reach profitability soon. Its current share price of US$5.83 remains considerably below the analyst consensus price target of US$26.91. This gap, while substantial, underlines the inherent risks and future potential that analysts see in Enovix, considering assumed improvements in profit margins and operational efficiencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Enovix

Designs, develops, and manufactures lithium-ion battery cells in the United States and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives