- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

Evaluating EHang Holdings (NasdaqGM:EH) Valuation After Fresh Analyst Buy Rating and Renewed Market Focus

Reviewed by Kshitija Bhandaru

The recent initiation of coverage by a DBS analyst, assigning a Buy rating to EHang Holdings (NasdaqGM:EH), has put the spotlight on the company's ongoing strategic moves and future growth trajectory.

See our latest analysis for EHang Holdings.

After attracting renewed attention with fresh analyst coverage, EHang Holdings’ share price momentum appears to be building, with an energetic year-to-date share price return of over 21%. However, its 1-year total shareholder return is still slightly negative, so long-term investors may be waiting for stronger execution.

If news-driven shifts like this have you watching closely, it could be a perfect moment to discover fast growing stocks with high insider ownership.

With analyst optimism running high and the shares still trading at a significant discount to consensus price targets, investors now face a critical question: is this an entry point for upside, or does the market already reflect the company’s growth story?

Most Popular Narrative: 19.5% Undervalued

With a narrative fair value of $23.71 compared to EHang Holdings’ last close at $19.09, the gap points to significant upside if consensus projections play out. The current discount suggests strong confidence in future growth drivers credited by analysts.

The ongoing expansion of urban air mobility use cases, especially driven by government initiatives in smart cities, emergency response, and low-altitude economic ecosystems, positions EHang's autonomous aerial vehicles as foundational infrastructure. This is likely to sustain robust long-term demand and revenue growth as cities increasingly adopt eVTOL solutions.

Curious what’s fueling this bullish outlook? The narrative hinges on a transformative set of assumptions: think aggressive revenue growth, margin expansion, and bold profitability targets. Want to see how these ambitious projections stack up to analyst forecasts? Unlock the details behind the number that caught Wall Street’s eye.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as delayed regulatory certifications and heavy reliance on the China market could limit EHang’s growth if these issues are not managed carefully.

Find out about the key risks to this EHang Holdings narrative.

Another View: A Look at Market Comparisons

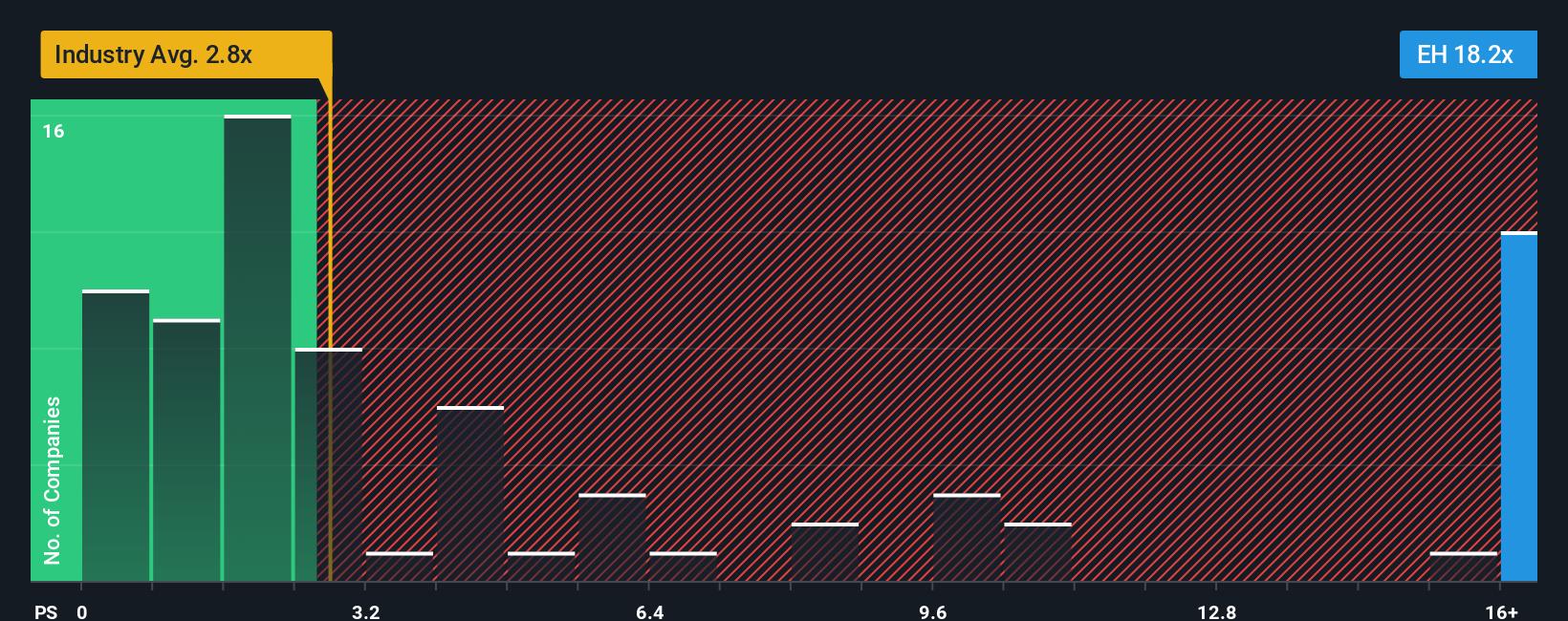

Taking a different approach, a glance at EHang Holdings' sales ratio paints a less optimistic picture. The company trades at 21 times sales, much higher than its industry peers at 3.3 times and above its fair ratio of 10.4. Such a premium signals the market is already pricing in a lot of future growth, which could be too much depending on how the business actually performs.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EHang Holdings Narrative

Prefer to dig deeper or want your own perspective? You can explore the underlying data and craft a personal narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EHang Holdings.

Looking for More Investment Ideas?

Unlock bigger opportunities by tapping into smart investment themes. These stock ideas could put you ahead of the crowd before others catch on.

- Tap into innovation and see which companies in artificial intelligence are capturing investor attention right now by checking out these 24 AI penny stocks.

- Get ahead of market trends by examining these 885 undervalued stocks based on cash flows, revealing stocks that stand out for their attractive pricing and cash flow potential.

- Capitalize on futuristic tech and rapid breakthroughs by evaluating these 26 quantum computing stocks, shaping tomorrow's quantum-powered industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential and fair value.

Market Insights

Community Narratives