- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

Evaluating EHang Holdings (NasdaqGM:EH) After Landmark Africa Flight and Global Expansion Partnership

Reviewed by Simply Wall St

If you’ve been following EHang Holdings (NasdaqGM:EH), you probably know the stock is on a lot more watchlists after the latest headline. The company announced a strategic partnership with China Road and Bridge Corporation, aiming to fast-track the global rollout of its autonomous eVTOL aircraft. Their collaboration took center stage at this year’s Aviation Africa summit, marking EHang’s first successful human-carrying pilotless flight in Africa and demonstrating just how quickly the company is extending its international reach.

This is not an isolated flash in the news either. Over the past year, EHang has steadily grown its global presence and now operates in 21 countries. With moves into new markets and momentum from this recent strategic alliance, the stock has delivered a 40% increase over the past twelve months, even after some bumps following revised revenue guidance last month. Despite short-term price volatility, EHang’s long-term return stands out and investor interest appears to remain strong.

With these rapid milestones and new partnerships, some investors may be asking whether EHang represents a value opportunity with global potential, or if the market has already priced in the company’s long-term prospects.

Most Popular Narrative: 31.2% Undervalued

According to the most widely followed narrative, EHang Holdings is currently considered undervalued, trading at a significant discount to its estimated fair value. The narrative hinges on rapid expansion in urban air mobility and the company's evolving business model, both seen as major growth drivers.

The ongoing expansion of urban air mobility use cases, especially driven by government initiatives in smart cities, emergency response, and low-altitude economic ecosystems, positions EHang's autonomous aerial vehicles as foundational infrastructure. This is likely to sustain robust long-term demand and revenue growth as cities increasingly adopt eVTOL solutions.

What’s behind this bullish outlook? The narrative leans on bold projections, including game-changing earnings growth and a future profit margin far exceeding today's numbers. Want to uncover which assumptions are fueling the analysts' price targets? The details might surprise you.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, EHang's concentrated sales in China and the risk of slower international expansion could introduce uncertainty to the upbeat valuation narrative.

Find out about the key risks to this EHang Holdings narrative.Another View: Multiples Paint a Different Picture

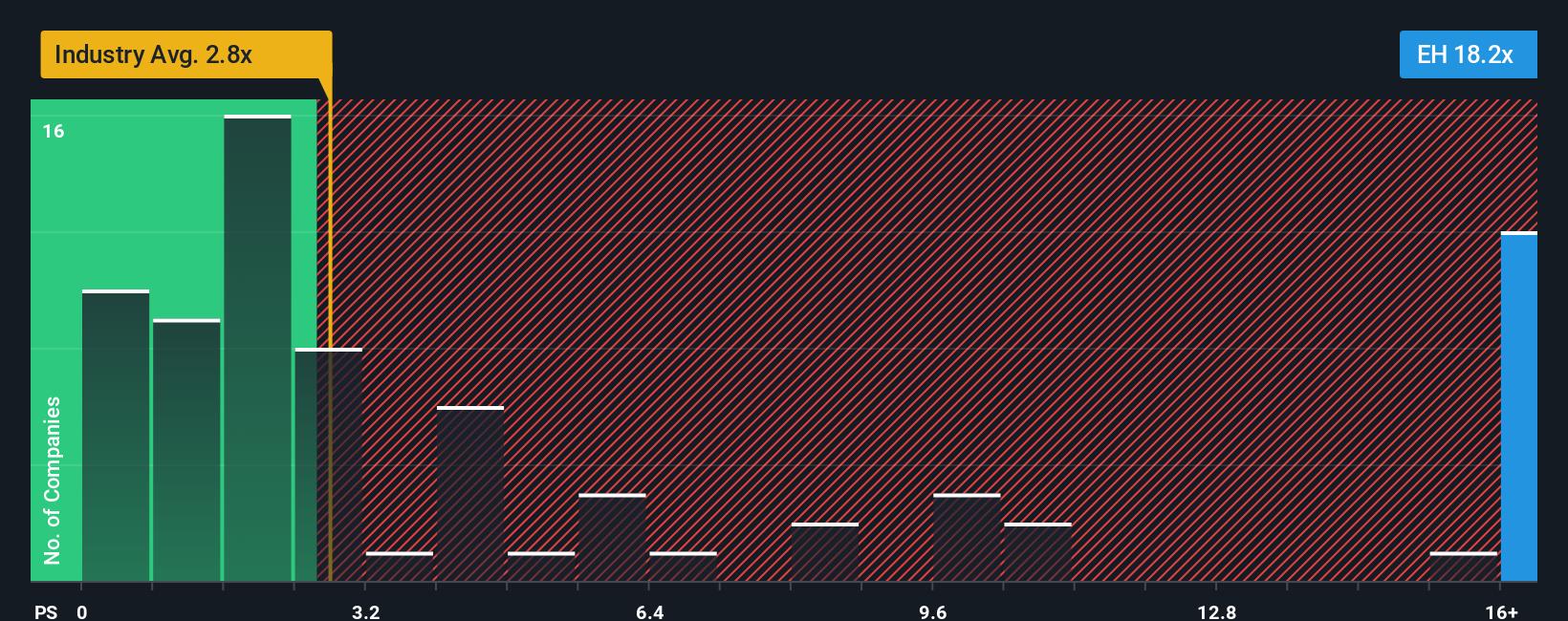

While analysts see EHang as undervalued based on future growth, a look at its sales-based valuation shows the shares actually trade at a much higher level than most industry peers. Which method gets closer to the truth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding EHang Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own EHang Holdings Narrative

If you see things differently, or want to dig deeper into the data, you can craft your own story in just a couple of minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EHang Holdings.

Looking for more investment ideas?

Don't let great opportunities slip by. Uncover stocks that match your strategy with Simply Wall Street’s tools and stay ahead on the smartest trends in the market.

- Earn steady income and safeguard your portfolio by tapping into dividend stocks with yields > 3% for stand-out companies offering attractive yields above 3%.

- Explore the next wave of artificial intelligence breakthroughs by searching for tomorrow’s tech leaders through AI penny stocks.

- Strengthen your growth potential by finding shares undervalued by their future cash flows using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives