- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

EHang (NasdaqGM:EH) Valuation in Focus After VT35 Launch and New Industry Partnerships

Reviewed by Simply Wall St

EHang Holdings (NasdaqGM:EH) just revealed its latest upgrade in aerial mobility with the VT35 long-range pilotless aircraft. This launch shows the company’s drive to bring practical electric vertical take-off technology to more intercity and cross-sea applications.

See our latest analysis for EHang Holdings.

The VT35 launch lands just as EHang’s stock momentum has picked up in 2024, with a 15% share price return year-to-date and a healthy 8.2% total shareholder return over the past year. Despite some legal noise recently and a turbulent 90-day stretch, the longer-term picture is even more impressive. EHang boasts a remarkable 353% three-year total shareholder return, signaling that market optimism toward its future in pilotless flight is still alive and well.

If you’re interested in where aerial tech is heading next, it’s a great moment to explore opportunities in high-growth tech and AI. See the full list for free: See the full list for free.

With analyst price targets still sitting well above current trading levels, and rapid revenue expansion on display, investors now face a key question: Is EHang truly undervalued at today’s prices, or has the market already priced in its future growth?

Most Popular Narrative: 24% Undervalued

The narrative consensus points to EHang Holdings trading roughly a quarter below what analysts see as its fair value. This substantial discount compared to the last close highlights differing views between the current market and forward-looking projections, drawing attention to the underlying catalysts.

The company's deepening partnerships with municipal governments (such as Hefei's RMB 500 million support for the VT35 hub) and involvement in setting regulatory and safety standards enhances regulatory acceptance and ecosystem integration. This supports wider market entry, improved top-line growth, and improved long-term earnings visibility.

Want a glimpse at the ambitious financial roadmap driving this price target? The full story reveals the big assumptions behind future earnings, jaw-dropping revenue growth, and premium profit margins, plus which pivotal factors could shift the outcome. Find out what’s powering this bullish narrative.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady expansion is not guaranteed. EHang’s heavy reliance on China and notable certification delays could challenge both growth and profitability ahead.

Find out about the key risks to this EHang Holdings narrative.

Another View: The Price-To-Sales Perspective

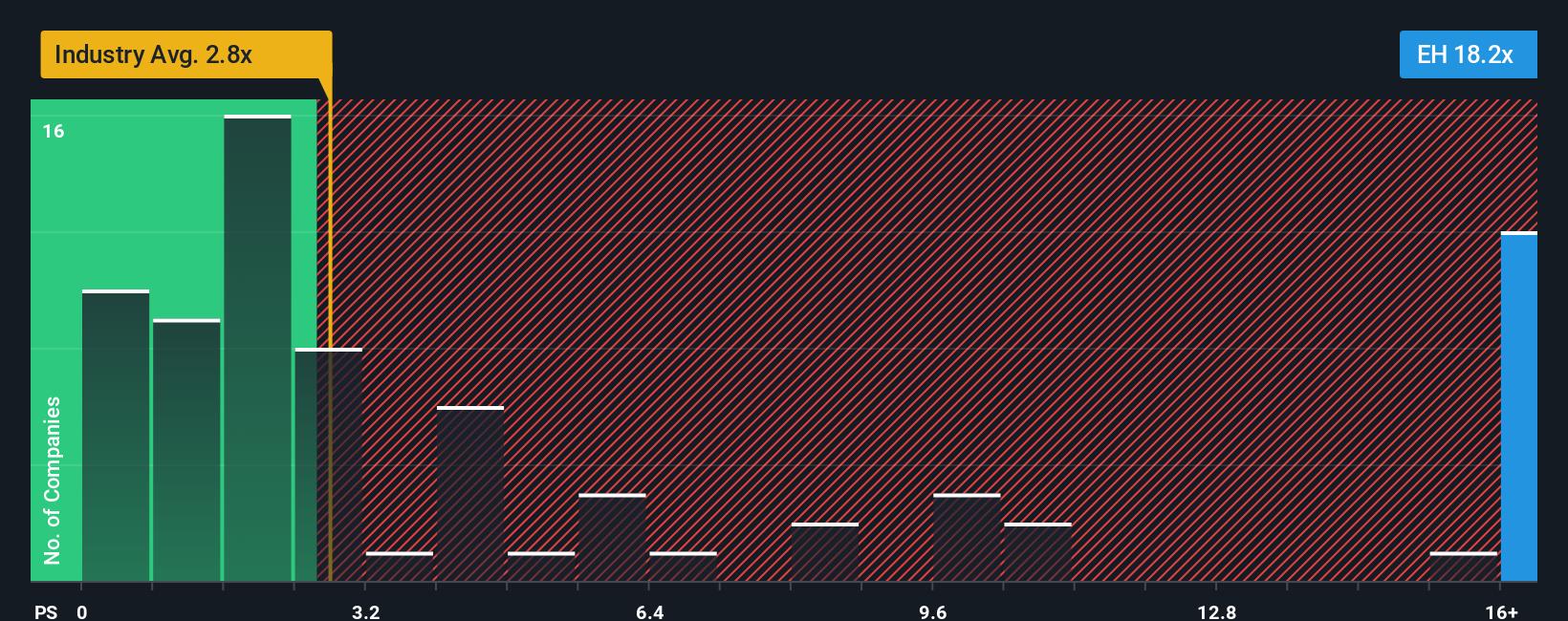

Looking at EHang’s valuation through its price-to-sales ratio tells a different story. The company trades at 19.8 times sales, which is far above the US Aerospace & Defense industry average of 3.1 times and the peer average of 3.5 times. Even compared to the fair ratio of 10.4, this is a steep premium. This suggests that the market has priced in very optimistic growth. Could this high multiple withstand slower expansion, or is there a risk of repricing if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EHang Holdings Narrative

If this view does not match yours, or you want to interpret the numbers in your own way, you can easily craft your own perspective in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EHang Holdings.

Looking for More Investment Ideas?

Don’t let your next best investment slip by. Make smarter, faster moves and spot winners early with these expert-curated stock lists from Simply Wall Street:

- Tap into companies reshaping tomorrow by checking out these 24 AI penny stocks, which are at the forefront of game-changing artificial intelligence breakthroughs.

- Go after stable cash returns with these 17 dividend stocks with yields > 3%, featuring established businesses delivering attractive yield and sustained payouts above 3%.

- Capitalize on high-growth innovation with these 27 quantum computing stocks, focused on quantum computing pioneers pushing the boundaries of what is possible in tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives