- United States

- /

- Electrical

- /

- NasdaqCM:EFOI

Bearish: This Analyst Is Revising Their Energy Focus, Inc. (NASDAQ:EFOI) Revenue and EPS Prognostications

One thing we could say about the covering analyst on Energy Focus, Inc. (NASDAQ:EFOI) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

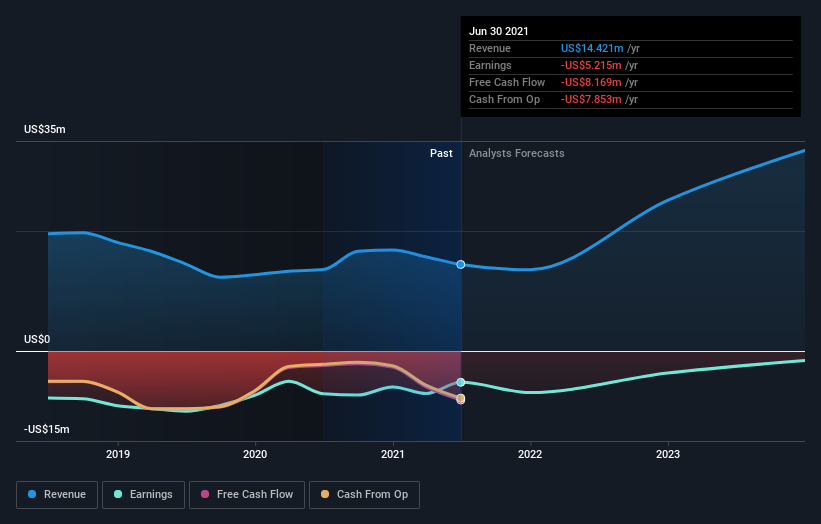

Following the latest downgrade, the single analyst covering Energy Focus provided consensus estimates of US$14m revenue in 2021, which would reflect a discernible 6.0% decline on its sales over the past 12 months. Losses are expected to increase substantially, hitting US$1.58 per share. However, before this estimates update, the consensus had been expecting revenues of US$19m and US$1.06 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for Energy Focus

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would also point out that the forecast 12% annualised revenue decline to the end of 2021 is better than the historical trend, which saw revenues shrink 24% annually over the past five years By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 9.8% per year. So while a broad number of companies are forecast to grow, unfortunately Energy Focus is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Energy Focus. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that Energy Focus' revenues are expected to grow slower than the wider market. After a cut like that, investors could be forgiven for thinking the analyst is a lot more bearish on Energy Focus, and a few readers might choose to steer clear of the stock.

As you can see, the analyst clearly isn't bullish, and there might be good reason for that. We've identified some potential issues with Energy Focus' financials, such as a short cash runway. Learn more, and discover the 3 other risks we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Energy Focus, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Energy Focus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:EFOI

Energy Focus

Designs, develops, manufactures, markets, and sells energy-efficient lighting systems, and controls and ultraviolet-C light disinfection products in the United States and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives