- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Valuation Insights as Defense Recognition and Drone Tech Investment Drive New Growth Focus

Reviewed by Kshitija Bhandaru

Leonardo DRS (DRS) is in the spotlight after being recognized by the Department of Defense for top performance in a counter-drone technology competition. The company also invested $15 million in Hoverfly Technologies, which further expands its capabilities.

See our latest analysis for Leonardo DRS.

The recent defense accolades and growth-focused investments have come alongside some share price volatility, but momentum for Leonardo DRS remains strong. With a year-to-date share price return of 33.5% and an impressive total shareholder return of 49.2% over the past year, investors are still seeing considerable upside. Ongoing wins in counter-drone tech and new partnerships like Hoverfly’s keep the long-term growth outlook bright even after occasional market dips.

If today’s surge in advanced defense tech has you curious about the broader sector, now is a great time to discover other opportunities in aerospace and defense. See the full list for free.

Given all this momentum, the key question is whether Leonardo DRS shares are still undervalued or if recent gains now reflect all of the company’s future prospects. This may leave little room for a bargain opportunity.

Most Popular Narrative: 11.8% Undervalued

With Leonardo DRS closing at $43.23 and the narrative fair value set at $49.00, the price target is notably higher than where shares currently trade. This sets the backdrop for a market view that anticipates further upside, if optimistic projections come to fruition.

Anticipated increases in U.S. and allied defense budgets, with substantial front-loaded funding and new NATO commitments, are expected to drive persistent and potentially accelerating demand for advanced defense technologies. This positions Leonardo DRS for strong multiyear revenue growth and increasing backlog. The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Want to know the secret behind this bold upside scenario? The answer lies in a powerful cocktail of projected revenue growth, higher margins and a future profit multiple usually reserved for industry disruptors. Which big financial leap do analysts assume for Leonardo DRS? Uncover the eye-opening assumptions driving this potential valuation jump.

Result: Fair Value of $49.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing raw material shortages and growing reliance on government contracts could quickly challenge the company’s upbeat prospects if conditions unexpectedly worsen.

Find out about the key risks to this Leonardo DRS narrative.

Another View: What Do the Multiples Say?

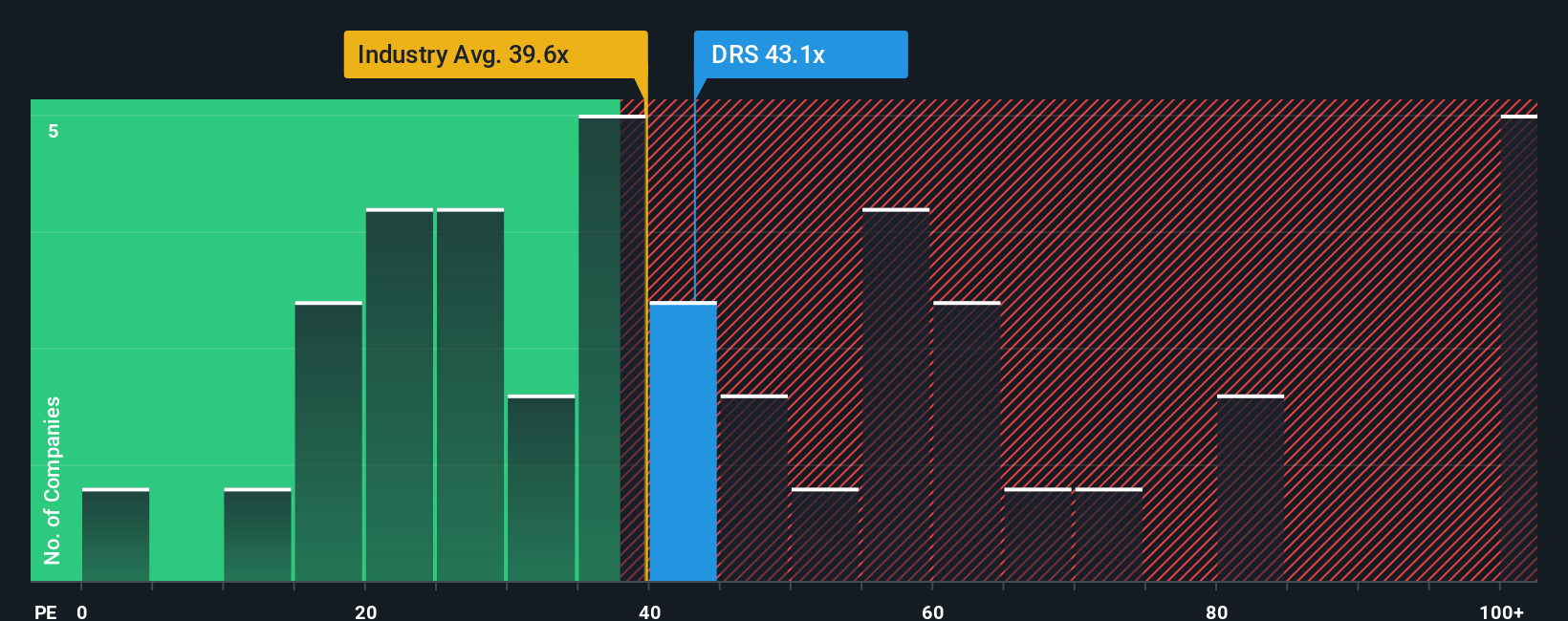

Looking through the lens of price-to-earnings ratios, Leonardo DRS does not look cheap. Its current PE ratio of 46x is well above both the US Aerospace & Defense industry average of 38.9x and the peer average of 29.4x. It is also considerably higher than the fair ratio of 27.1x that the market could move toward. This premium suggests investors are willing to pay up for growth, but raises the risk if future results do not measure up. Will the company’s strong prospects justify this lofty multiple, or could sentiment shift quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leonardo DRS Narrative

If the numbers and stories above have you wondering about a different angle, you can easily dig into the data and craft your own Leonardo DRS narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Investment Ideas?

If you want to make your next move count, these hand-picked stock themes offer powerful ways to capture growth and protect your portfolio against market surprises. Don’t let opportunity pass you by. Smart investors look beyond the headlines to what’s next.

- Target long-term wealth by tapping into these 19 dividend stocks with yields > 3%, which delivers attractive, consistent yields above market averages for income-focused investors.

- Fuel your strategy with innovation and invest in the future by checking out these 24 AI penny stocks, which are making breakthroughs in artificial intelligence.

- Maximize value by finding these 892 undervalued stocks based on cash flows, which are trading below what their cash flows suggest they’re worth, giving you the edge others miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives