- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Valuation Check After New Military Satcom Breakthrough and Saudi Defense Partnership

Reviewed by Simply Wall St

Leonardo DRS (DRS) just cleared two big milestones: successfully running its new multi channel, software defined radio in orbit and signing a cooperation memorandum with Saudi Arabia’s Ministry of Defense on ground combat vehicle technology.

See our latest analysis for Leonardo DRS.

Those breakthroughs are landing at a time when the stock is catching its breath, with a 7.38% year to date share price return and a powerful 167.05% three year total shareholder return that still signals long term momentum rather than fatigue.

If these defense gains have you thinking more broadly about the sector, it is a good moment to explore other opportunities across aerospace and defense stocks for ideas beyond Leonardo DRS.

With revenue and earnings still growing, a strong backlog, and Wall Street targets sitting well above today’s price, the real debate now is whether Leonardo DRS remains mispriced value or if the market has already baked in its next leg of growth.

Most Popular Narrative: 26.5% Undervalued

Compared with Leonardo DRS's last close at $34.77, the most widely followed narrative points to a meaningfully higher fair value anchored in sustained growth and margins.

The company's strategic alignment with national priorities, including investments in naval modernization, next generation air and missile defense (such as the Golden Dome initiative), and counter UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Want to see what kind of revenue runway and margin profile could justify this valuation gap, the earnings multiple it implies, and why consensus hardly disagrees?

Result: Fair Value of $47.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent raw material constraints and heavier R&D spending could squeeze margins, delay contract execution, and challenge the optimistic growth assumptions embedded in this narrative.

Find out about the key risks to this Leonardo DRS narrative.

Another View: Multiples Paint a Richer Picture

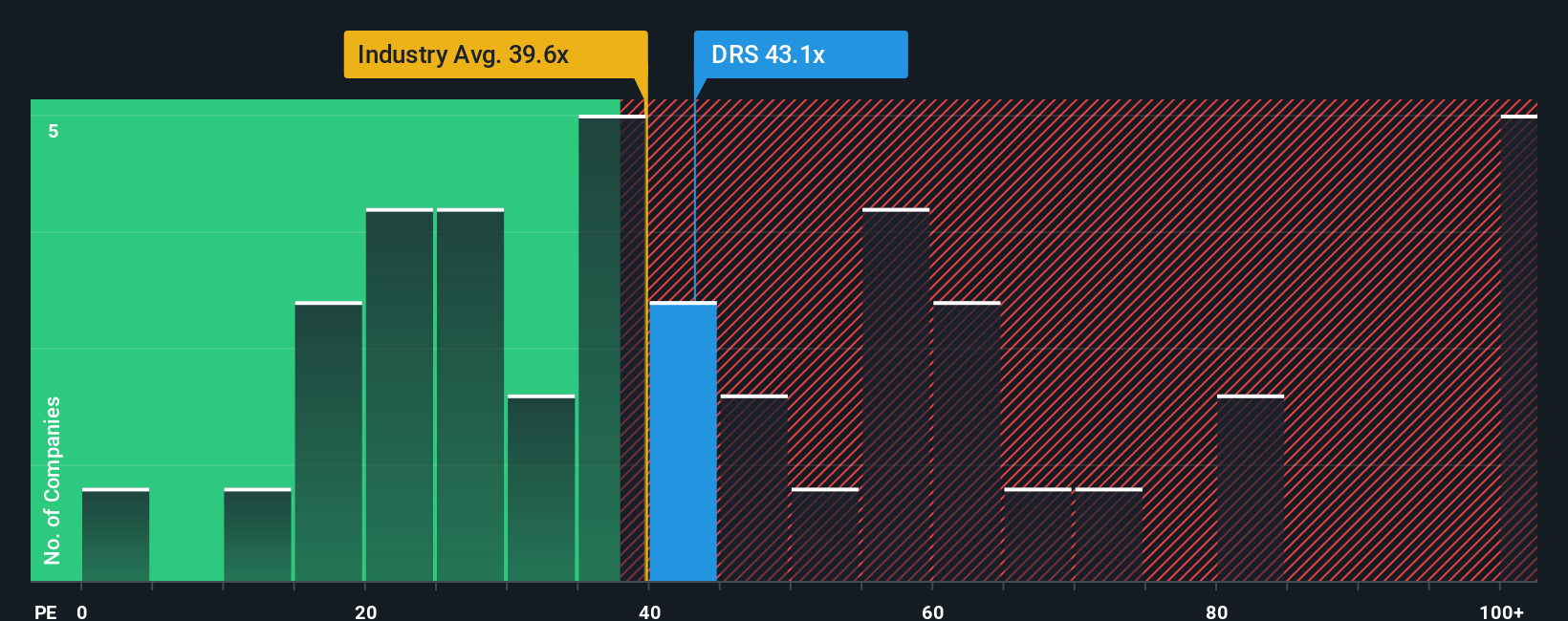

While the narrative suggests upside, the earnings multiple sends a caution signal. DRS trades on a 34.9x price to earnings ratio, below peers at 49.8x and the US Aerospace and Defense average of 37.3x, but well above its 26.1x fair ratio, implying limited margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo DRS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo DRS Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Ready for your next investing move?

Do not stop at one compelling defense name. Sharpen your edge by using the Simply Wall St Screener to uncover focused stock ideas before other investors react.

- Capture overlooked value opportunities by tracking these 898 undervalued stocks based on cash flows that market sentiment has not fully appreciated yet.

- Ride powerful innovation trends by targeting these 24 AI penny stocks at the forefront of artificial intelligence adoption.

- Lock in potential income through these 10 dividend stocks with yields > 3% offering yields that may support long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion