- United States

- /

- Machinery

- /

- NasdaqGS:CVGI

Earnings growth of 5.2% over 3 years hasn't been enough to translate into positive returns for Commercial Vehicle Group (NASDAQ:CVGI) shareholders

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Commercial Vehicle Group, Inc. (NASDAQ:CVGI), who have seen the share price tank a massive 73% over a three year period. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 58% lower in that time. Furthermore, it's down 31% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Since Commercial Vehicle Group has shed US$22m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Commercial Vehicle Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Commercial Vehicle Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

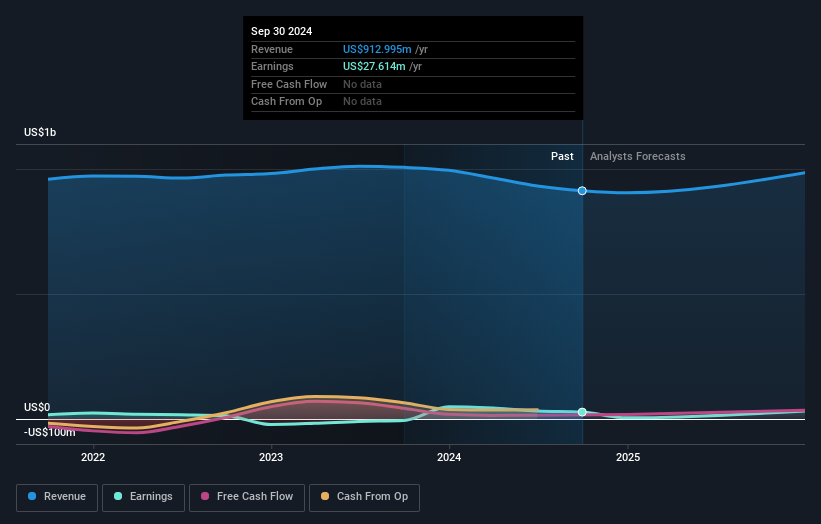

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Commercial Vehicle Group has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Commercial Vehicle Group in this interactive graph of future profit estimates.

A Different Perspective

Investors in Commercial Vehicle Group had a tough year, with a total loss of 58%, against a market gain of about 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Commercial Vehicle Group better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Commercial Vehicle Group (including 1 which makes us a bit uncomfortable) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CVGI

Commercial Vehicle Group

Designs, manufactures, assembles, and sells systems, assemblies, and components to commercial and electric vehicle, and industrial automation markets in North America, Europe, and the Asia-Pacific regions.

Very undervalued moderate.