- United States

- /

- Building

- /

- NasdaqGS:CSTE

Caesarstone's (NASDAQ:CSTE) Stock Price Has Reduced 58% In The Past Five Years

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Caesarstone Ltd. (NASDAQ:CSTE) share price is a whole 58% lower. That is extremely sub-optimal, to say the least.

View our latest analysis for Caesarstone

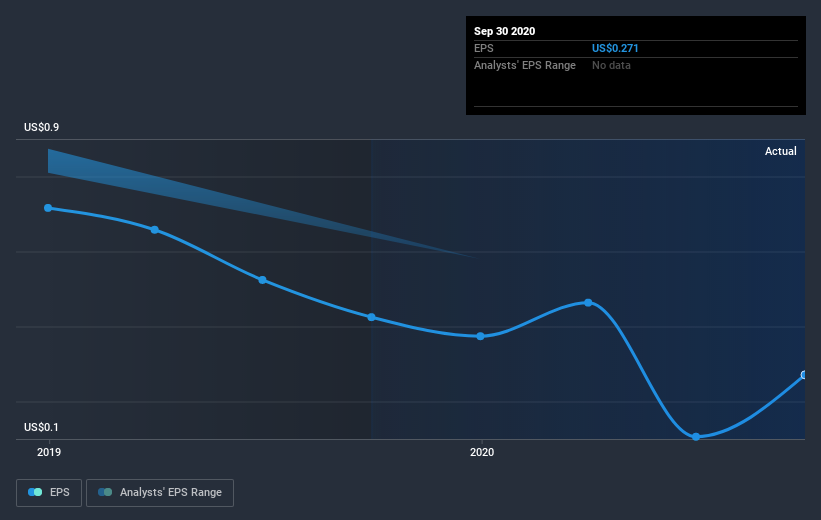

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Caesarstone's share price and EPS declined; the latter at a rate of 35% per year. This fall in the EPS is worse than the 16% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. The high P/E ratio of 47.58 suggests that shareholders believe earnings will grow in the years ahead.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Caesarstone's key metrics by checking this interactive graph of Caesarstone's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Caesarstone the TSR over the last 5 years was -56%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 25% in the last year, Caesarstone shareholders lost 2.5% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Caesarstone (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Caesarstone, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CSTE

Caesarstone

Designs, develops, manufactures, and sells engineered stone and porcelain products under Caesarstone and other brands in the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives