- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Byrna Technologies Inc.'s (NASDAQ:BYRN) Shares Climb 34% But Its Business Is Yet to Catch Up

Despite an already strong run, Byrna Technologies Inc. (NASDAQ:BYRN) shares have been powering on, with a gain of 34% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

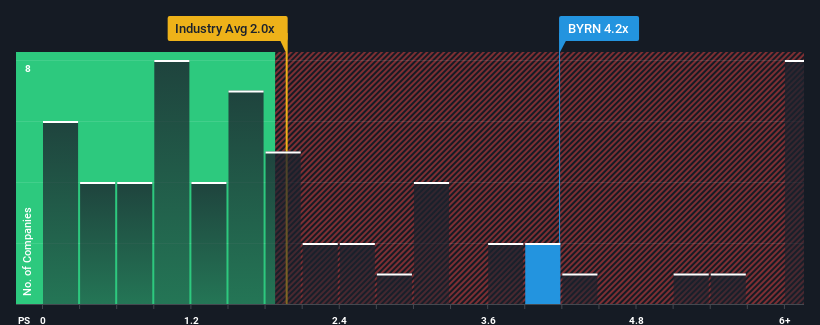

Since its price has surged higher, given around half the companies in the United States' Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2x, you may consider Byrna Technologies as a stock to avoid entirely with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Byrna Technologies

How Byrna Technologies Has Been Performing

While the industry has experienced revenue growth lately, Byrna Technologies' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Byrna Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Byrna Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 5.7% over the next year. With the industry predicted to deliver 10% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Byrna Technologies' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Byrna Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Byrna Technologies trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Byrna Technologies that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives