- United States

- /

- Electrical

- /

- NasdaqCM:BWEN

Increases to Broadwind, Inc.'s (NASDAQ:BWEN) CEO Compensation Might Cool off for now

Key Insights

- Broadwind's Annual General Meeting to take place on 15th of May

- Total pay for CEO Eric Blashford includes US$440.0k salary

- Total compensation is 58% above industry average

- Over the past three years, Broadwind's EPS fell by 30% and over the past three years, the total shareholder return was 1.9%

The share price of Broadwind, Inc. (NASDAQ:BWEN) has struggled to grow by much over the last few years and probably has to do with the fact that earnings growth has gone backwards. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 15th of May. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Broadwind

Comparing Broadwind, Inc.'s CEO Compensation With The Industry

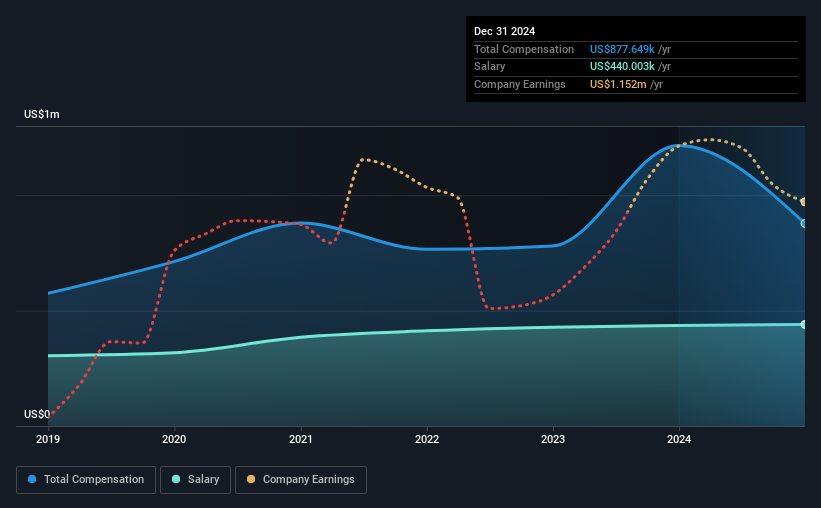

According to our data, Broadwind, Inc. has a market capitalization of US$35m, and paid its CEO total annual compensation worth US$878k over the year to December 2024. Notably, that's a decrease of 28% over the year before. We note that the salary of US$440.0k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar-sized companies in the American Electrical industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$556k. This suggests that Eric Blashford is paid more than the median for the industry. Moreover, Eric Blashford also holds US$791k worth of Broadwind stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$440k | US$435k | 50% |

| Other | US$438k | US$781k | 50% |

| Total Compensation | US$878k | US$1.2m | 100% |

On an industry level, roughly 18% of total compensation represents salary and 82% is other remuneration. According to our research, Broadwind has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Broadwind, Inc.'s Growth Numbers

Broadwind, Inc. has reduced its earnings per share by 30% a year over the last three years. It saw its revenue drop 30% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Broadwind, Inc. Been A Good Investment?

Broadwind, Inc. has not done too badly by shareholders, with a total return of 1.9%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

The flat share price growth combined with the the fact that earnings have failed to grow makes us wonder whether the share price will have any further strong momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Broadwind that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade Broadwind, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Broadwind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BWEN

Broadwind

Manufactures and sells structures, equipment, and components for clean technology and other specialized applications in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives