- United States

- /

- Building

- /

- NasdaqCM:BNC

CEA Industries (BNC): Assessing Valuation After Aggressive BNB Accumulation and $500M Private Placement

Reviewed by Kshitija Bhandaru

CEA Industries (NasdaqCM:BNC) is making headlines after revealing it now holds 480,000 BNB tokens, which makes it the largest publicly reported institutional holder of Binance Coin. This milestone comes as the company publicly targets 1% of BNB’s total supply by the end of the year, fueled by a recent $500 million private placement.

See our latest analysis for CEA Industries.

CEA Industries’ bold push into crypto, including a $500 million private placement, major BNB acquisitions, a $250 million buyback, and Carly Howard’s board appointment, has supercharged momentum lately. After a rough patch in September, the stock’s 44% year-to-date share price return and an impressive 1-year total shareholder return of nearly 66% highlight how confidence is picking up as management doubles down on digital assets and insider buying continues.

If bold moves like these have you exploring what’s next, now is a perfect moment to widen your search and discover fast growing stocks with high insider ownership

The surge in BNB holdings and expansion of digital asset strategy have sent shares higher. However, with CEA Industries trading well below analyst targets, is this a genuine buying opportunity or is the market already pricing in future growth?

Price-to-Book Ratio of 71x: Is it justified?

CEA Industries trades at a staggering price-to-book ratio of 71x, with a recent close of $11.37. This is far above peer average multiples and suggests that the market is assigning a major premium to the stock’s assets.

The price-to-book ratio compares the company's market value to its net asset value on the balance sheet. In industries where tangible assets matter, like capital goods, this metric is often used to gauge whether a stock is trading cheap or expensive relative to the value the company controls.

At 71x, CEA Industries sits well above both the peer group average (8.3x) and the broader US Building industry average (2.9x). This extreme premium implies the market anticipates immense future value creation or transformation. It may also reflect significant speculative enthusiasm not backed by the company’s fundamentals or past profitability.

With no fair value regression available, it is difficult to benchmark what the “right” multiple should be. However, the current pricing stands out as unusually aggressive, even among fast-growing small caps.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 71x (OVERVALUED)

However, CEA Industries’ steep valuation could unravel if BNB prices stumble or if digital asset strategies fail to deliver anticipated growth.

Find out about the key risks to this CEA Industries narrative.

Another View: DCF Model Tells a Different Story

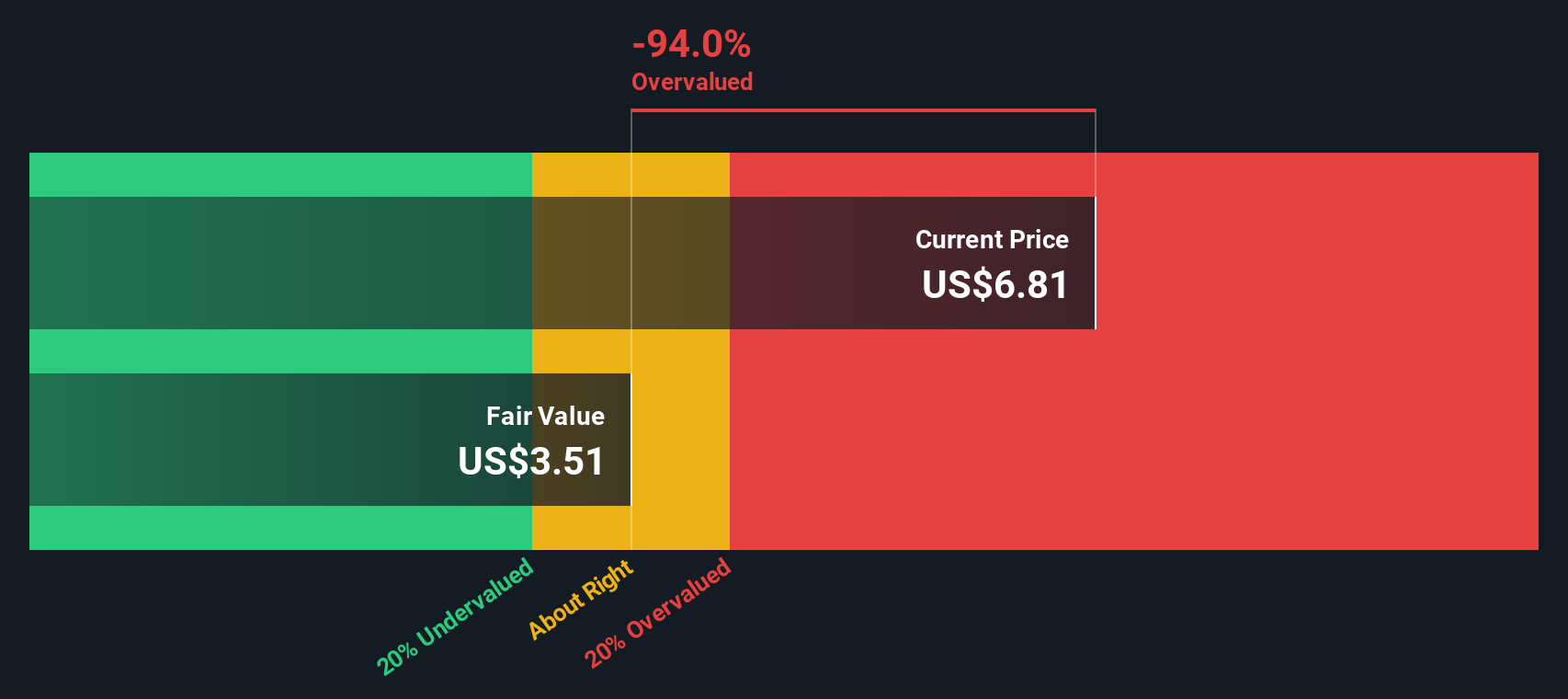

Looking from a different angle, our SWS DCF model delivers a far more conservative view on CEA Industries’ value. According to the model’s inputs, the stock trades well above its estimated fair value of $3.62. This signals clear overvaluation based on projected cash flows, rather than asset multiples. Does this reinforce concerns about the current price, or is the market seeing something deeper?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CEA Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CEA Industries Narrative

If you have a different perspective, or want to dig into the numbers personally, you can quickly build your own outlook in just a few minutes. Do it your way

A great starting point for your CEA Industries research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Use the Simply Wall Street Screener to confidently expand your watchlist and spot tomorrow’s standouts before the crowd does.

- Unleash your growth strategy by reviewing these 25 AI penny stocks which are poised for breakthroughs in artificial intelligence and automation technologies.

- Secure consistent income streams by evaluating these 19 dividend stocks with yields > 3% that feature robust yields and reliable payout histories.

- Jump ahead of market trends and pinpoint overlooked opportunities by comparing these 888 undervalued stocks based on cash flows that are trading well below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BNC

CEA Industries

Through its subsidiary, Surna Cultivation Technologies LLC, focuses on the sale of environmental control and other technologies and services to the controlled environment agriculture (CEA) industry in the United States and Canada.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success