- United States

- /

- Electrical

- /

- NasdaqCM:BLNK

Will Blink Charging’s (BLNK) Expanded UK Network Strengthen Its Competitive Edge in Global EV Infrastructure?

Reviewed by Simply Wall St

- Earlier this month, Blink Charging Co. announced it joined the UK's Paua platform, adding 850 public charging locations and around 3,500 connectors to one of the country's largest EV charging networks, while also completing a citywide charging infrastructure upgrade in Porterville, California.

- This expansion strengthens Blink's international presence and supports greater accessibility for EV fleet operators and drivers, highlighting its ongoing efforts to enable clean transportation solutions for businesses and municipalities.

- We'll explore how Blink's integration with Paua and expanded public charging network could influence its business outlook moving forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Blink Charging Investment Narrative Recap

To be a shareholder in Blink Charging, investors need to believe that the company’s expanding infrastructure and international partnerships, like its integration with Paua in the UK, can drive network coverage and unlock meaningful growth opportunities. Despite these moves affirming Blink’s ambition to serve large-scale EV fleets, the current news does not fundamentally alter the biggest near-term catalyst, growing charger utilization and service revenue, or address the most pressing risk, which remains mounting losses and cash burn that could limit future investment.

The recent upgrade and installation of DC Fast Chargers in Porterville, California, directly ties into Blink’s efforts to ramp up recurring service revenues and charger utilization. Projects like these, funded by public and private investment, illustrate tangible steps toward strengthening Blink’s footprint, a critical element as utilization is expected to support more stable earnings and underpin the company’s business outlook.

But while expansion efforts reflect progress, investors should also weigh the ongoing risk to financial stability if losses and cash constraints continue to escalate in the quarters ahead...

Read the full narrative on Blink Charging (it's free!)

Blink Charging's narrative projects $217.2 million revenue and $22.1 million earnings by 2028. This requires 27.5% yearly revenue growth and a $235.7 million increase in earnings from -$213.6 million today.

Uncover how Blink Charging's forecasts yield a $2.40 fair value, a 58% upside to its current price.

Exploring Other Perspectives

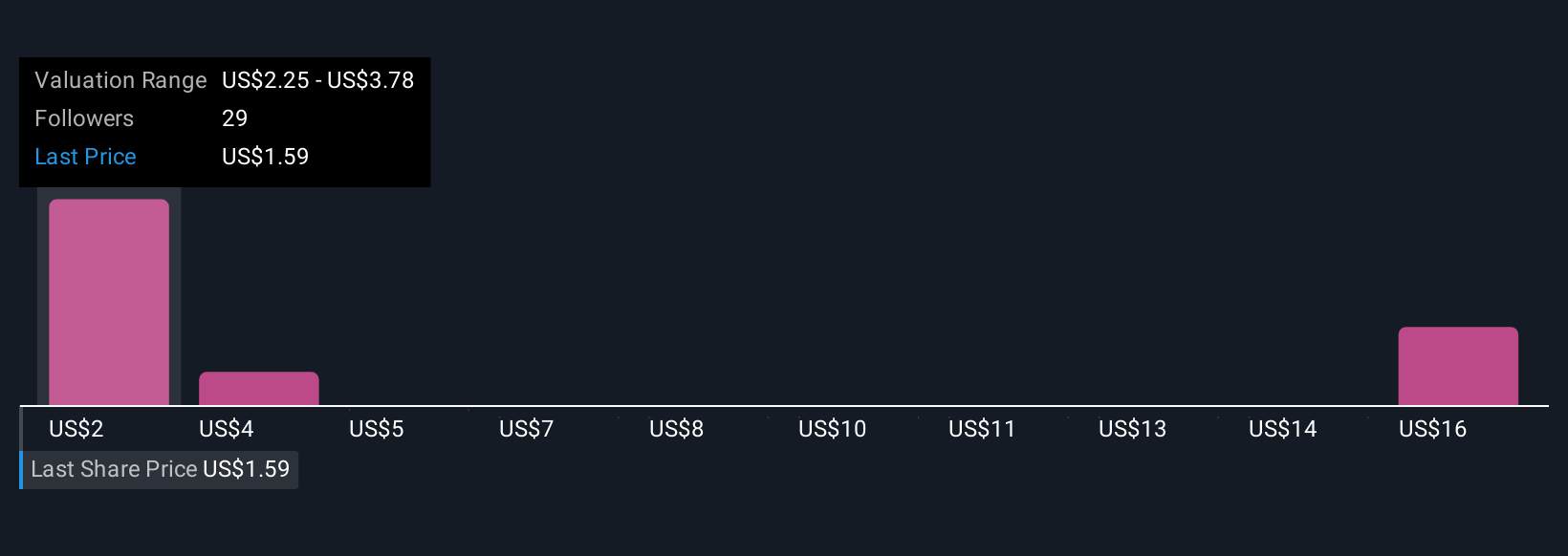

Eight fair value estimates from the Simply Wall St Community range widely from US$2.25 to US$17.51 per share. While some see strong upside, persistent challenges around profitability and cash burn could influence Blink’s capacity to realize its potential, explore how your view compares.

Explore 8 other fair value estimates on Blink Charging - why the stock might be worth just $2.25!

Build Your Own Blink Charging Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blink Charging research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Blink Charging research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blink Charging's overall financial health at a glance.

No Opportunity In Blink Charging?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blink Charging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLNK

Blink Charging

Through its subsidiaries, owns, operates, manufactures, and provides electric vehicle (EV) charging equipment and networked EV charging services in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives