- United States

- /

- Trade Distributors

- /

- NasdaqGS:BECN

Insufficient Growth At Beacon Roofing Supply, Inc. (NASDAQ:BECN) Hampers Share Price

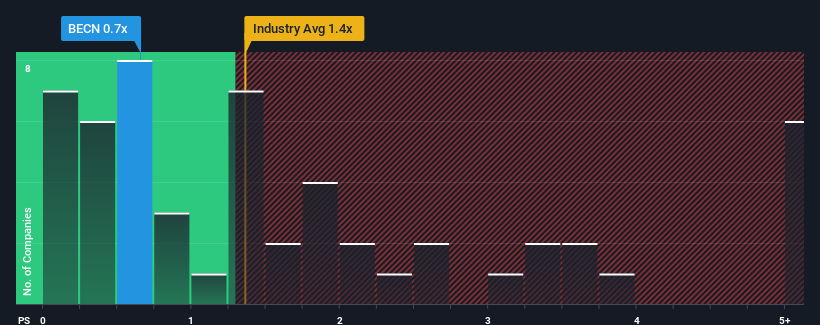

When you see that almost half of the companies in the Trade Distributors industry in the United States have price-to-sales ratios (or "P/S") above 1.4x, Beacon Roofing Supply, Inc. (NASDAQ:BECN) looks to be giving off some buy signals with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beacon Roofing Supply

What Does Beacon Roofing Supply's Recent Performance Look Like?

Beacon Roofing Supply's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beacon Roofing Supply.Is There Any Revenue Growth Forecasted For Beacon Roofing Supply?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beacon Roofing Supply's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.2% last year. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 2.9% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.1% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Beacon Roofing Supply's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Beacon Roofing Supply's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Beacon Roofing Supply's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Beacon Roofing Supply that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beacon Roofing Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BECN

Beacon Roofing Supply

Engages in the distribution of residential and non-residential roofing and complementary building products to professional contractors, home builders, building owners, lumberyards, and retailers in the United States and Canada.

Acceptable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives