- United States

- /

- Trade Distributors

- /

- NasdaqGS:BECN

Beacon Roofing Supply, Inc.'s (NASDAQ:BECN) Popularity With Investors Is Clear

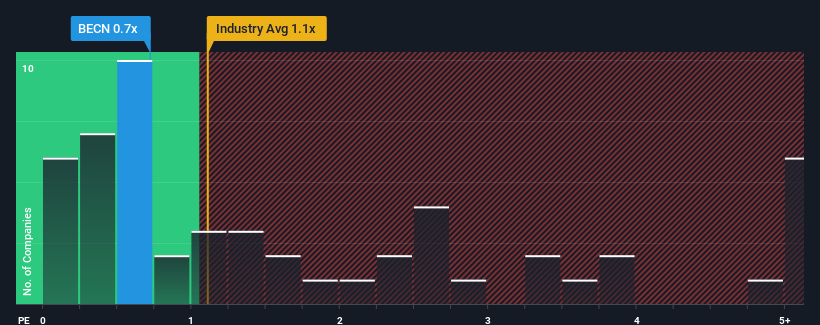

It's not a stretch to say that Beacon Roofing Supply, Inc.'s (NASDAQ:BECN) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the Trade Distributors industry in the United States, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Beacon Roofing Supply

What Does Beacon Roofing Supply's Recent Performance Look Like?

Beacon Roofing Supply certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beacon Roofing Supply.Is There Some Revenue Growth Forecasted For Beacon Roofing Supply?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beacon Roofing Supply's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.9%. This was backed up an excellent period prior to see revenue up by 45% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.5% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.9%, which is not materially different.

With this information, we can see why Beacon Roofing Supply is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Beacon Roofing Supply's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Beacon Roofing Supply's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 2 warning signs for Beacon Roofing Supply (1 is a bit unpleasant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beacon Roofing Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BECN

Beacon Roofing Supply

Engages in the distribution of residential and non-residential roofing and complementary building products to professional contractors, home builders, building owners, lumberyards, and retailers in the United States and Canada.

Acceptable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives