- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Axon Enterprise (NasdaqGS:AXON) Increases 2025 Revenue Guidance Despite Lower Q1 Net Income

Reviewed by Simply Wall St

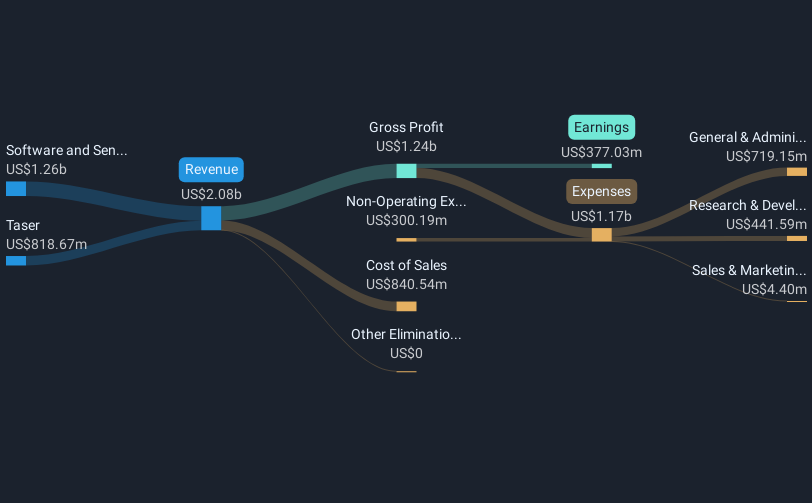

Axon Enterprise (NasdaqGS:AXON) recently raised its full-year 2025 earnings guidance, reflecting strong growth expectations with a revised revenue range of $2.6 to $2.7 billion. Despite this optimistic outlook, the company's first-quarter earnings revealed a drop in net income and earnings per share compared to the previous year, albeit with considerable revenue growth. While the market as a whole has experienced a general upward trend due to favorable trade news and advancements in technology sectors, Axon's 19.75% price increase over the past month might have been buoyed further by its new product launches and raised guidance, aligning with broader market optimism.

Every company has risks, and we've spotted 1 warning sign for Axon Enterprise you should know about.

The recent news regarding Axon Enterprise's revised 2025 earnings guidance underscores the company's strong growth potential, despite a recent drop in net income and earnings per share. By raising its revenue expectations to US$2.6 to $2.7 billion, Axon positions itself as a significant player in the technology and public safety sectors, which seem to support Axon’s shares in the short term. Over the past five years, the company's total returns, including dividends, have seen a very large 650.68% rise, showcasing its substantial growth and investor confidence over the period.

In the shorter term, over the past year, Axon's share performance surpassed the US Aerospace & Defense industry average return of 19.4%, reflecting its resilience and the market's positive reception to its strategic initiatives. The recent 19.75% share price increase has brought the current share price closer to the consensus analyst price target of US$665.10, only 9.5% above Axon's current market position.

Moving forward, the raised earnings guidance and recent product launches could significantly impact Axon's revenue and earnings forecasts, signaling sustained growth potential. However, the necessity to maintain an elevated PE ratio of 123.2x to justify future valuations remains a concern when compared to the industry average of 32.4x. Investors may need to balance these anticipated growth aspects with the inherent risks associated with its ambitious expansion plans.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives