- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

A Fresh Look at Axon Enterprise (AXON) Valuation Following Analyst Optimism and New AI Product Innovations

Reviewed by Kshitija Bhandaru

Axon Enterprise (AXON) has attracted fresh attention following a period of renewed analyst optimism. This renewed focus is driven by its acquisition of Prepared, the rollout of new AI-powered products, and recent industry conference presentations.

See our latest analysis for Axon Enterprise.

Axon's recent surge in analyst optimism and its AI-driven product initiatives have made waves, even as the share price has pulled back roughly 11% over the past three months from recent highs. Yet, momentum over the past year has been striking, with a 53% 1-year total shareholder return that outpaces most of its peers and hints at strong underlying confidence despite short-term volatility. Investors appear to be reassessing risks and growth potential as the company leans into innovation and prominent industry exposure.

If the latest moves at Axon have sparked your interest, this could be the perfect time to see what else is building momentum. Discover fast growing stocks with high insider ownership

With Axon’s strong long-term returns, ambitious growth strategy, and a recent pullback in share price, the big question remains: is the stock setting up for a bargain entry, or is the market already anticipating its next leg of growth?

Most Popular Narrative: 24% Undervalued

With the most popular narrative placing fair value at $884.69, Axon’s last close of $670.68 suggests substantial upside is still on the table. The narrative draws on aggressive growth assumptions and market expansion, introducing a bold stance among analysts and investors.

Accelerating demand for next-generation technologies, including AI, drones, robotics, body cameras, and digital evidence management, demonstrates a rapid shift by public safety agencies toward modern, cloud-based, and connected solutions. This supports sustained revenue growth as agencies upgrade from legacy systems and adopt more comprehensive SaaS offerings. Fast-track adoption of new Axon products such as Draft One (AI), TASER 10, Axon Body 4, and Dedrone (counter-drone) is driving up average deal values and product bundles per customer, raising net revenue per user and supporting higher long-term margins as the ecosystem deepens.

Curious what powers such a confident call? This narrative hinges on extraordinary future growth projections, relentless market adoption, and margin optimism. What are the pivotal assumptions behind these numbers? Dive in to uncover the math and ambition fueling this bullish view.

Result: Fair Value of $884.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on government budgets and intensifying regulatory scrutiny could challenge Axon's ambitious growth story if funding or adoption slows unexpectedly.

Find out about the key risks to this Axon Enterprise narrative.

Another View: Multiples Raise Questions

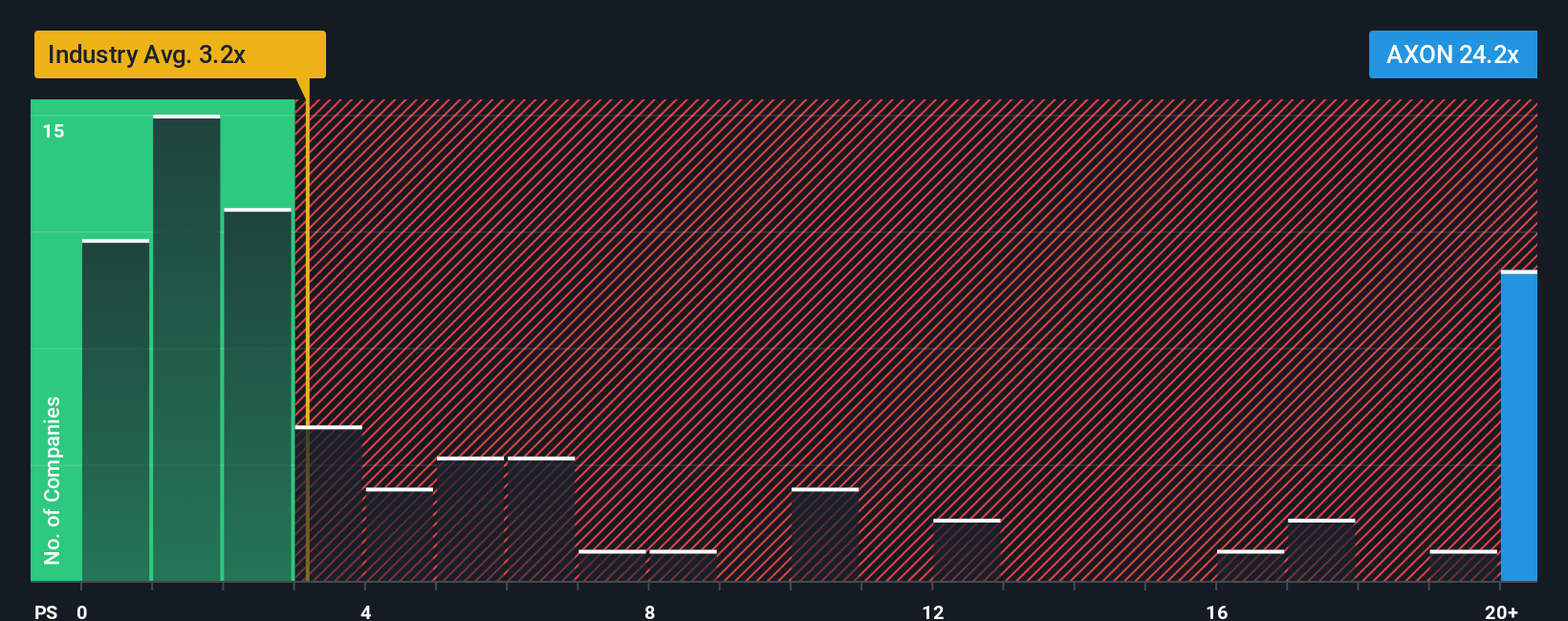

While the popular narrative points to significant upside, a look at valuation multiples tells a different story. Axon is currently trading at a price-to-sales ratio of 22x, which is sharply higher than both its industry average of 3x and the peer average of 7.7x. It is also above the fair ratio of 15.8x. This notable premium suggests the market expects Axon to deliver extraordinary performance, but it also introduces a heightened risk if those expectations fall short. Is the market simply looking further ahead, or does this premium hint at over-exuberance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axon Enterprise Narrative

If you see things differently or want to explore Axon’s story with your own perspective, you can easily build a custom view in just minutes. Do it your way

A great starting point for your Axon Enterprise research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn your curiosity into results by checking out other fast-moving stocks and hidden opportunities. Find unique ways to put your money to work, right now.

- Unlock exciting long-term potential as you tap into these 871 undervalued stocks based on cash flows, which the market may be overlooking this quarter.

- Capitalize on generational change by selecting these 33 healthcare AI stocks, poised to transform medicine with powerful AI-driven breakthroughs.

- Join the next financial wave and target growth stories among these 79 cryptocurrency and blockchain stocks, reshaping industries through innovative blockchain and crypto solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives