- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

What Can Investors Expect After AeroVironment’s 124% Surge and Strong Defense Contract Wins?

Reviewed by Bailey Pemberton

You might be asking yourself: after AeroVironment's stock has rocketed up over 350% in the last five years, is it still a smart move, or is the best growth now behind it? Let’s be honest, this isn’t your average defense and aerospace company. Over just the last month, shares soared nearly 29%, before dipping back by about 11% in the past week. That kind of jump, not to mention an eye-popping 124% gain already in 2024, leaves many investors excited, and maybe a little anxious about whether this pace can last.

AeroVironment’s stock often rides the wave of industry news about the growing demand for unmanned systems and heightened focus on national security innovation. When government contracts expand or international tensions rise, market sentiment about future prospects can shift quickly, and that has fueled both spikes and dips in its share price. But here’s the kicker: despite all this enthusiasm, our value score comes in at just 0 out of 6 on major undervaluation checks. In short, based on typical valuation metrics, AeroVironment doesn’t look undervalued right now.

So, how does that reconcile with what we’re seeing in the market, and what does that mean for your decision? Let’s break down the most popular ways investors think about valuation. Stick around, because there’s an even smarter angle to sizing up AeroVironment that I’ll share at the end.

AeroVironment scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AeroVironment Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those back to today using a required rate of return. This method aims to find the present value of all expected future cash AeroVironment will generate.

For AeroVironment, the company's latest twelve months Free Cash Flow is negative, at $-193.8 Million. However, analysts predict significant improvement, projecting annual Free Cash Flow to reach $234.6 Million in 2028. Looking further ahead, by 2035 extrapolated figures estimate Free Cash Flow could exceed $600 Million. All projections are in $ and are derived from a combination of direct analyst estimates for the next five years and calculated trends beyond that.

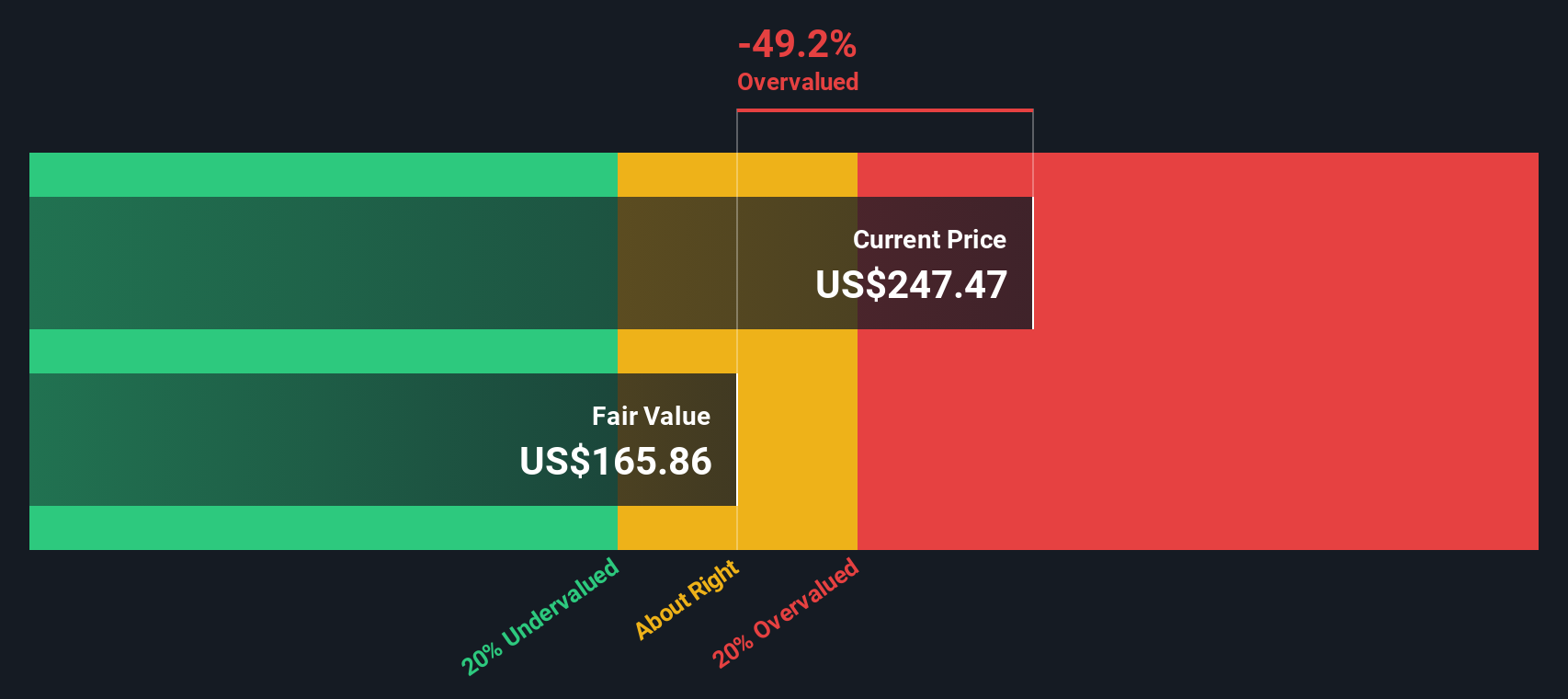

Using this approach, the DCF-derived fair value for AeroVironment is $170.69 per share. However, at current prices, the stock is calculated to be 105.4% above its intrinsic value. This suggests AeroVironment is significantly overvalued according to its future cash flow potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AeroVironment may be overvalued by 105.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AeroVironment Price vs Sales

The Price-to-Sales (P/S) ratio is a common way to value companies that may not yet be profitable but are showing strong revenue growth. For a fast-growing firm like AeroVironment, this metric can reveal whether investors are paying a premium for each dollar of sales. It is particularly useful for businesses in expansion mode or those reinvesting heavily for future growth.

In general, higher growth expectations and lower risk can justify a higher P/S ratio, while slower growth or increased risk should result in a lower multiple being reasonable. This is why benchmarks like the industry average and peer group serve as useful context, but they are not always the final word.

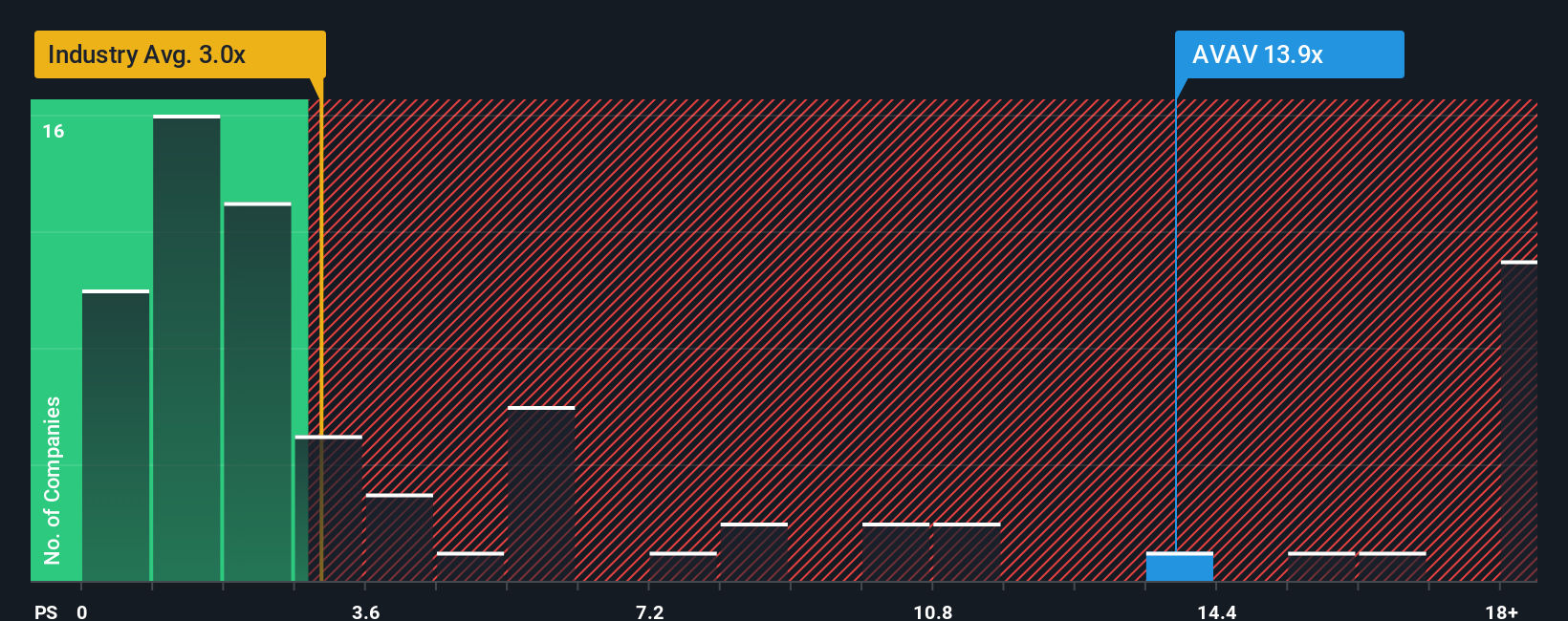

Right now, AeroVironment trades at a P/S ratio of 16.05x. For comparison, the aerospace and defense industry average sits at 3.02x, and direct peers average 7.15x. On the surface, this indicates that AeroVironment is priced at a significant premium to both competitors and broader sector norms. This likely reflects bullish expectations for its revenue growth and market position.

However, Simply Wall St’s Fair Ratio is a proprietary benchmark that weighs not just sales, but also factors like profit margins, risk profile, growth rate, industry standards, and the company’s market cap. It currently stands at 5.74x for AeroVironment. Unlike simple peer or industry comparisons, this Fair Ratio gives a more tailored view of how much investors should reasonably pay for each dollar of sales.

Comparing the current P/S ratio of 16.05x with the Fair Ratio of 5.74x suggests the stock is trading well above what its growth potential and risk profile justify at this time.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AeroVironment Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are Simply Wall St’s breakthrough approach that lets investors create a story around a company by combining their personal view of its future with numbers like forecast revenue, profit margins, and fair value. Instead of just looking at isolated metrics, a Narrative links AeroVironment’s business outlook to a dynamic forecast, showing how your beliefs about its opportunities and risks lead directly to a calculated value for the company’s shares.

The best part? Narratives are clear, accessible, and visible right on the Community page, used by millions of investors. They help you decide when to buy or sell by constantly updating your Fair Value estimate as news or earnings roll in, so your decisions stay informed and timely. For example, some investors in the AeroVironment community believe that rapid international expansion and advanced laser tech could drive fair value as high as $384, while others, wary of government contract dependence, believe it may be as low as $225. Narratives let you test your own story, compare with others, and make decisions grounded in both facts and your view of what is possible for AeroVironment.

Do you think there's more to the story for AeroVironment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives