- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

Rethinking AeroVironment’s Soaring Stock After 50% Surge Amid Growing Defense Demand

Reviewed by Bailey Pemberton

If you have been watching AeroVironment’s wild ride lately, you are not alone. It is hard not to notice a stock that has jumped 19.4% in just the past week and soared 50.1% over the last 30 days. If that pace turns your head, consider the bigger picture: up 130.3% so far this year, and a stunning 418.4% over five years. Even veteran investors are taking a closer look. Such explosive momentum always begs the same question: should you jump in, sit tight, or start thinking about locking in gains?

There are plenty of reasons AeroVironment is moving higher. As a leader in unmanned systems and innovative defense technologies, the company is benefiting from a world where governments are prioritizing advanced drones and robotics. Market trends toward autonomous solutions in both military and commercial sectors are giving AeroVironment consistent tailwinds, and investors are noticing the shift.

But strong price performance does not always mean the stock is a bargain. In fact, according to a broad set of valuation checks—such as price-to-earnings, price-to-book, and several others—AeroVironment is not undervalued in any of the six categories typically used. That puts its valuation score at 0 out of a possible 6, a sign that all this enthusiasm is already baked into the price.

So what are these valuation approaches telling us about AeroVironment’s current standing, and is there a smarter way to judge the stock’s true worth? Let’s dig into the numbers, then explore a more nuanced perspective at the end that could change how you think about value altogether.

AeroVironment scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AeroVironment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and discounting them back to their present value. This approach helps investors look beyond current earnings by focusing on how much cash a business could generate over time.

For AeroVironment, the current last twelve months' free cash flow is $-193.8 million. Looking ahead, analysts forecast significant growth, with free cash flow projected to reach $247.8 million by 2028. From there, more distant estimates extrapolated by Simply Wall St where analyst estimates end show even larger gains up to 2035, with free cash flow reaching $721.4 million that year.

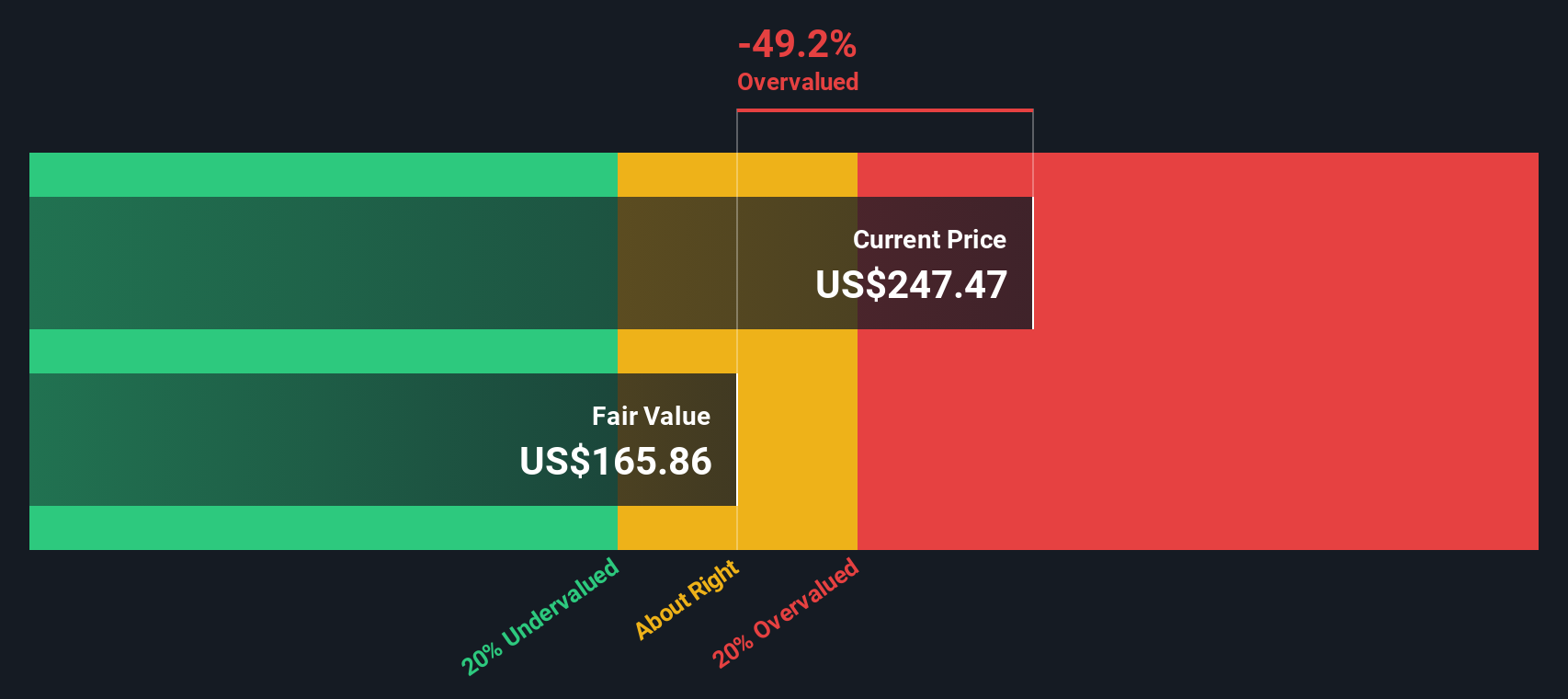

Based on these forecasts and using a two-stage DCF method, the estimated intrinsic fair value for AeroVironment’s stock is $203.30. However, this valuation suggests that the shares are currently trading at a steep premium, sitting around 77.2% above the level DCF deems fair. In other words, the recent surge in the stock price appears to have more than accounted for the company’s anticipated growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AeroVironment may be overvalued by 77.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AeroVironment Price vs Sales

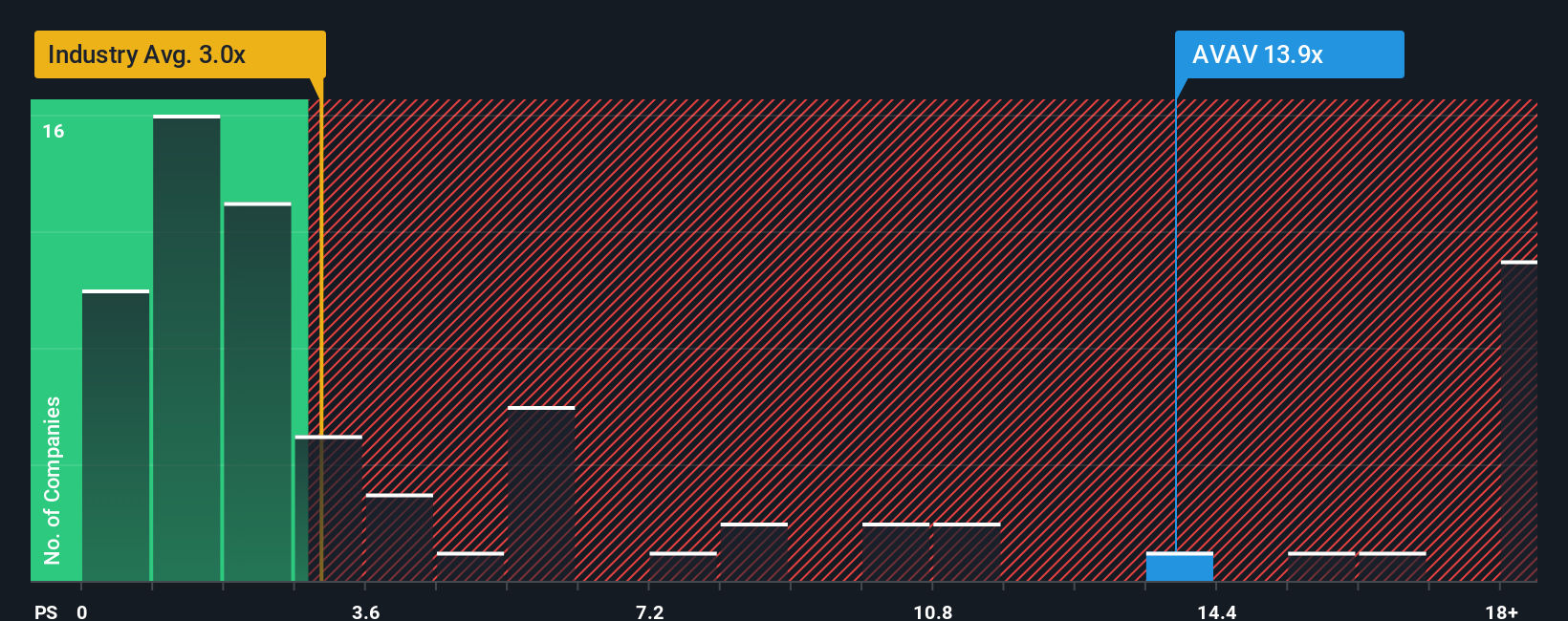

For companies that are rapidly scaling revenue but may not yet be consistently profitable, the price-to-sales (PS) multiple is a preferred metric for valuation. The PS ratio is particularly useful because it allows investors to compare companies regardless of short-term earnings fluctuations. It also factors in the growth potential that underpins future profitability. When investors expect higher growth or see lower risk in a business model, they tend to justify a higher PS multiple. Conversely, companies with slower growth or more uncertainty typically trade at lower multiples.

Currently, AeroVironment is trading at a PS ratio of 16.57x. This stands out against the Aerospace and Defense industry average of 3.35x and its peers’ average of 7.43x. This comparison highlights how excited the market is about AeroVironment’s future prospects. However, Simply Wall St’s proprietary “Fair Ratio,” which adjusts for the company’s unique growth rate, profit margins, market capitalization, industry factors, and specific risks, comes in at 4.49x. Unlike simple peer or industry comparisons, the Fair Ratio is tailored to AeroVironment’s actual profile and serves as a more precise yardstick for valuation.

Comparing AeroVironment’s PS ratio of 16.57x to its Fair Ratio of 4.49x shows that the stock is priced well above what would be considered reasonable for its business dynamics, even after accounting for growth and risk factors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AeroVironment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives: a simple but powerful approach to investing that lets you tie together the story you believe about a company with your expectations for its financial future, and then see what that means for fair value.

Think of a Narrative as your personalized investment thesis. It combines the company’s unique situation, drivers, and risks with your own projections for key metrics like future revenue, earnings, and profit margins. This story isn’t just words, but is mapped to real financial forecasts, making it clear how your assumptions impact what you believe the stock should be worth today.

On Simply Wall St’s Community page (used by millions of investors), anyone can create or view Narratives for AeroVironment and instantly see how their outlook affects its estimated fair value. Narratives help you decide when to buy or sell by letting you compare your fair value against the current share price. They are constantly updated as new news or earnings come in, ensuring your thinking keeps pace with the company’s latest developments.

For example, on AeroVironment, some investors see the company’s dominance in next-gen defense and set a fair value above $335, while others worry about international sales or execution and estimate as low as $225, proving there is no single right answer. The right answer is the one that fits your story and numbers best.

Do you think there's more to the story for AeroVironment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives