- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment, Inc.'s (NASDAQ:AVAV) Share Price Is Still Matching Investor Opinion Despite 27% Slump

AeroVironment, Inc. (NASDAQ:AVAV) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

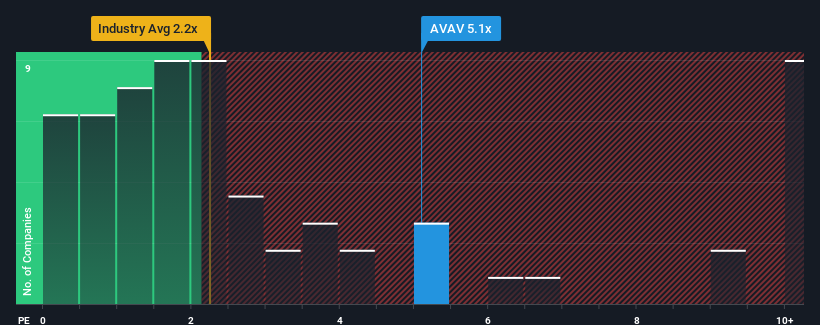

Although its price has dipped substantially, given around half the companies in the United States' Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.2x, you may still consider AeroVironment as a stock to avoid entirely with its 5.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for AeroVironment

What Does AeroVironment's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, AeroVironment has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think AeroVironment's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For AeroVironment?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like AeroVironment's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.4%. This was backed up an excellent period prior to see revenue up by 65% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.7% each year, which is noticeably less attractive.

With this information, we can see why AeroVironment is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On AeroVironment's P/S

Even after such a strong price drop, AeroVironment's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that AeroVironment maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for AeroVironment with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives