- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV): Valuation Spotlight After Major Air Force Contract and Laser Comms Breakthroughs

Reviewed by Kshitija Bhandaru

If you are weighing what to do with AeroVironment (AVAV) right now, you are hardly alone. The company just landed a $499 million U.S. Air Force contract through its BlueHalo subsidiary and announced a sweeping order for its laser communications terminals headed for space. With a new partnership lined up in Taiwan for next-gen autonomous defense systems, operational progress is picking up pace. It is no surprise investor optimism has clearly ramped up this month, helped along by bullish ratings and rising demand for military tech across the board.

Momentum in AeroVironment is easy to spot. The stock has gained 16% over the past month, with the year-to-date return climbing to 78%, even as shares have bounced around following earnings surprises and headline-making announcements. Recent launches like the Tomahawk Grip TA5 tactical controller and new JUMP 20 sensor payloads, along with expanding global presence and collaboration deals, give the company clear catalysts that go beyond a single news cycle. Together, these moves are helping cement AeroVironment’s status as more than a drone maker, broadening its impact across the defense landscape.

After this substantial run-up, is AeroVironment’s valuation now stretched, or is the market underestimating just how much future growth is still on the table?

Most Popular Narrative: 8.8% Undervalued

The prevailing view suggests AeroVironment is trading below its fair value, with robust growth drivers placing the company in an enviable position relative to peers.

Strong and increasing backlog, sustained sales momentum, and greater revenue visibility for FY26 and beyond are cited as supporting a favorable long-term growth profile. This is despite temporary fluctuations in unfunded backlog due to contract vehicle consolidations.

Curious how this aerospace innovator is carving out its lead? The calculation behind its fair value hinges on rapid-fire growth targets and ambitious earnings improvement. Want to uncover the specific financial leap that sets this narrative apart from the crowd? Dive deeper and see which surprising forecasts push the stock’s valuation above the current share price.

Result: Fair Value of $305.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in U.S. defense budgets and intensifying competition in the drone market could dampen AeroVironment's growth story in the future.

Find out about the key risks to this AeroVironment narrative.Another View: What Do Earnings Multiples Tell Us?

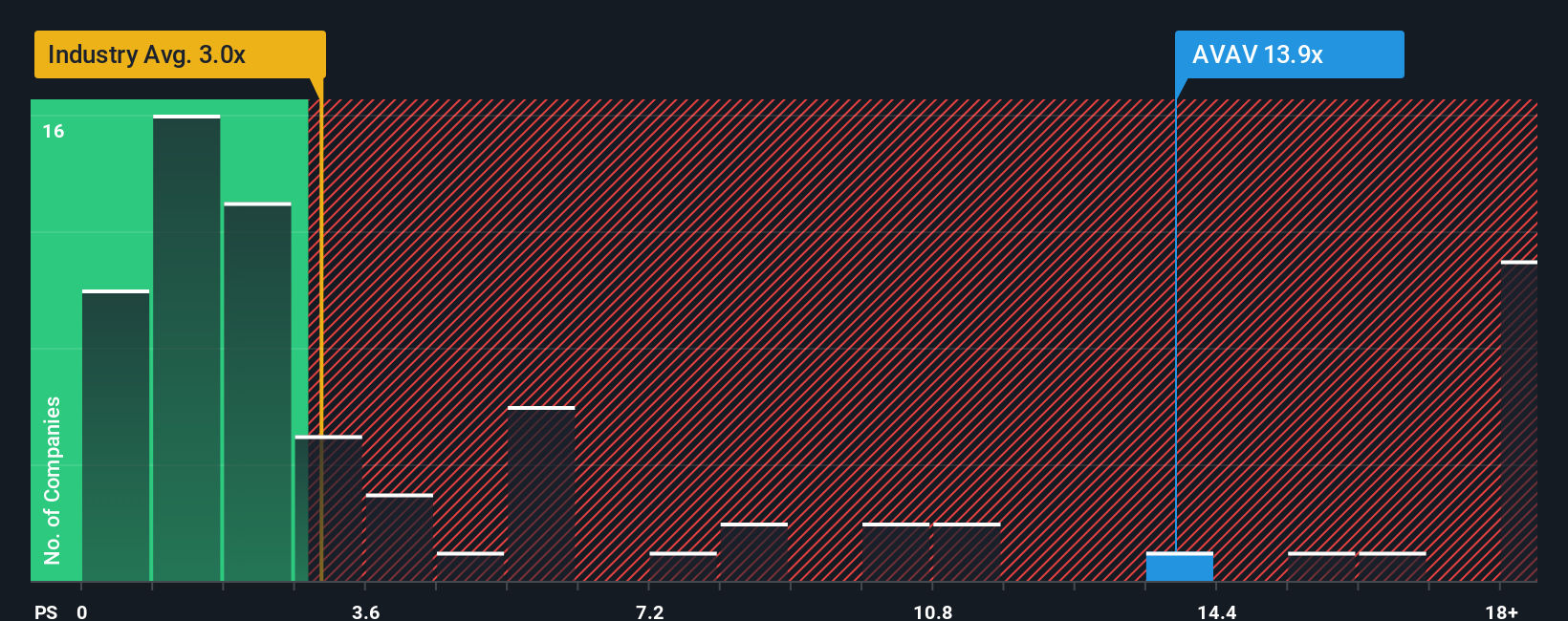

Looking at valuation from a different angle, AeroVironment appears expensive when compared to the average company in its industry based on its sales. This raises the question: are investors looking too far ahead, or not far enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AeroVironment Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft a custom view in just a few minutes. Do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your perspective and take control of your portfolio by tapping into top-performing opportunities tailored for the smartest investors. Don’t get left behind while the next big winners emerge. Put these unique ideas to work for you today.

- Find value others may be missing by zeroing in on companies trading below their real worth. Start with our undervalued stocks based on cash flows and position yourself ahead of the market curve.

- Unlock income potential and stability by targeting businesses offering generous yields. Use our dividend stocks with yields > 3% to grow your returns and weather any market storm.

- Tap into the future of artificial intelligence with companies shaping tomorrow’s breakthroughs. Take the lead using our AI penny stocks to spot the innovators before everyone else.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives