- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV) Valuation in Focus After Strong Share Price Momentum and Recent Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for AeroVironment.

After surging more than 25% in the past month, AeroVironment's share price momentum is drawing interest as expectations remain high and yearly gains are strong. While a sharp 14% drop this past week cooled some of the excitement, the stock remains up 124% year-to-date, with its three-year total shareholder return topping 320%. For now, momentum is still firmly in AVAV's corner as investors weigh both growth potential and recent volatility.

Inspired by AeroVironment's rapid moves? You might also want to check out See the full list for free. for more companies worth watching in the aerospace and defense space.

With strong gains still fresh in investors' minds, the question remains: is AeroVironment undervalued with room to run, or has the market already priced in all of its impressive future growth?

Most Popular Narrative: 8.7% Undervalued

Compared to AeroVironment’s last close price of $350.59, the most widely followed narrative assigns a higher fair value, signaling that momentum could be justified by long-term fundamentals. This view points to growth drivers and industry shifts, which underpin the thesis for continued upside.

AeroVironment's recent contract wins and rapid expansion into advanced areas like space-based laser communications and directed energy weapons position the company to capitalize on the persistent global shift toward defense modernization. This targets urgent demands among the U.S. and allied militaries, likely supporting sustained top-line revenue growth and backlog visibility over multiple years.

The real story behind this price target? It hinges on bold financial forecasts and record-setting projected margins. Find out which aggressive growth assumptions are fueling the fair value and why analysts believe AeroVironment could command a tech-like multiple by 2028.

Result: Fair Value of $384 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on U.S. defense contracts and intensifying competition could quickly challenge AeroVironment’s growth story if market conditions change.

Find out about the key risks to this AeroVironment narrative.

Another View: Market Ratios Paint a Different Picture

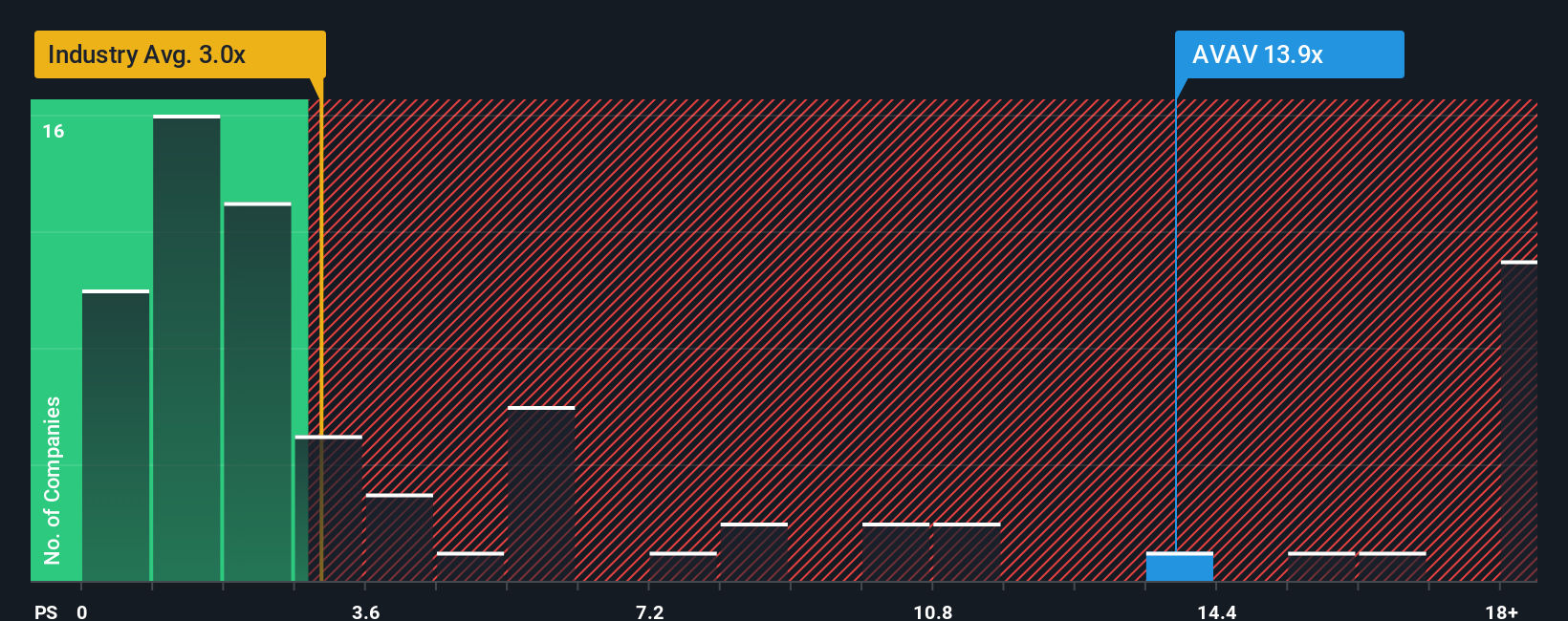

Looking beyond the growth narratives, market multiples offer a cautionary signal. AeroVironment trades at a price-to-sales ratio of 16.1x, well above both the industry average of 3x and its fair ratio of 5.6x. This sizable gap suggests that investors could be taking on more valuation risk than peers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AeroVironment Narrative

If you see things differently or want to analyze the numbers for yourself, you can quickly build your own perspective on AeroVironment in just a few minutes. Do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the crowd by checking out other innovative opportunities. Open up fresh angles for your watchlist with these unique routes to potential growth:

- Capture the excitement of tech breakthroughs when you follow these 24 AI penny stocks as they power tomorrow's artificial intelligence revolution.

- Reimagine your portfolio’s potential with these 868 undervalued stocks based on cash flows identified as strong bargains by our advanced fair value analysis.

- Get in early on future finance trends through these 79 cryptocurrency and blockchain stocks as blockchain and digital assets go mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives