- United States

- /

- Banks

- /

- NasdaqGS:WAFD

3 Dividend Stocks To Consider With Yields Up To 5.7%

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn with major indices like the S&P 500 and Dow Jones facing consecutive declines, investors are increasingly seeking stable income sources amidst tech sector volatility and economic uncertainty. Dividend stocks can offer such stability, providing consistent returns through regular payouts; this makes them an attractive option for those looking to navigate current market conditions while potentially benefiting from yields as high as 5.7%.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.33% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.79% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.61% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.24% | ★★★★★★ |

| Heritage Commerce (HTBK) | 5.08% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.27% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.29% | ★★★★★★ |

| Ennis (EBF) | 6.01% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.58% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★★ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

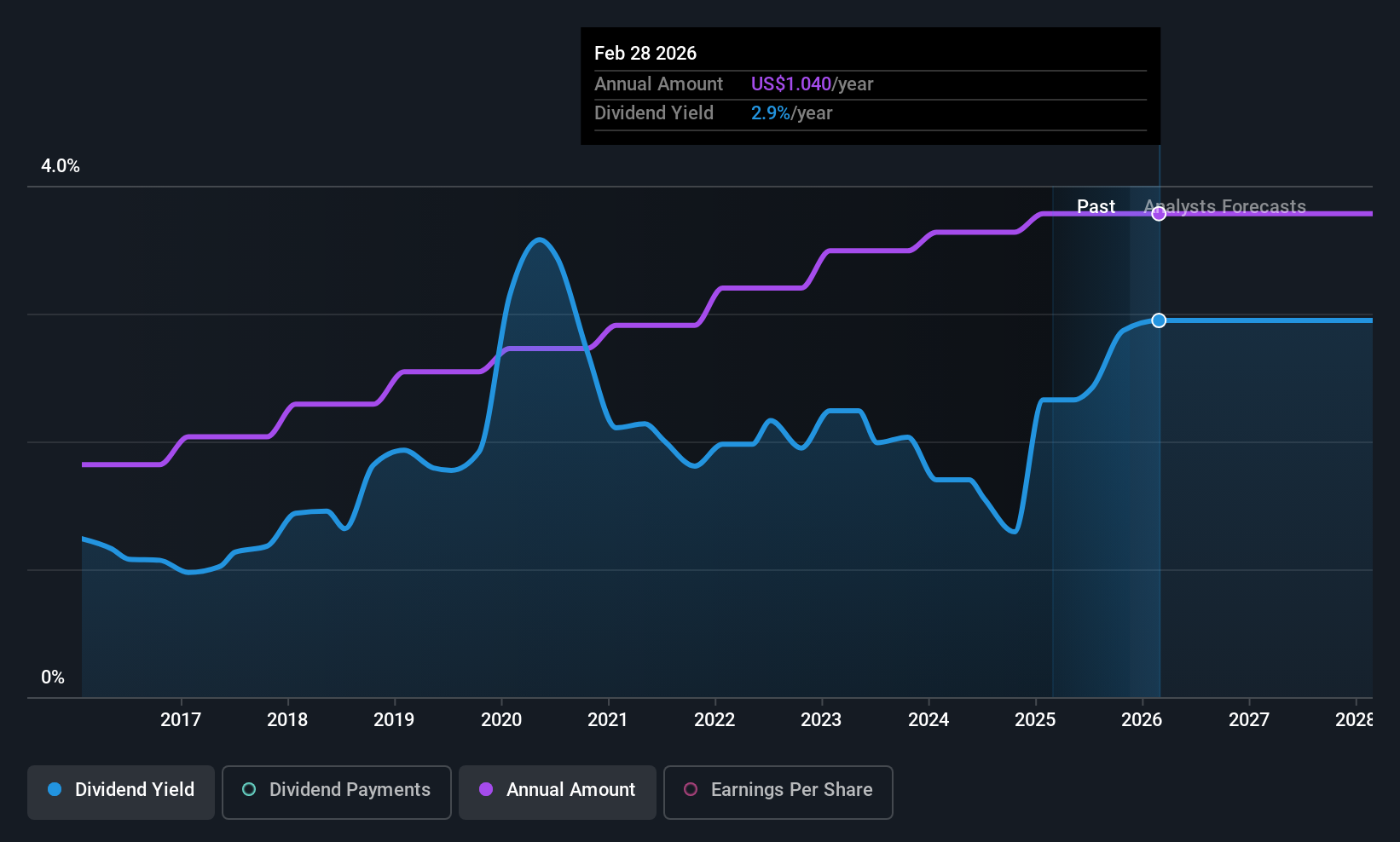

Apogee Enterprises (APOG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Apogee Enterprises, Inc. operates in the architectural products and services sector, specializing in building enclosures and glass products for preservation and protection, with a market cap of approximately $720.62 million.

Operations: Apogee Enterprises, Inc.'s revenue is primarily derived from its Architectural Metals segment at $519.75 million, followed by Architectural Services at $429.81 million, Architectural Glass at $290.85 million, and Performance Surfaces contributing $171.74 million.

Dividend Yield: 3.1%

Apogee Enterprises offers a stable dividend yield of 3.05%, supported by a sustainable payout ratio of 49.9% from earnings and 33.6% from cash flows, ensuring reliability for investors. Recent leadership changes with Donald A. Nolan as CEO may influence strategic direction, including potential M&A activities to bolster growth. Despite facing lower profit margins compared to the previous year, Apogee maintains consistent dividend payments over the past decade amidst reaffirmed fiscal guidance projecting net sales between US$1.39 billion and US$1.42 billion for 2026.

- Delve into the full analysis dividend report here for a deeper understanding of Apogee Enterprises.

- Our valuation report here indicates Apogee Enterprises may be undervalued.

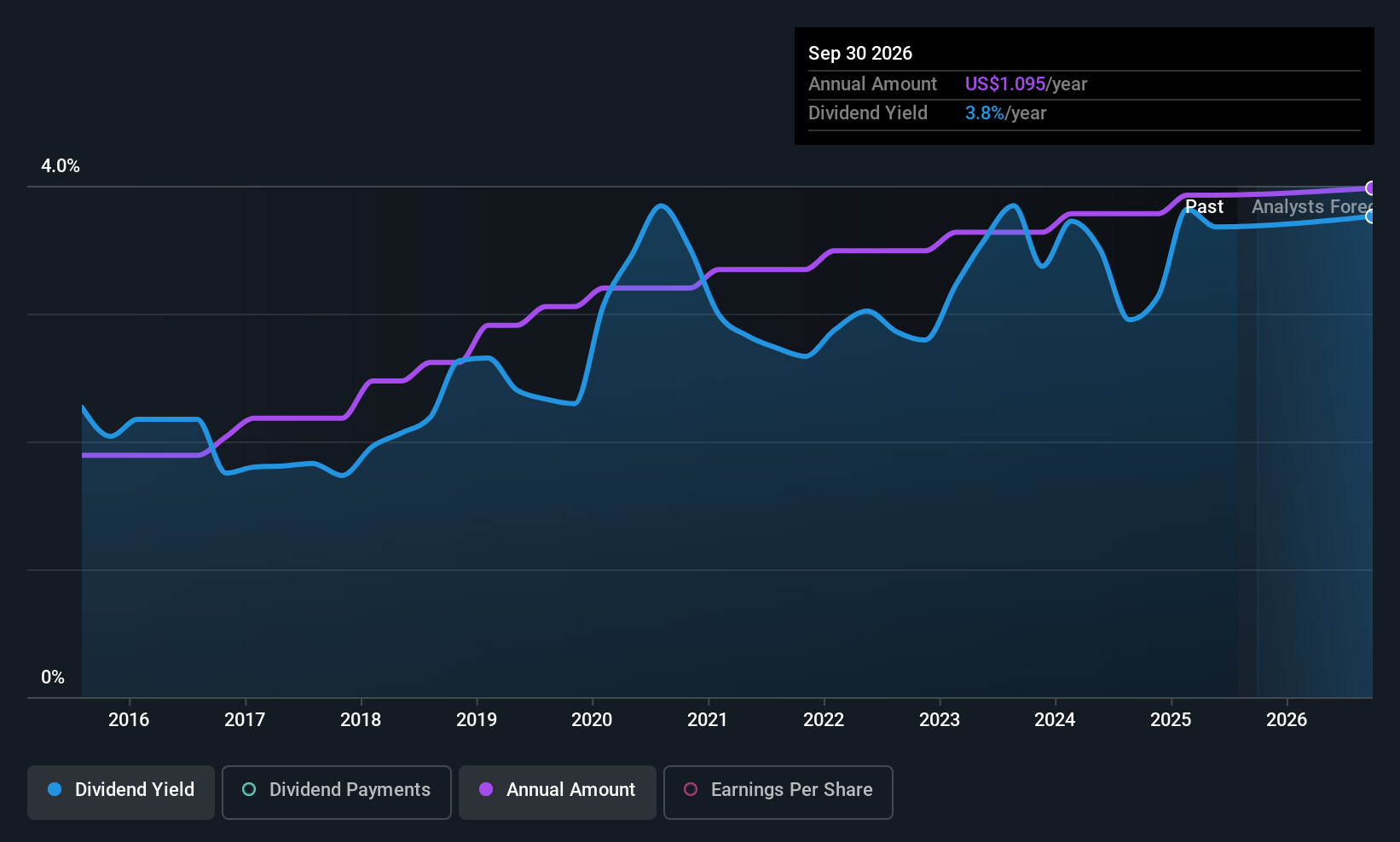

WaFd (WAFD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WaFd, Inc. is the bank holding company for Washington Federal Bank, offering lending, depository, insurance, and other banking services in the United States with a market cap of approximately $2.40 billion.

Operations: WaFd, Inc.'s revenue is primarily derived from its Thrift / Savings and Loan Institutions segment, which generated $717.73 million.

Dividend Yield: 3.5%

WaFd, Inc. maintains a reliable dividend track record with its 171st consecutive quarterly cash dividend of US$0.27 per share, supported by a sustainable payout ratio of 40.6%. Despite net interest income slightly declining to US$654.24 million for the year ending September 30, 2025, earnings per share have grown modestly over five years. The recent preferred stock dividend declaration underscores WaFd's commitment to returning capital to shareholders while trading below estimated fair value enhances its appeal for value-focused investors.

- Get an in-depth perspective on WaFd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, WaFd's share price might be too pessimistic.

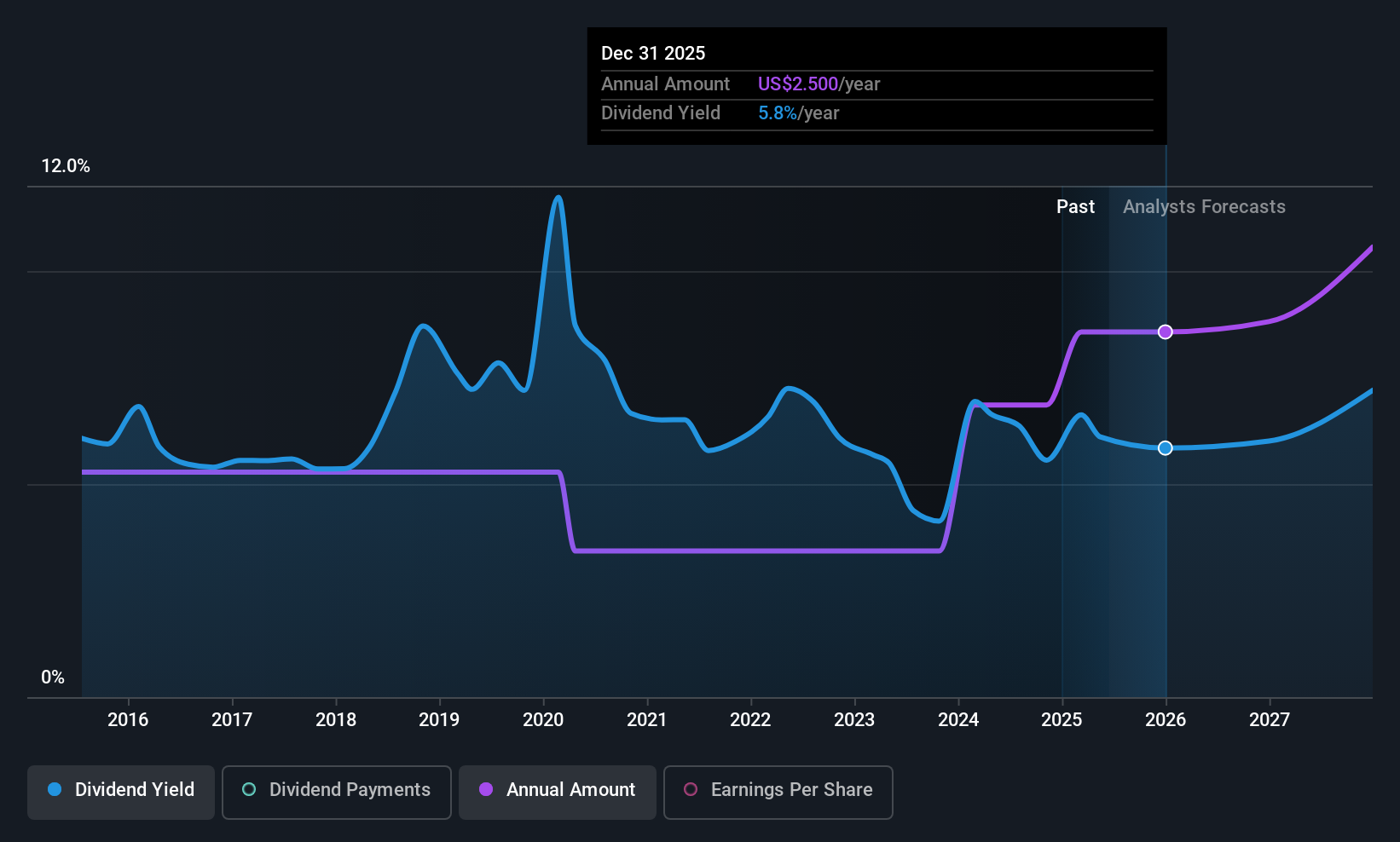

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Latinoamericano de Comercio Exterior S. A (BLX) is a financial institution that specializes in providing trade financing solutions across Latin America, with a market cap of approximately $1.62 billion.

Operations: Banco Latinoamericano de Comercio Exterior S. A (BLX) generates revenue from two main segments: Treasury, contributing $31.51 million, and Commercial, accounting for $276.93 million.

Dividend Yield: 5.7%

Banco Latinoamericano de Comercio Exterior, S.A. offers a compelling dividend yield of 5.7%, placing it in the top 25% of US dividend payers, with dividends well-covered by earnings at a payout ratio of 41.6%. Despite its volatile dividend history over the past decade, recent earnings growth and strategic capital strengthening through a $200 million AT1 offering bolster its financial position. The company's stock trades below estimated fair value, enhancing its appeal for value investors seeking income.

- Click here to discover the nuances of Banco Latinoamericano de Comercio Exterior S. A with our detailed analytical dividend report.

- Our expertly prepared valuation report Banco Latinoamericano de Comercio Exterior S. A implies its share price may be lower than expected.

Summing It All Up

- Click this link to deep-dive into the 137 companies within our Top US Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives