- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

Is It Too Late to Invest in AMSC After Its 132% Year-to-Date Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with American Superconductor stock? You are not alone if you are feeling both intrigued and cautious right now. After all, AMSC has powered through some truly spectacular gains, jumping 1.2% in just the past week, soaring 21.3% over the last 30 days, and absolutely rocketing 132.1% year-to-date. Zoom out to a one-year view, and the stock is up 147.5%. For those who have held on for the long ride, the 3-year return of 1275.9% is the kind of performance that turns heads at any investment club meeting.

This surge is not just an isolated moment. Much of the excitement connects back to market chatter about grid modernization and the push toward renewable energy infrastructure, where American Superconductor’s technology could play a big role. Investors seem to be reassessing the company’s risk and growth profile, and that reevaluation is showing up in the price chart.

But here is where things get interesting. Despite all the price momentum, American Superconductor’s value score stands at just 0. That means, according to six standard valuation checks, it is not considered undervalued in any of them. So if you are eyeing these recent gains, you are probably wondering, does the current price still make sense? In the next section, we will dive into the different valuation approaches and hint at a smarter way to measure value that savvy investors should not miss.

American Superconductor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

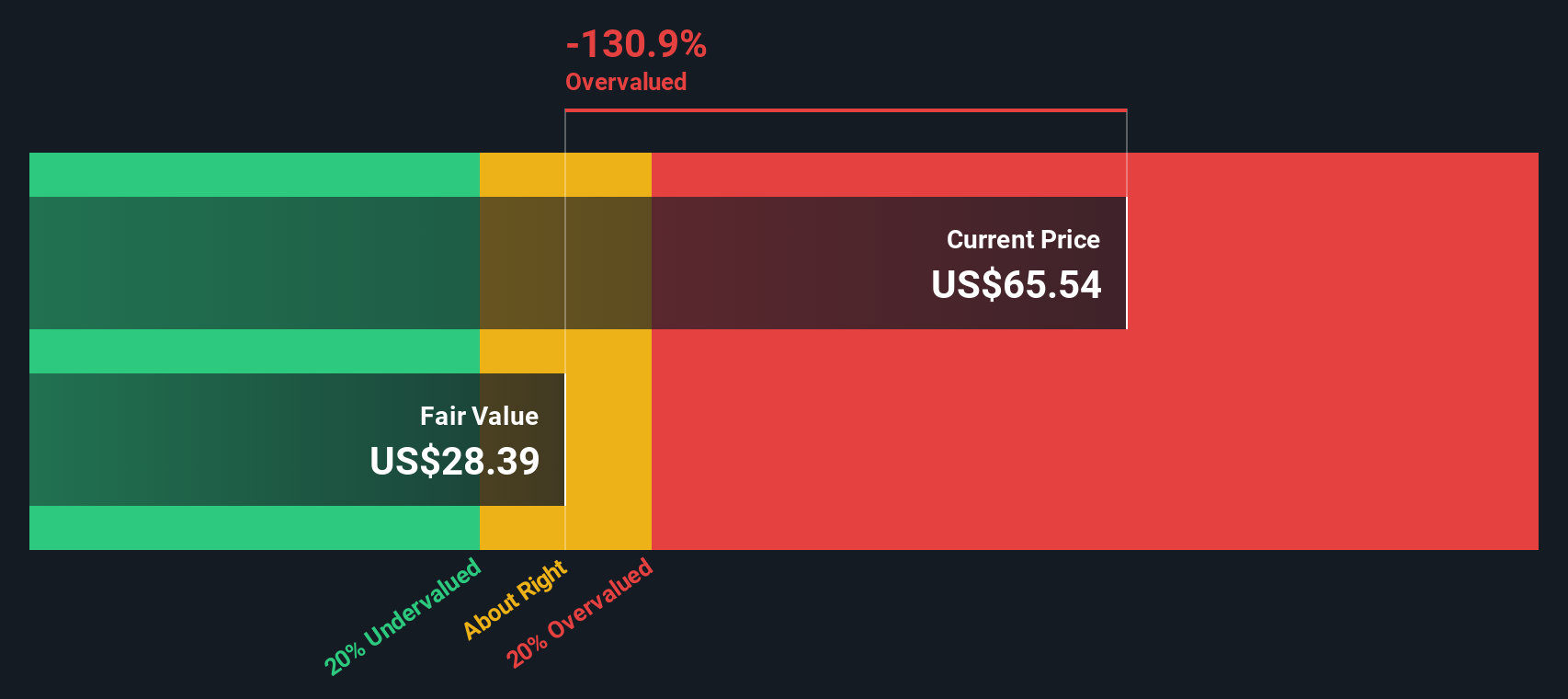

Approach 1: American Superconductor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s intrinsic value by projecting the company’s future free cash flows and then discounting them back to their value today. This approach helps investors understand what a business might truly be worth based on its capacity to generate cash over time.

For American Superconductor, the latest reported Free Cash Flow is $26.6 Million. Analysts have provided estimates of Free Cash Flow growing over the next few years, with projections reaching $52.1 Million by 2028. Beyond that, Simply Wall St extrapolates a possible continuation of growth, with modeled Free Cash Flow potentially hitting over $113 Million by 2035. These projections are used in the two-stage free cash flow to equity model, which is commonly applied to businesses expected to experience different growth rates over time.

Based on this model, the DCF fair value for American Superconductor is calculated at $28.91 per share. However, when compared to its recent share price, the stock is trading about 105.1% above its intrinsic value according to this method. This suggests that, from a DCF standpoint, American Superconductor appears considerably overvalued at current prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Superconductor may be overvalued by 105.1%. Find undervalued stocks or create your own screener to find better value opportunities.

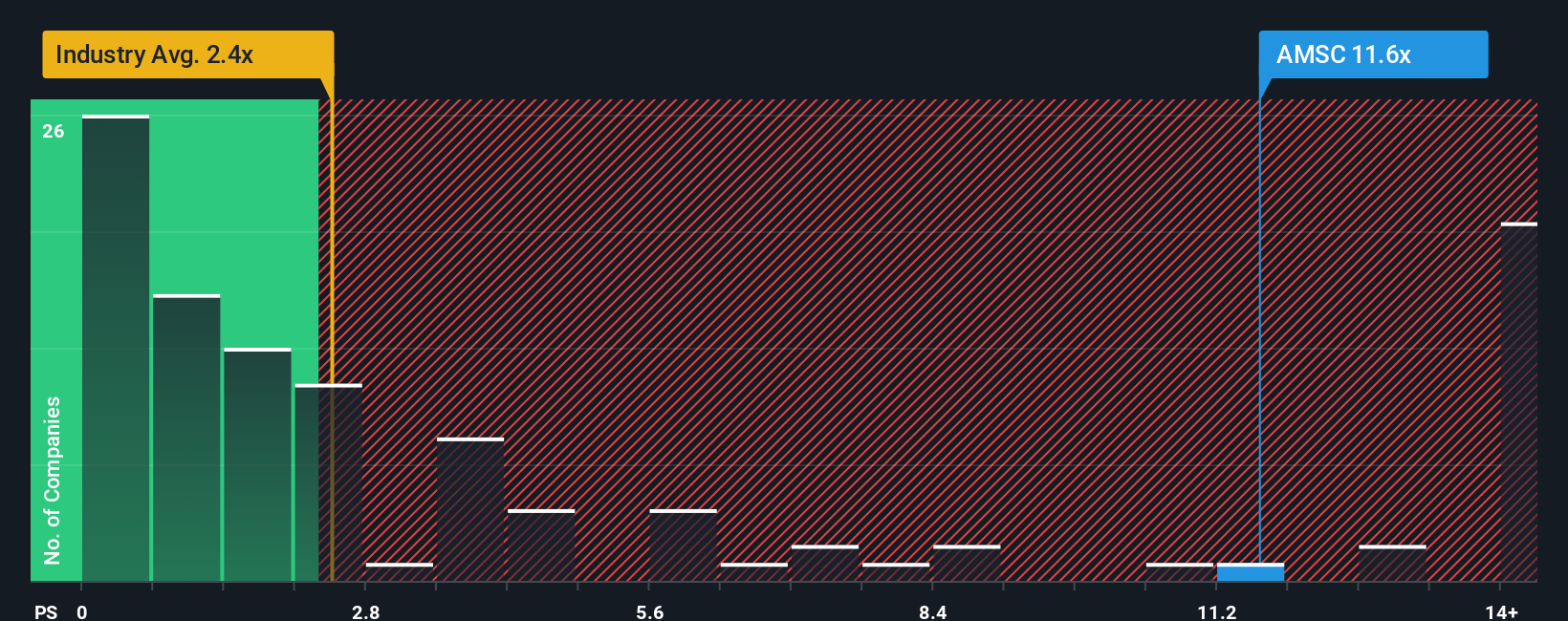

Approach 2: American Superconductor Price vs Sales

For companies like American Superconductor that are investing heavily in growth and may not have consistent earnings, the Price-to-Sales (P/S) ratio is a widely used valuation tool. The P/S ratio is helpful because it focuses on how much investors are paying for each dollar of revenue, making it particularly relevant for businesses in transformative industries or those earlier in their profitability cycle.

In general, growth expectations and perceived risk determine what a “normal” or “fair” multiple should be. Higher anticipated growth and lower risk typically justify a higher P/S, whereas slower-growing or riskier firms tend to trade at lower multiples.

American Superconductor currently trades at a P/S ratio of 10.51x. To put that in perspective, the average for its Electrical industry peers is just 3.37x and the overall sector average is 2.18x. This means AMSC shares are valued significantly above most comparable companies on a basic sales metric alone.

Simply Wall St’s “Fair Ratio” adds more nuance to this picture. Unlike raw peer or industry comparisons, the Fair Ratio factors in details like the company’s specific growth trajectory, profit margins, business model, size, and risk profile. For AMSC, the Fair Ratio sits at 2.24x, which is far below its current multiple. This suggests that once you adjust for what actually makes the company unique, its valuation still looks stretched.

Comparing the Fair Ratio to the current P/S makes it clear that the stock is trading much higher than what’s justified by its fundamentals at this stage.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

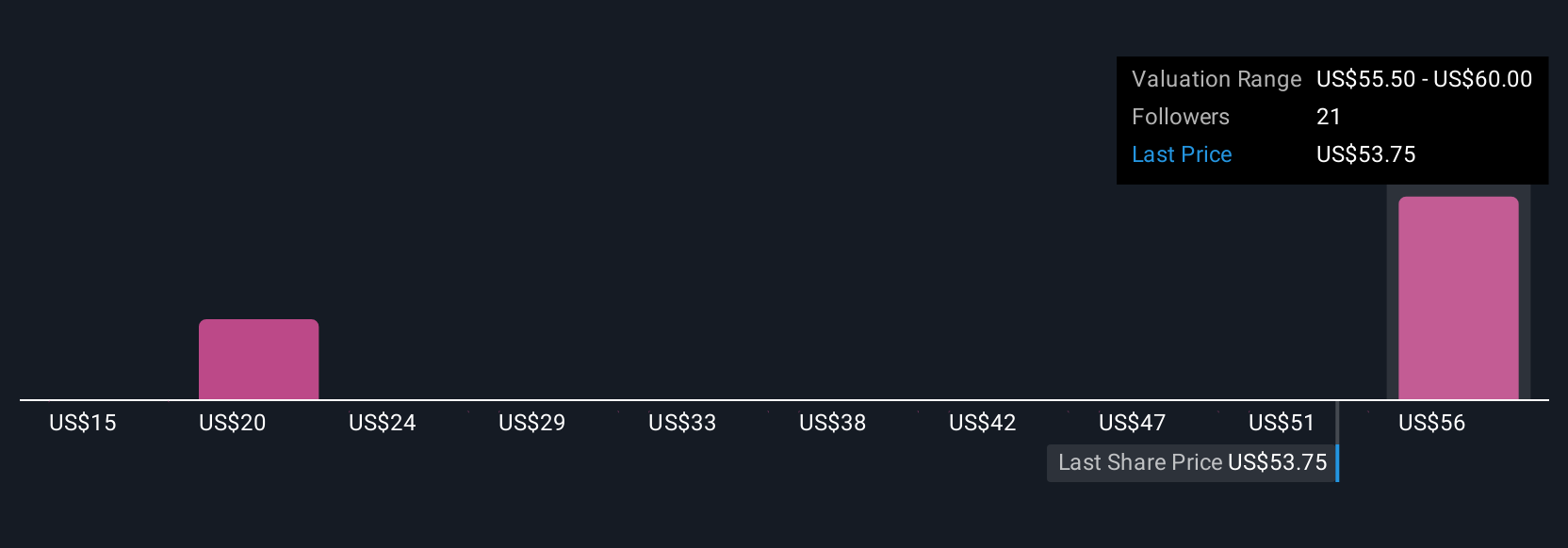

Upgrade Your Decision Making: Choose your American Superconductor Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your personal story about a company, a tool that allows you to combine the numbers (like your fair value, revenue, earnings, and margin estimates) with your perspective on where the business is headed.

Instead of just looking at charts or ratios in isolation, Narratives connect the company’s real-world story (its growth drivers, risks, and news) with financial forecasts and then with a calculated fair value, showing you how the story could play out in the future.

On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy to create and share these stories so you can see the logic behind each person's view, whether you are bullish or cautious. Narratives update dynamically as fresh news or quarterly earnings roll in, so your fair value is always based on the latest information.

For example, some American Superconductor Narratives project robust wind and semiconductor growth, leading to a high fair value near $66.67, while more conservative views highlight market risks and one-off gains, setting lower fair values. These differences help investors decide if today’s price justifies buying, holding, or selling.

Do you think there's more to the story for American Superconductor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives